Looking for WebEngage alternatives? Compare the 10 best e-commerce engagement platforms—including Maestra, Braze, MoEngage, CleverTap, Klaviyo and more—to find the right fit for your growth goals.

Best WebEngage Alternatives: Smarter E‑Commerce Engagement

Choosing a marketing platform shouldn’t be about compromise. This guide cuts through the noise to present 10 WebEngage alternatives, focusing on what each does best. Discover options that align with your priorities—whether that’s advanced personalization, channel integration, or implementation speed.

Content:

WebEngage Overview

WebEngage is a versatile customer engagement and retention platform designed to unify customer data and orchestrate marketing across channels like email, mobile push, SMS, web push, and more.

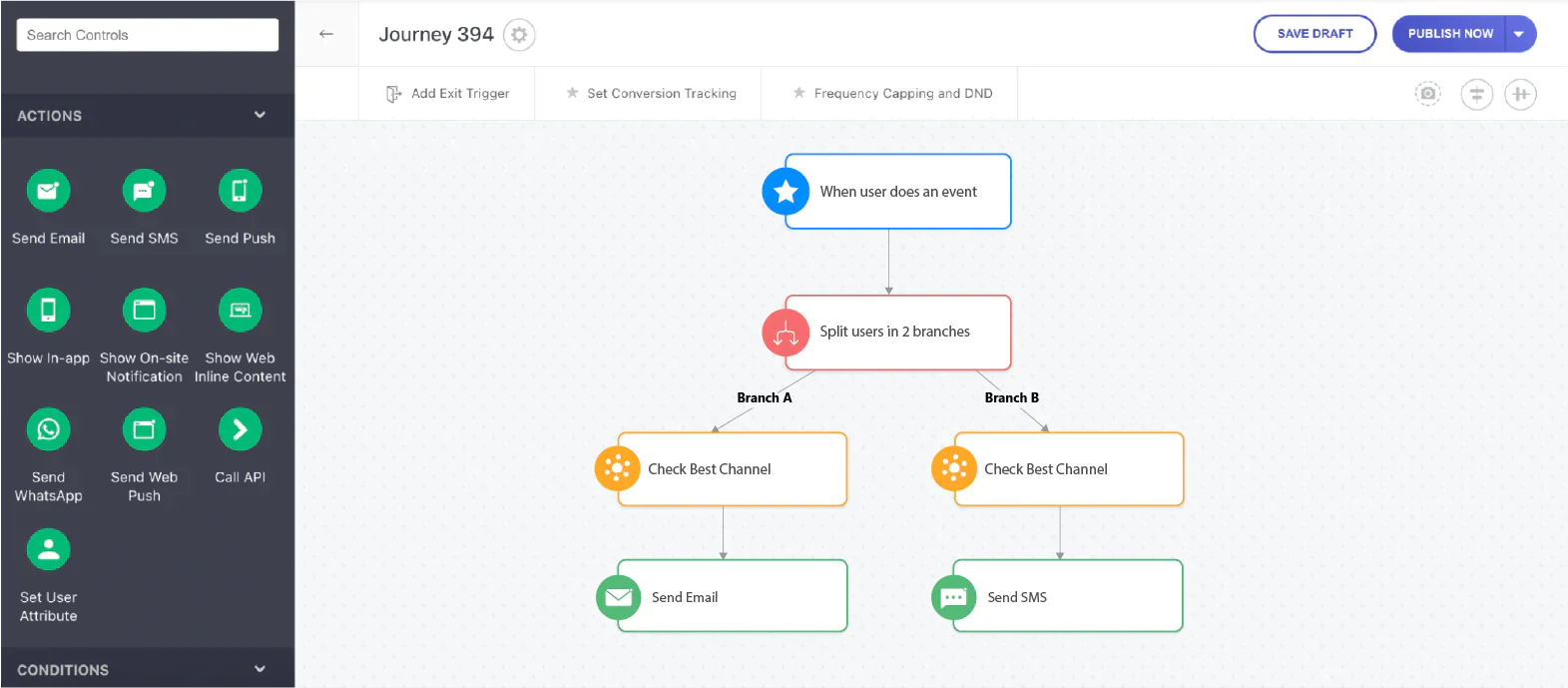

WebEngage’s Journey Designer

It offers a built-in Customer Data Platform (CDP), journey workflow builder, and personalization engine—all in one suite—to help brands create lifecycle marketing campaigns without stitching together multiple tools.

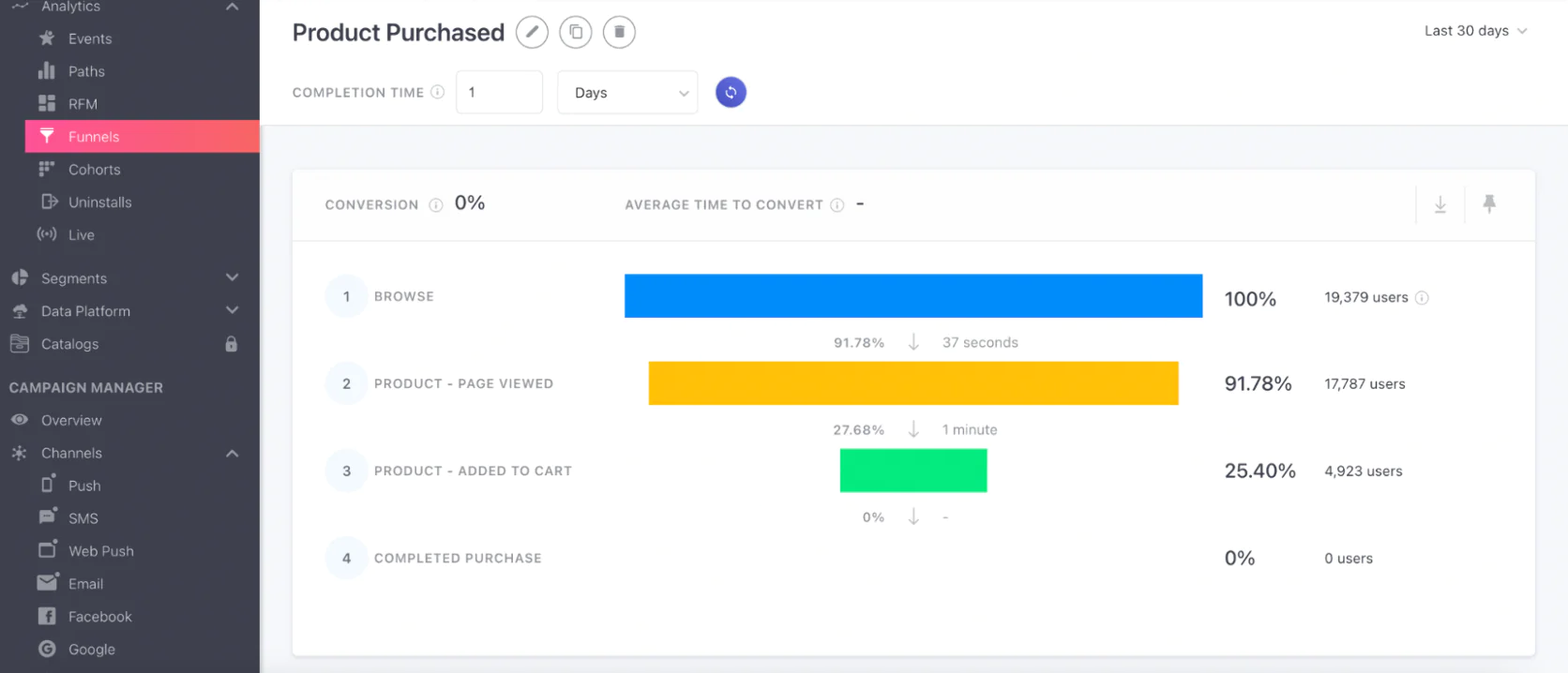

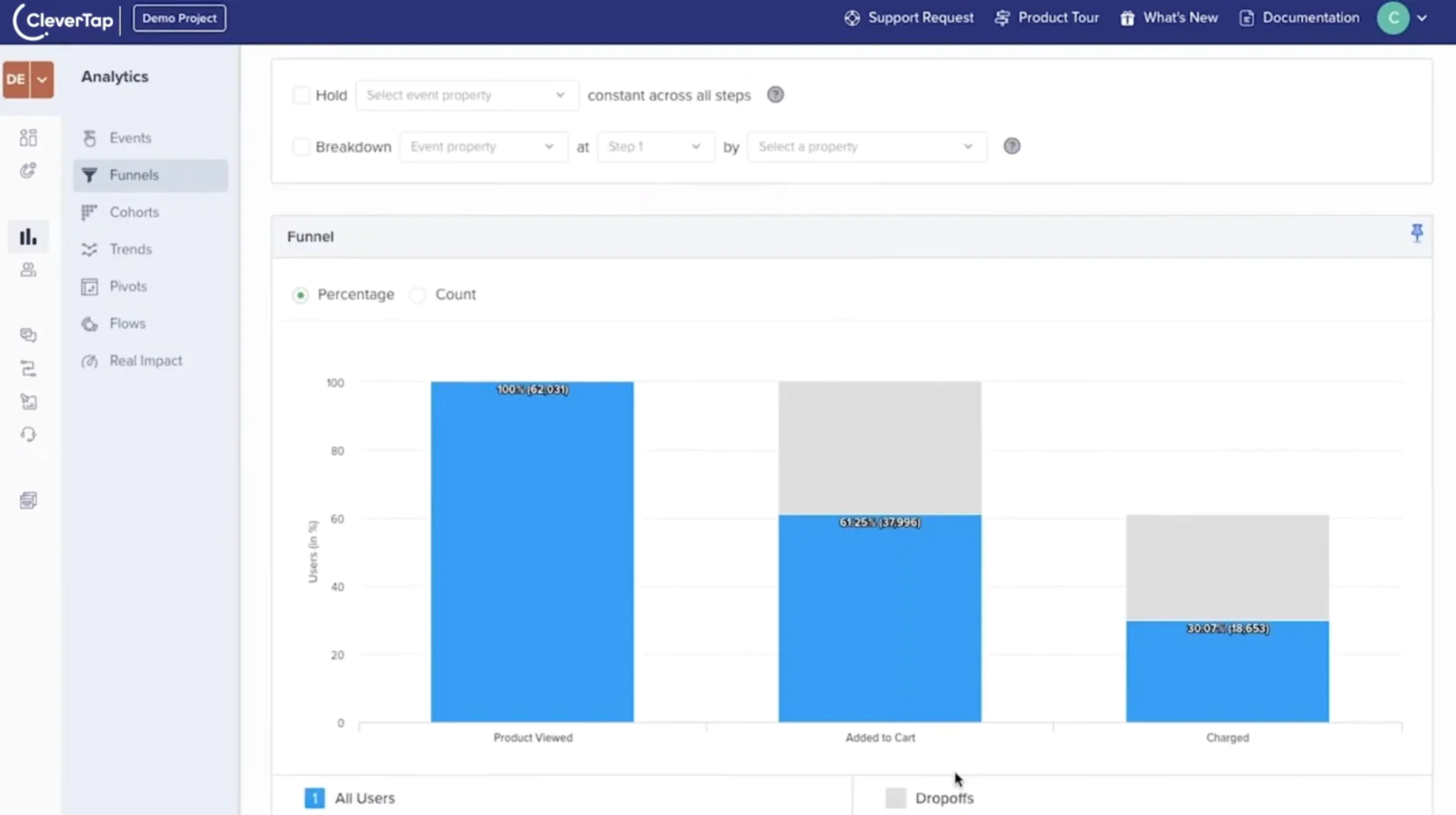

WebEngage’s funnels analysis

Originally known for on-site surveys and notification widgets, WebEngage expanded into a comprehensive multi-channel marketing automation solution. It particularly gained traction in emerging markets (such as India and Southeast Asia) by catering to the needs of mobile-first businesses and offering regionally attuned support.

Why Look for WebEngage Alternatives

While WebEngage provides robust capabilities, e-commerce leaders often outgrow it or seek features that better align with advanced growth strategies. Common reasons for exploring alternatives include:

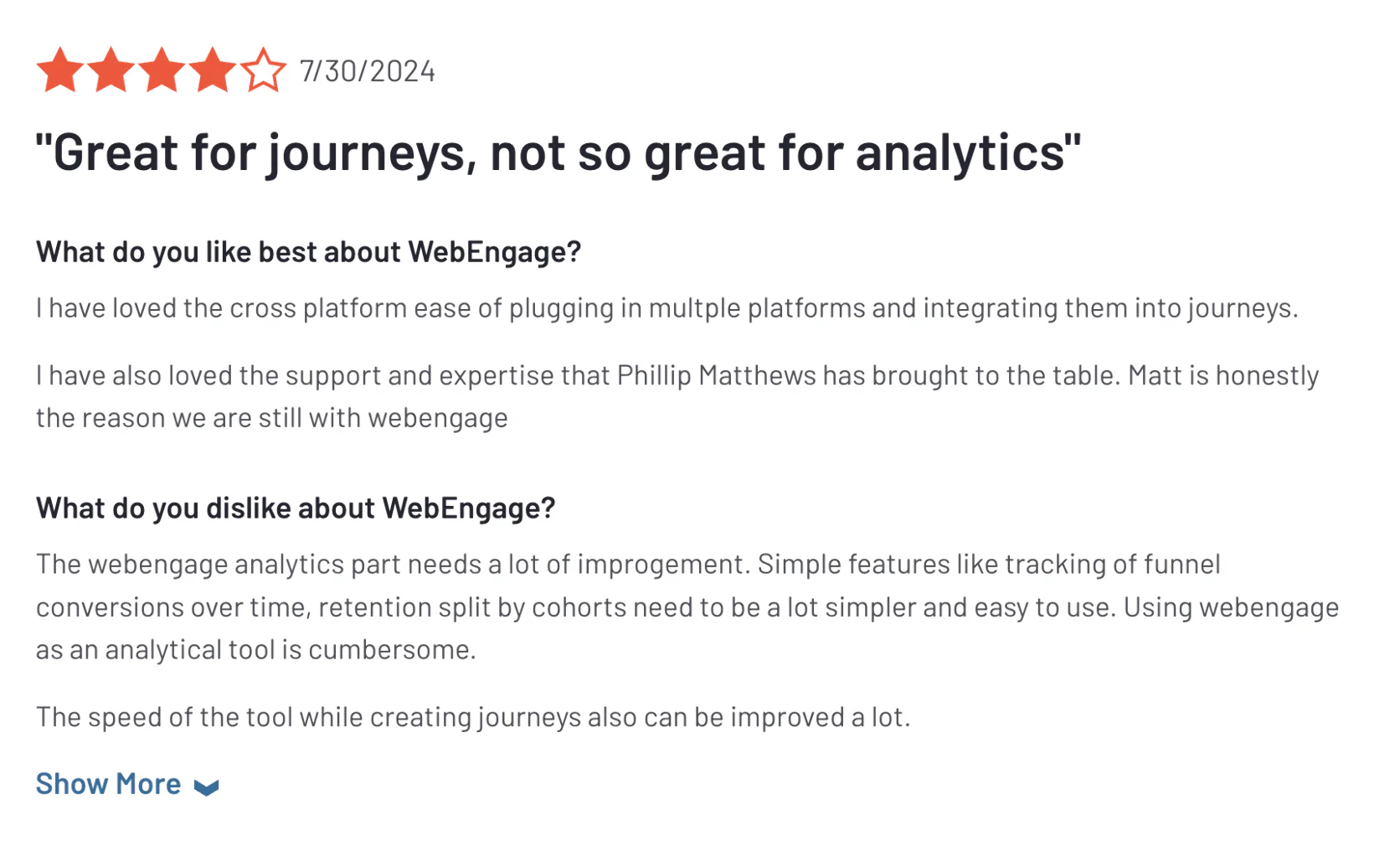

- Scaling and Sophistication: As companies scale, they may require more polished user interfaces or deeper real-time analytics than WebEngage’s current platform offers.

- Ecosystem and Support: WebEngage’s brand community and third-party ecosystem outside its core regions are still growing. Businesses in North America or Europe might find fewer experts and integrations for WebEngage compared to globally entrenched competitors.

- Cutting-Edge Features: In an era of AI-driven marketing, some alternatives are pushing ahead with built-in machine learning for things like send-time optimization, predictive segmentation, or product recommendations. WebEngage has been adding features, but certain rivals lead in innovative capabilities like real-time streaming data or on-site AI personalization.

- Pricing and Fit: WebEngage positions itself as a cost-effective solution (with basic plans starting around $199/month in some regions), and even offers startup credits to new businesses. However, as businesses grow, they might require enterprise-level reliability or compliance that larger vendors provide—or conversely, smaller brands might look for tools with free plans or lower entry pricing if WebEngage’s advanced tier pricing doesn’t fit their budget. In short, evolving needs and ROI considerations prompt leaders to reassess their tech stack.

In this article, we break down the best WebEngage alternatives for e-commerce brands. Whether you’re seeking a more all-in-one platform, better loyalty and CRM features, or just exploring options before a major investment, we’ve got you covered.

Alternatives at a Glance

To help you scan your options, here’s a comparison table of top WebEngage alternatives, their ideal use-cases, standout features, and pricing:

Platform

Best For

Key Features

Price Range

Maestra

Full‑funnel marketing for ambitious e-commerce brands

• Real-time CDP for behavior-driven segmentation

• Hyper-personalized omnichannel flows (email, SMS, push, ads)

• Built-in loyalty & promotions engine

• Real-time on-site personalization

• Dedicated Customer Success Manager

• Hyper-personalized omnichannel flows (email, SMS, push, ads)

• Built-in loyalty & promotions engine

• Real-time on-site personalization

• Dedicated Customer Success Manager

From $2,990/month

Braze

Enterprise-grade cross-channel engagement

• Canvas journey builder for multi-step campaigns

• Streaming data ingestion for real-time triggers

• Personalization with Liquid templating

• Strong mobile push & in-app messaging

• Analytics and AI for optimization

• Streaming data ingestion for real-time triggers

• Personalization with Liquid templating

• Strong mobile push & in-app messaging

• Analytics and AI for optimization

Custom pricing (typically starts around $+5,000/month, ~$60k/year minimum)

MoEngage

User retention in mobile-first markets

• Unified customer profiles with behavior tracking

• Push notifications (mobile & web) expertise

• AI-based content optimization (Sherpa)

• Journey orchestration similar to WebEngage

• Pre-built templates for e-commerce flows

• Push notifications (mobile & web) expertise

• AI-based content optimization (Sherpa)

• Journey orchestration similar to WebEngage

• Pre-built templates for e-commerce flows

From $750–$999/month (Growth plan for ~25k users)

CleverTap

Mobile app engagement & analytics

• Event-based segmentation and user funnels

• Real-time mobile analytics & A/B testing

• Omnichannel messaging (push, SMS, email, WhatsApp)

• RFM segmentation and predictive modeling

• In-app messaging and app UX optimization

• Real-time mobile analytics & A/B testing

• Omnichannel messaging (push, SMS, email, WhatsApp)

• RFM segmentation and predictive modeling

• In-app messaging and app UX optimization

Tiered: Essentials from ~$70/month (5k users); advanced and enterprise plans are custom quotes.

Iterable

Growth-stage omnichannel marketing

• Workflow Studio for cross-channel campaigns

• Flexible data model & API for custom use cases

• Email, push, SMS, direct mail, and more

• Catalog-based personalization (for product content)

• Dynamic segmentation and AI send-time optimization

• Flexible data model & API for custom use cases

• Email, push, SMS, direct mail, and more

• Catalog-based personalization (for product content)

• Dynamic segmentation and AI send-time optimization

Custom (mid-market plans reportedly from ~$500/month and up based on contacts)

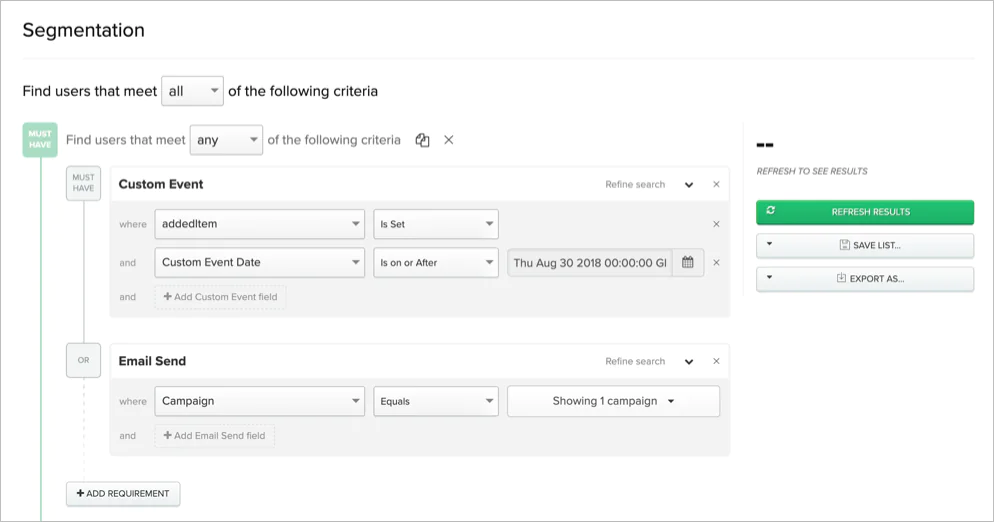

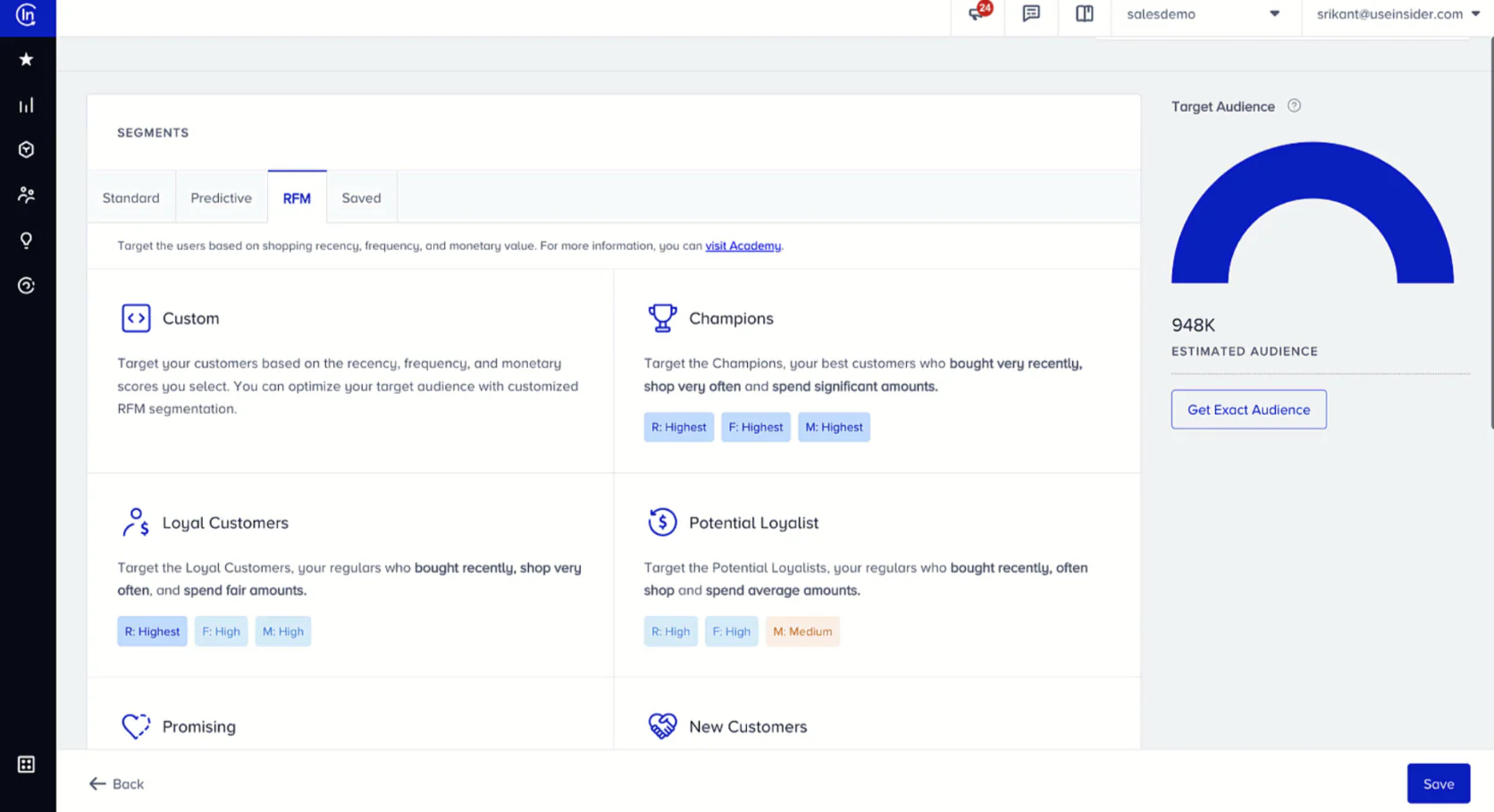

Insider

Personalized AI-driven customer journeys

• AI personalization across web and app (e.g. product recommendations)

• Multi-channel orchestration (email, push, SMS, WhatsApp, etc.)

• Behavior-based auto-segmentation

• On-site marketing suite (pop-ups, banners)

• Industry-specific templates (travel, retail, etc.)

• Multi-channel orchestration (email, push, SMS, WhatsApp, etc.)

• Behavior-based auto-segmentation

• On-site marketing suite (pop-ups, banners)

• Industry-specific templates (travel, retail, etc.)

Custom pricing (enterprise-level; typically via demo request)

Klaviyo

Data-driven email/SMS for retail brands

• Deep e-commerce integrations (Shopify, Magento, etc.)

• Powerful email and SMS automation flows

• Segmentation based on purchase and browsing data

• Pre-built flows for cart abandonment, win-back, etc.

• Predictive analytics for CLV and churn

• Powerful email and SMS automation flows

• Segmentation based on purchase and browsing data

• Pre-built flows for cart abandonment, win-back, etc.

• Predictive analytics for CLV and churn

Free up to 250 contacts; paid from ~$20/month (scales with list size—e.g. ~$175/month for 10k contacts)

Netcore Cloud

All-in-one marketing cloud (especially APAC)

• Unified platform: Email, SMS, WhatsApp, push, analytics in one

• Advanced personalization & product recommendations

• Journey designer for cross-channel flows

• AI-based optimization (send-time, churn prediction)

• Strong regional support and deliverability

• Advanced personalization & product recommendations

• Journey designer for cross-channel flows

• AI-based optimization (send-time, churn prediction)

• Strong regional support and deliverability

Custom (tailored quotes; competitive in emerging markets)

SAP Emarsys

Retail-focused omnichannel marketing

• Industry-specific solutions: pre-built campaigns for retail, etc.

• Loyalty management and voucher system

• AI-driven segmentation and product recommendations

• Omnichannel campaigns (email, SMS, ads, even direct mail)

• Robust reporting and revenue attribution

• Loyalty management and voucher system

• AI-driven segmentation and product recommendations

• Omnichannel campaigns (email, SMS, ads, even direct mail)

• Robust reporting and revenue attribution

Custom (enterprise pricing via SAP; some sources indicate starting in low $ hundreds for basic, scaling to large enterprise contracts)

Bloomreach Engagement (Exponea)

Data-rich CDP + marketing automation

• Customer Data Platform combined with campaign tools

• Real-time single customer view and event tracking

• Omnichannel campaign builder (email, SMS, push, web personalization)

• AI-based product recommendations and predictions

• Revenue-focused analytics and A/B testing

• Real-time single customer view and event tracking

• Omnichannel campaign builder (email, SMS, push, web personalization)

• AI-based product recommendations and predictions

• Revenue-focused analytics and A/B testing

Custom (pricing based on number of customers, events, and channels used—typically mid-to-high range for enterprise)

Tool #1: Maestra

Best WebEngage Alternative for Full-Funnel E‑Commerce Marketing

Maestra is an all-in-one omnichannel marketing platform built specifically for e-commerce brands that are ready to leave patchwork solutions behind. It combines real-time data, intelligent automation, and personalized customer experiences into one unified hub.

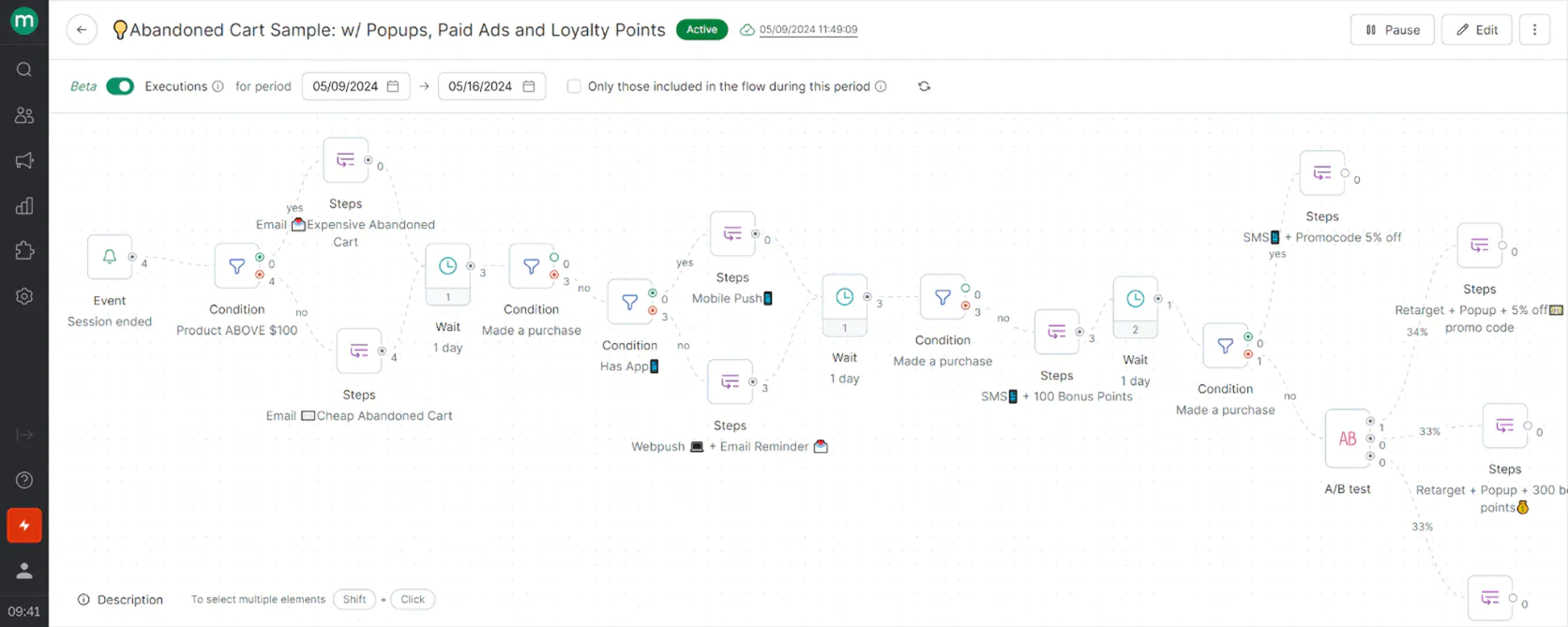

Maestra’s flow example: abandoned card flow with emails, mobile and web pushes, pop-ups, paid ads and loyalty points

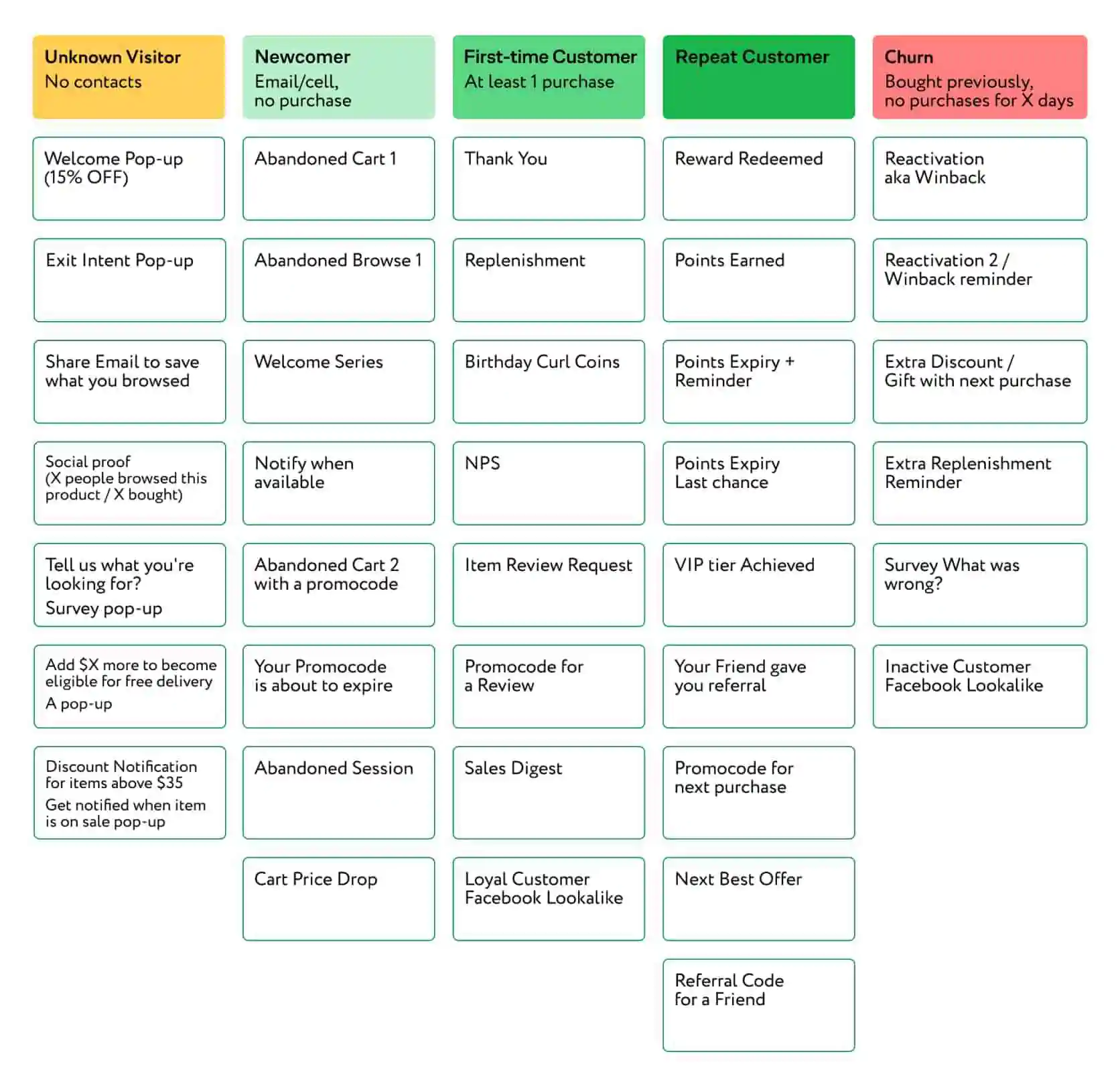

From email and SMS campaigns to on-site personalization and loyalty programs, Maestra’s platform is designed to cover the entire customer journey end-to-end. For a marketing leader tired of juggling multiple tools (CRM, email service, SMS platform, loyalty app, etc.), Maestra offers a breath of fresh air by natively bringing these capabilities together.

Key Features:

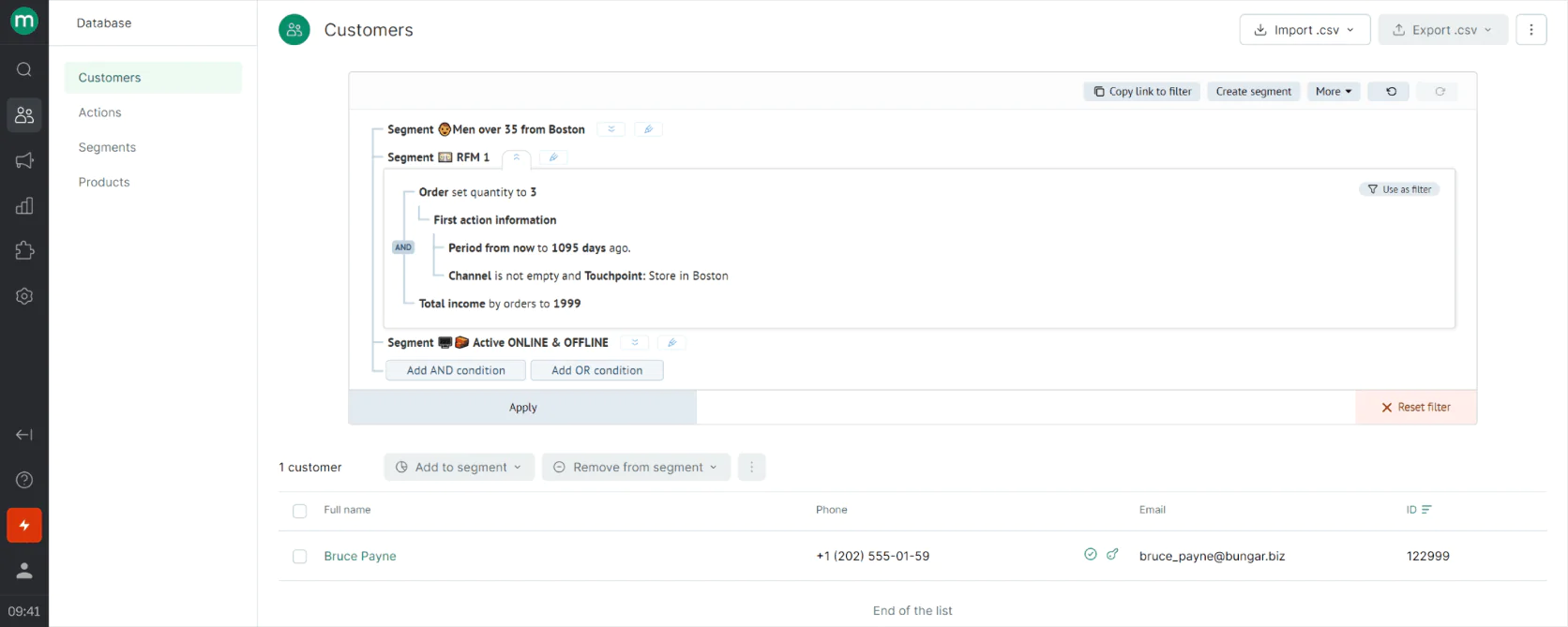

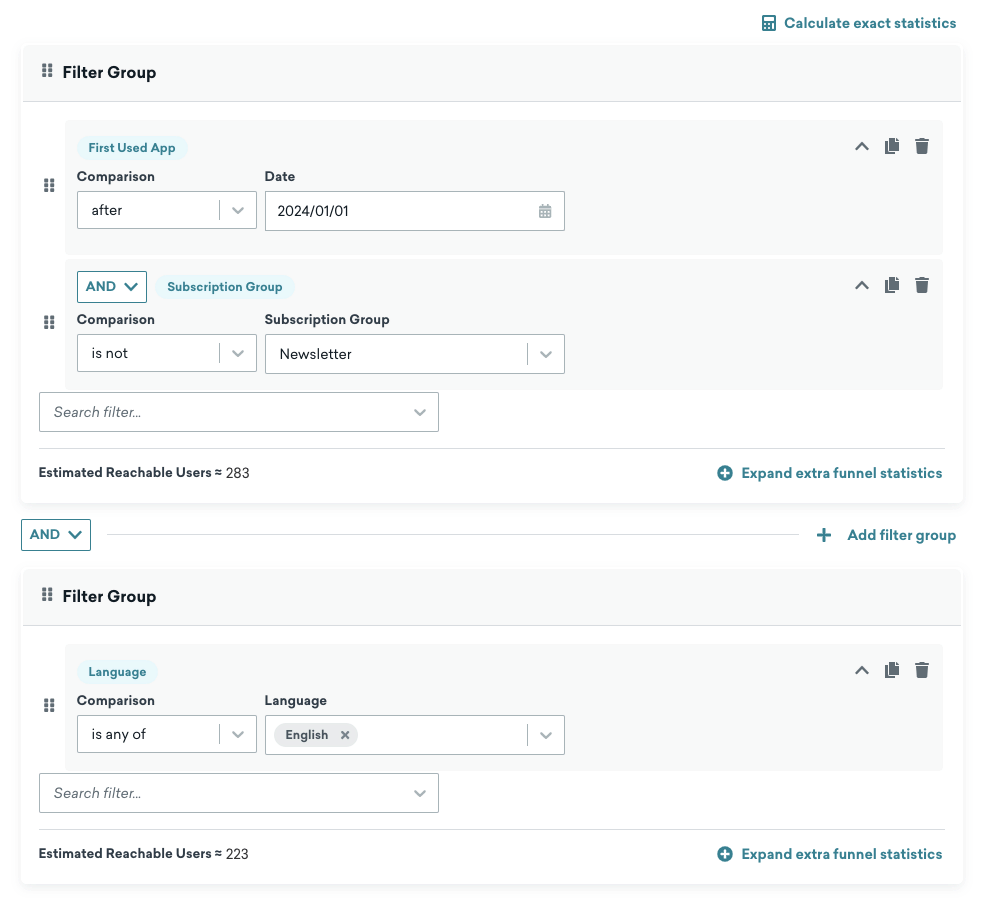

- Real-Time CDP and Segmentation: Maestra includes a real-time Customer Data Platform that tracks shopper behavior across channels and updates segments instantly. For example, if a customer makes a purchase, they can be removed from a “win-back” campaign on-the-fly (no delays), ensuring communications stay relevant. This live unified profile underpins all of Maestra’s marketing actions.

- Omnichannel Journey Orchestration: A drag-and-drop Flow Builder lets you create campaigns that seamlessly span email, SMS, push notifications, in-app messages, website pop-ups, and even paid ads. You can map out sophisticated sequences (e.g., browse abandonment → email → no response → SMS with offer → site personalization when they revisit) without writing code. Triggers can be behavioral (e.g. cart abandonment, price drop) or time-based, and branching logic can use real-time conditions like inventory levels or customer loyalty status.

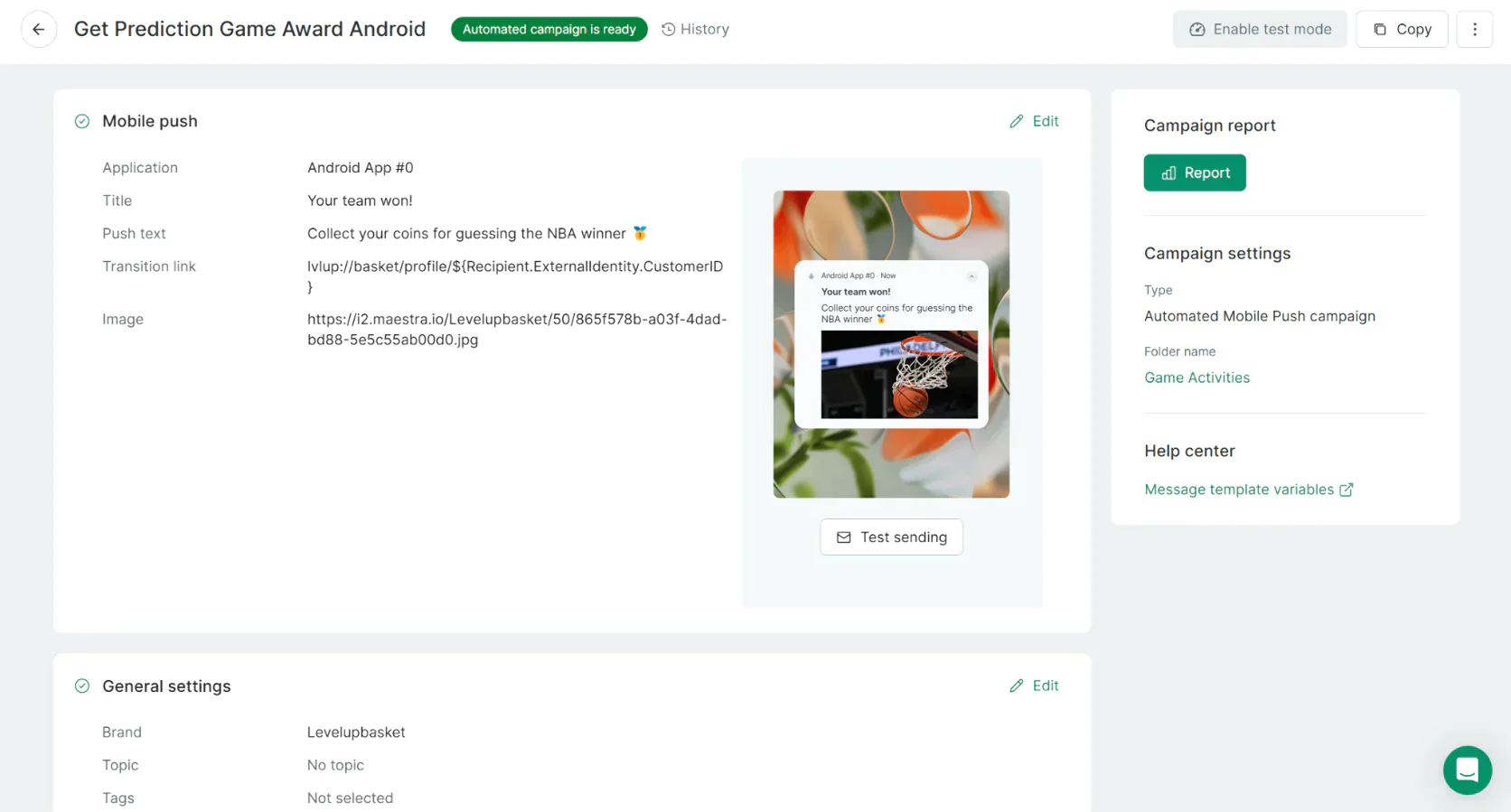

Maestra’s mobile push builder

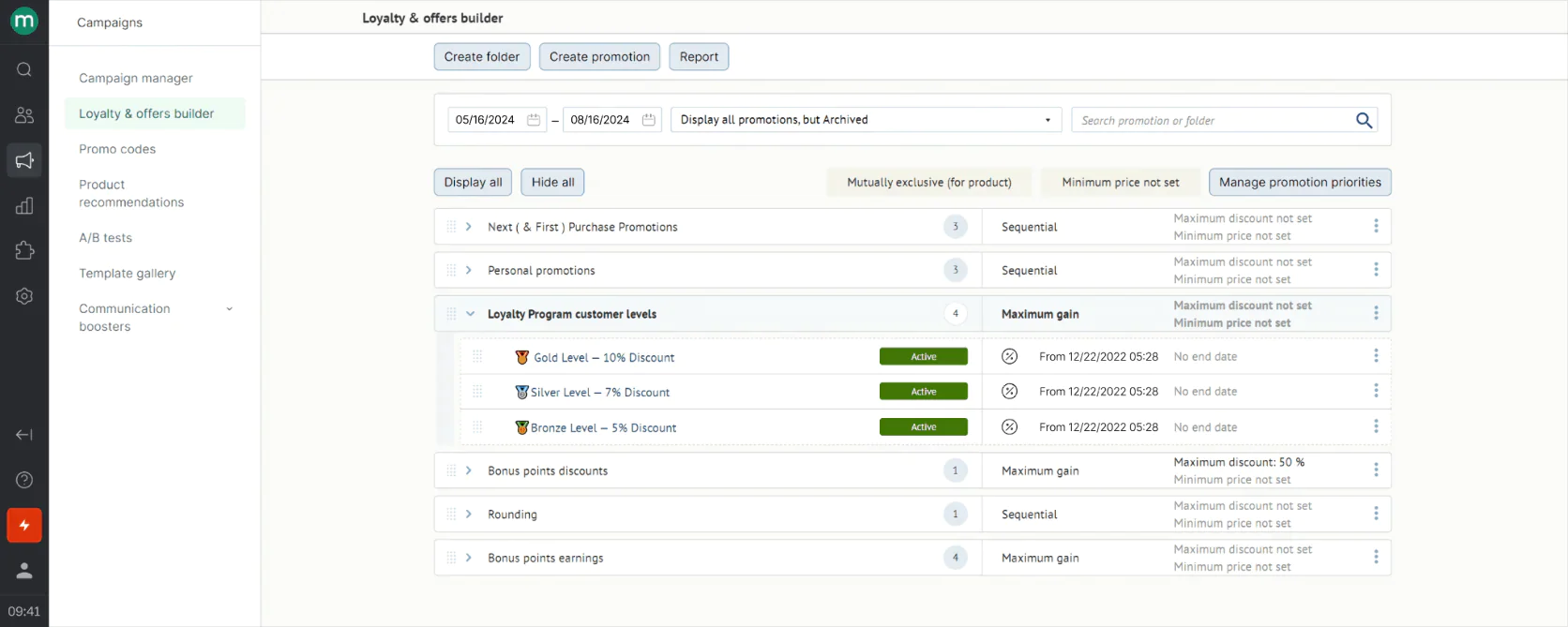

- Built-In Loyalty and Promotions Engine: Unlike WebEngage which would require a separate loyalty tool, Maestra has a native loyalty program module. Marketers can create point-based rewards, VIP tiers, referral incentives, and time-limited promotions from the same platform that sends their campaigns. Crucially, these loyalty incentives can plug directly into campaigns—e.g. an email can automatically include the customer’s current loyalty points balance.

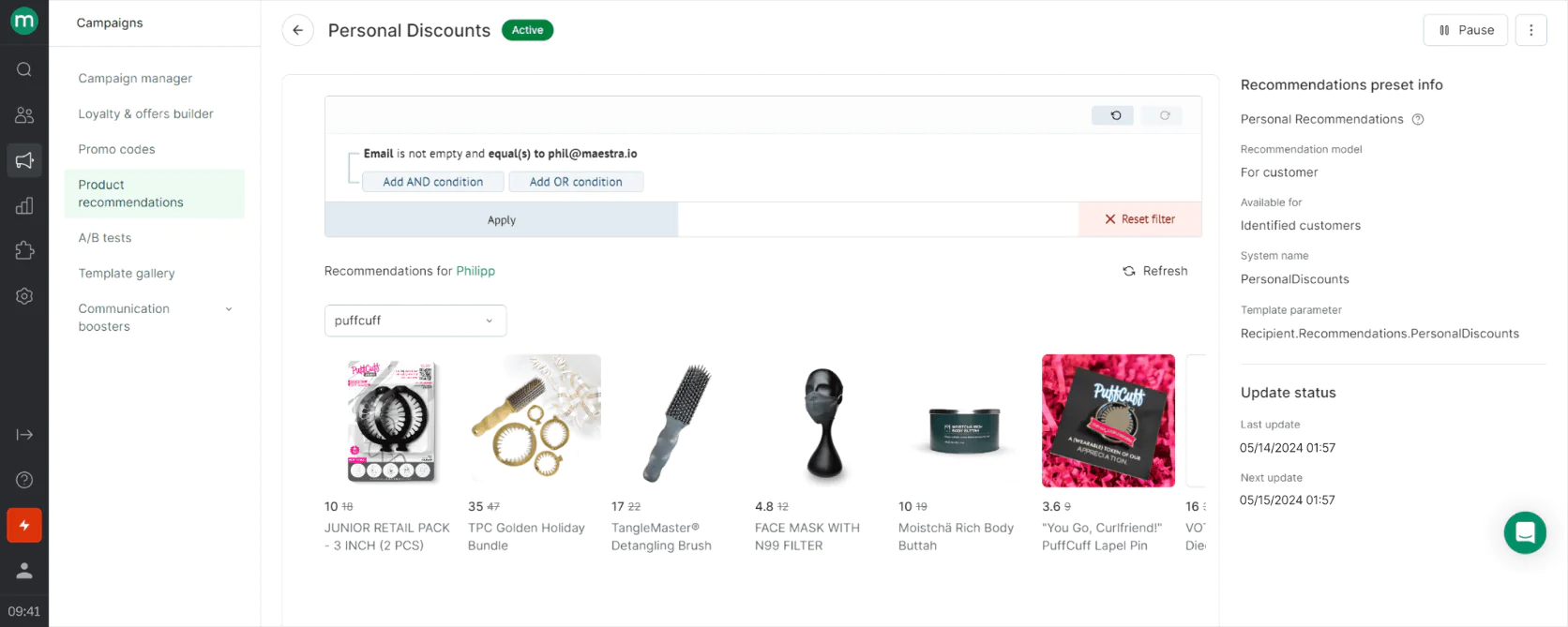

- Real-Time Personalization (On-Site and In-Email): Maestra can personalize web content for each visitor in-session. For instance, it can swap homepage banners or product recommendations based on a user’s past purchases or browsing history, all powered by its unified data. Emails and SMS can also pull in dynamic content (like recommending products the user showed interest in) without needing separate integration. This kind of on-site personalization happening while the user is browsing is usually only seen in top-tier tools.

Personal product recommendations in Maestra

- Dedicated Customer Success Manager (CSM): Every client gets a dedicated CSM acting almost like an extension of your team. This manager assists with onboarding, strategy, and even hands-on campaign setup. Maestra doesn’t leave the heavy lifting to your team alone; they actively help design your flows, set up templates, and optimize performance continuously. For busy marketing teams or non-technical founders, this level of support can dramatically shorten the time to value.

Strengths and Weaknesses

Maestra’s biggest strength is making personalization at scale feel effortless. It’s not just about blasting messages—it’s about sending the right message on the right channel at the right moment.

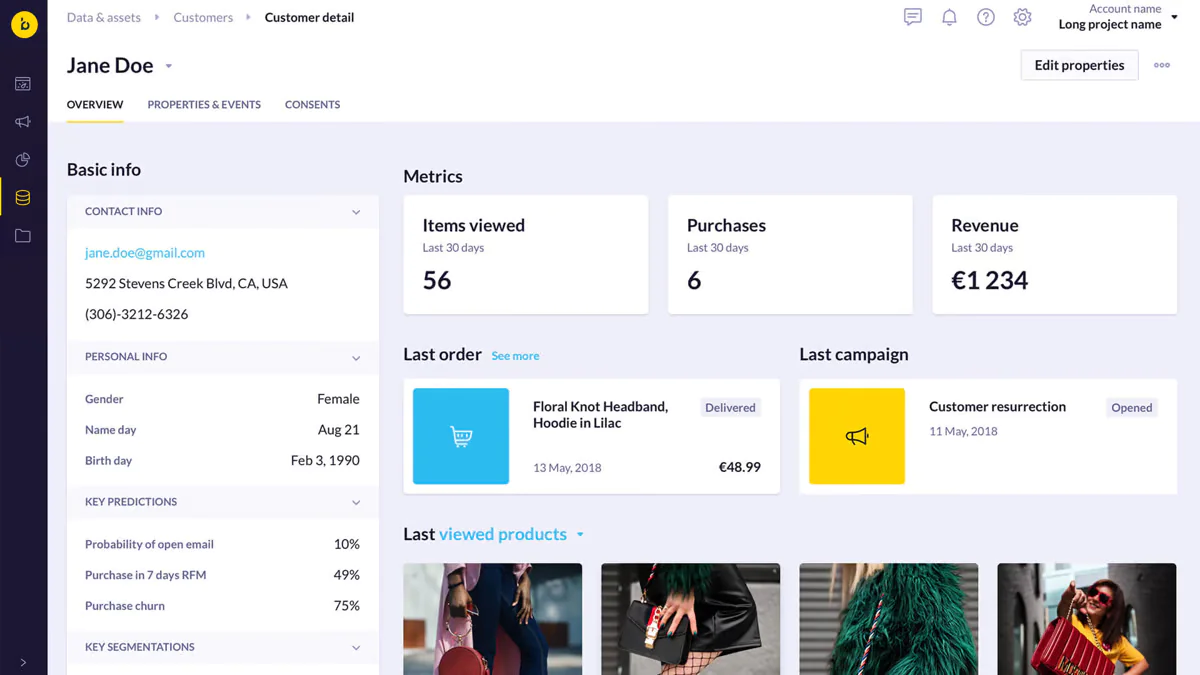

Maestra: user segmentation

Users praise the platform’s ability to set up highly tailored, behavior-triggered campaigns that automatically adapt to each shopper’s journey. For example, you can configure a flow where if a customer’s cart value is above a certain amount, they get a premium upsell sequence, but if it’s below, they get a different nurturing path—all in one visual canvas.

Marketers coming from more manual tools notice they can build complex journeys in Maestra without needing a developer, thanks to the intuitive drag-and-drop builder and rich library of pre-built conditions and actions.

PuffCuff’s flows launched with Maestra

Another strength is the breadth of built-in capabilities. Because Maestra includes email delivery, SMS, push, loyalty, product recommendations, and more in one place, everything works seamlessly together. There’s no stitching together five different tools (and no data silos).

Maestra’s promotions rule engine

On the flip side, Maestra is not aimed at beginners. Also, Maestra currently does not offer a free tier or self-service freemium—it’s a serious platform that typically involves a sales process and onboarding.

Another minor gap is that Maestra, while it encourages gathering customer feedback and reviews through incentives, doesn’t have a built-in reviews/UGC display widget like Yotpo or other review platforms. It integrates with review tools but doesn’t natively showcase UGC on your site. For most looking at WebEngage alternatives, this isn’t a dealbreaker, but it’s worth noting if product reviews management is a key focus—you might pair Maestra with a reviews solution.

Compared to WebEngage

WebEngage and Maestra share the goal of unified customer engagement, but Maestra takes it to another level of sophistication and integration.

Where WebEngage provides a solid campaign builder and multi-channel capabilities, Maestra eliminates many of the add-ons or workarounds that WebEngage might require. For example, WebEngage does offer a form of personalization and a basic CDP, but Maestra’s CDP is real-time and deeply integrated, allowing far more granular targeting and instant adaptation of campaigns.

Also, WebEngage doesn’t include a loyalty program out-of-the-box—you’d need a separate tool—whereas Maestra has it built-in, which means your loyalty data (points, tiers) is immediately usable in any campaign logic.

Another big difference is ease and support. WebEngage is powerful but can require a fair amount of setup and learning, and while their support is decent, it’s not as high-touch. Maestra’s model of giving each client a dedicated CSM means even complex migrations or campaign strategies become easier, since you have expert help on call. For a fast-growing e-commerce brand with limited internal tech bandwidth, this could be crucial.

In summary, compared to WebEngage, Maestra tends to offer more channels (e.g. loyalty, on-site web personalization), a more unified data approach, and a more concierge-style experience.

Tool #2: Braze

Best for Enterprise Omnichannel Customer Engagement

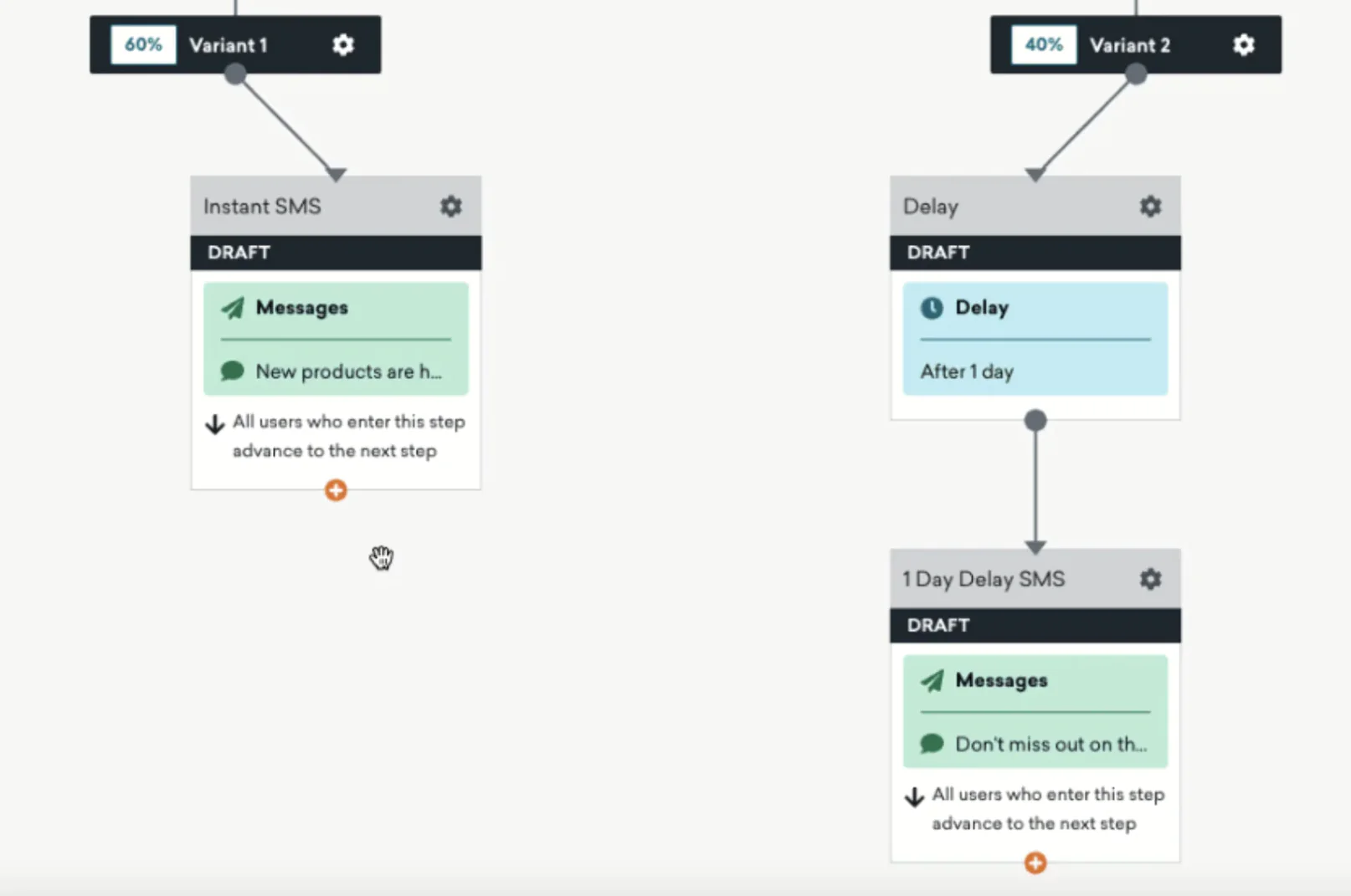

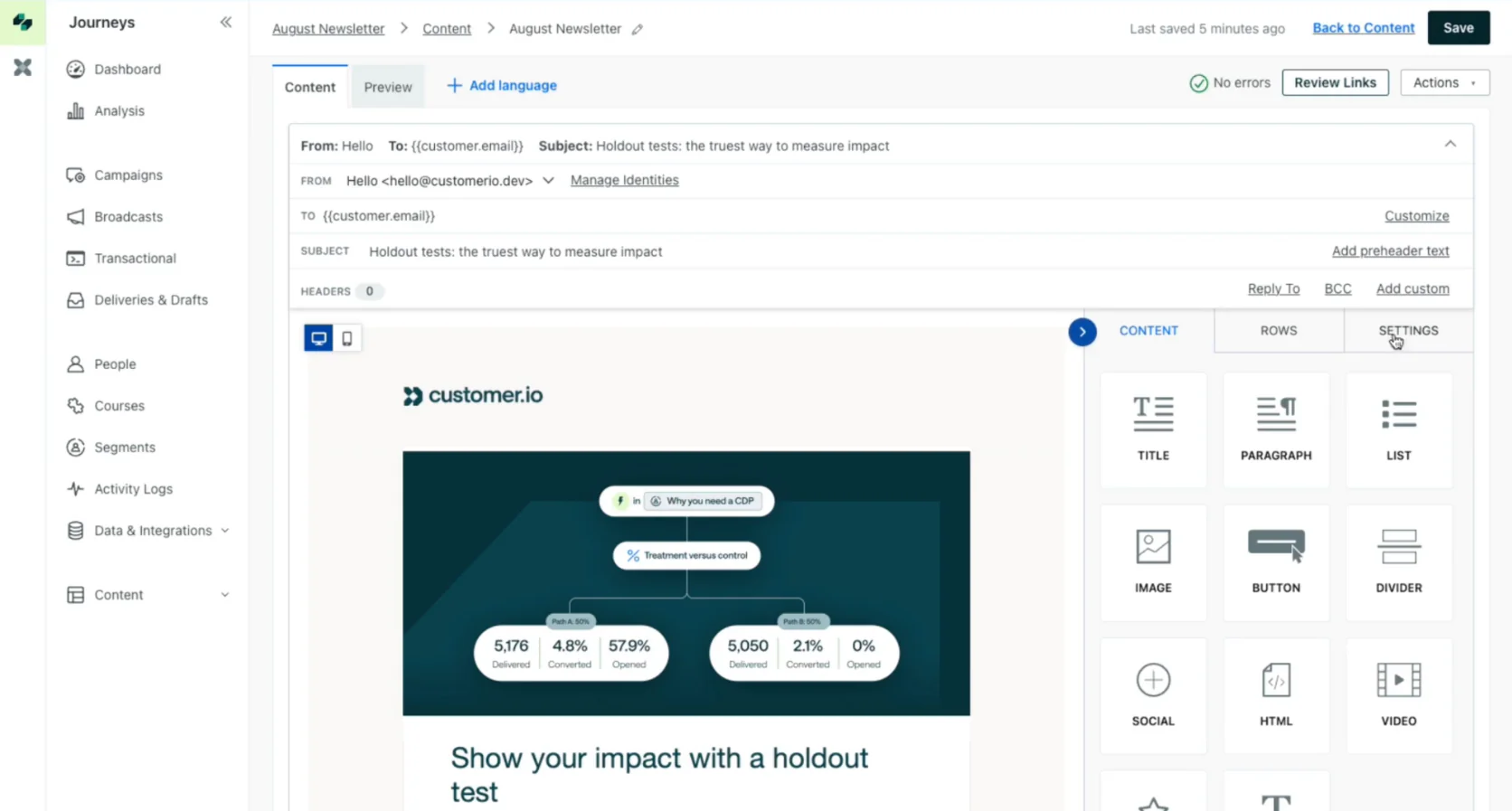

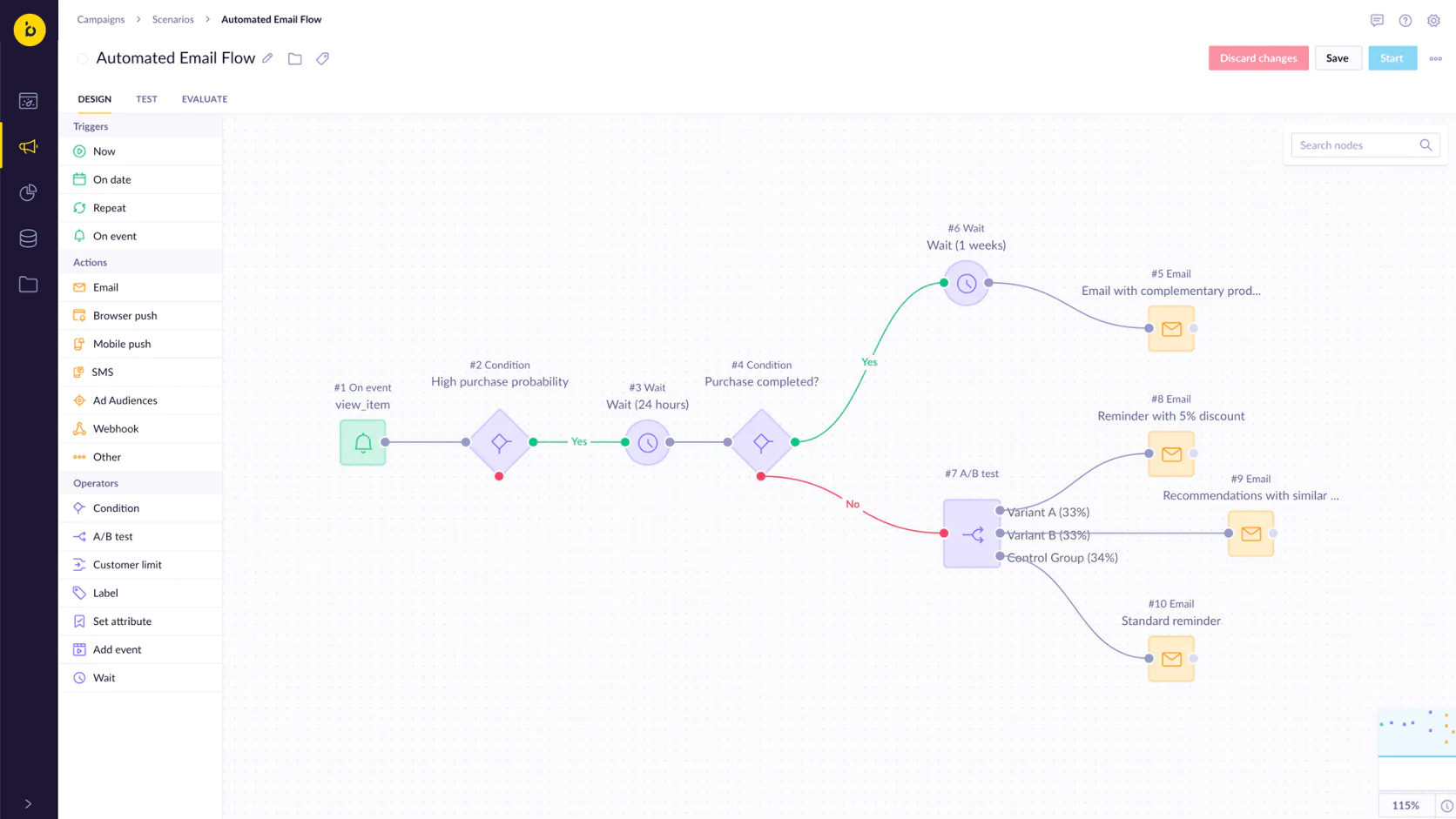

Braze is a heavyweight customer engagement platform widely adopted by large consumer brands and tech companies. It’s known for handling massive user bases and for its real-time, event-streaming architecture. With Braze, marketers and product teams can design sophisticated cross-channel campaigns using a feature called Canvas, which is Braze’s visual journey builder.

Braze’s Canvas tool

Braze excels particularly in mobile app engagement—think push notifications, in-app messages, and dynamic content inside apps—but it also spans email, SMS, and web channels. Its toolkit is often praised for flexibility: from using Liquid templating for advanced personalization to a robust API that allows developers to trigger messages and ingest data on the fly.

Key Features:

- Canvas Flow Builder: Braze’s Canvas is an intuitive yet powerful workflow editor for crafting multi-step campaigns. You can drag in triggers, conditions, and action blocks across channels (email, push, SMS, webhooks, etc.) to create unified customer journeys. For instance, a retail app might have a Canvas that sends an in-app message for a product browse event, waits 1 day, then sends an email if no purchase, and so on. Braze supports complex branching, looping, and even control groups all within Canvas, which is crucial for enterprise experiments.

- Real-Time Data Streaming: One of Braze’s core strengths is its ability to handle streaming events at scale. It offers near-instant triggering of campaigns based on user actions. Braze ingests a high volume of data points and can update user profiles or trigger messages in real time, which is great for time-sensitive use cases (flash sales, live event notifications, etc.). WebEngage has real-time aspects too, but Braze’s infrastructure is renowned for performance under huge loads.

- Personalization and Liquid Templating: Beyond just inserting a first name, Braze allows advanced personalization in messages using Liquid (a scripting language). Marketers can include dynamic content like recommended products or conditional blocks directly in emails or push messages. If you have data like “preferred category” or “last product viewed, ” Braze can use that to tailor each message. It’s very developer-friendly in this regard, enabling complex logic in communications.

- Multichannel and Integration Ecosystem: Braze covers email, mobile and web push, SMS, in-app messages, Content Cards (persistently in-app content), and even has partnerships for things like messaging apps. It also easily integrates with data warehouses and analytics tools. Their Currents feature lets you stream Braze data out to systems like Snowflake or BigQuery for advanced analysis, reflecting a focus on fitting into the enterprise data stack.

- Analytics and Testing: The platform provides rich campaign analytics, funnel reports, and conversion tracking. Marketers can run A/B tests or multivariate tests within Canvas. Braze also has predictive tools—for example, it can use predictive churn scores to create segments. The analytics are often cited as a strong suit, giving teams confidence in measuring the impact of campaigns quickly.

Strengths and Weaknesses

Braze is often lauded for its scalability and reliability. It’s the platform you choose when you have tens of millions of users and you need each to potentially receive a personalized, triggered message at exactly the right moment.

The engineering under the hood is solid. Marketers and growth teams love that once Braze is implemented, they can execute very elaborate retention or re-engagement strategies without constantly needing engineering support, which is a testament to its well-thought-out UI and features for non-technical use (despite the depth available for technical users).

Creating a segment in Braze

Another strength is Braze’s breadth of channels and use cases. It’s channel-agnostic and supports emerging channels quickly (for example, they’ve enabled messaging on new platforms faster than some competitors).

The Braze community and resources are also top-notch—you’ll find a lot of documentation, a supportive user community, and third-party specialists or agencies familiar with it. This is important for enterprise adoption, where you might want to hire people who already know the tool.

However, Braze is one of the most expensive options in this space. There’s no public price sheet, but reports suggest a floor of around $60k/year and many Braze deals run into six or even seven figures annually. There’s no free version, not even a cheap starter—it’s a serious investment. For smaller brands or those in cost-sensitive markets, Braze can be hard to justify. Another consequence of being enterprise-focused is the learning curve: although it’s powerful, new users can find Braze’s multitude of options overwhelming at first (especially if coming from a simpler tool). It often requires a more formal onboarding/training period.

Braze’s approach to being a platform (not an all-in-one suite) means it does not natively offer certain things like loyalty program management or product catalogs—you’re expected to integrate those via API. In contrast, some other alternatives (like Maestra or Emarsys) bake more e-commerce-specific features in. So Braze’s weakness could be that on its own, it’s “just” a superb messaging engine.

Compared to WebEngage

Braze and WebEngage share similar fundamentals (multi-channel messaging, automation workflows, analytics), but differ in target audience and polish. Braze is more polished and proven at massive scale—global brands with huge user bases trust Braze for real-time campaigns, whereas WebEngage has been more regional (strong in APAC) and focused on mid-market scale.

Feature-wise, Braze’s Canvas and WebEngage’s Journey Designer are analogous; both allow visual journey building. Braze’s interface and capabilities, however, might feel more refined in areas like in-app messaging customization or the depth of personalization logic (Liquid templates in Braze provide a level of control that WebEngage’s templating might not natively have).

When it comes to data integration, Braze often gets integrated with an external CDP or data warehouse for the richest view, while WebEngage tries to be a combined CDP+engagement tool. This means WebEngage might appeal if you want one tool to store user data and engage, but Braze will appeal if you already have a robust data infrastructure and want the best engagement tool plugged into it.

In short, WebEngage is a more cost-effective “all-in-one” for emerging markets, while Braze is the premium option for those who need absolute performance and are willing to pay for it. Many mid-sized e-com brands might find WebEngage sufficient, but enterprise players often shortlist Braze for its enterprise support, documentation, and track record.

Compared to Maestra

Braze is a strong alternative to Maestra for companies that prioritize a developer-friendly platform and perhaps already have other point solutions for things like loyalty or on-site personalization. Braze does not attempt to include loyalty or a built-in CDP—it expects you to bring data in.

Maestra, by contrast, includes those pieces (CDP, loyalty, even product recommendations) natively, aiming to reduce dependence on other tools. For an e-commerce company, this means Maestra can act more as a one-stop-shop, whereas Braze might need to work alongside a separate loyalty system or personalization engine.

Another comparison: Maestra’s dedicated CSM and hands-on approach vs. Braze’s support model. Braze does have customer success teams and plenty of enterprise support, but typically you won’t get the same level of “we’ll build your flows with you” service that Maestra provides. Maestra emphasizes a partnership style (appealing if your team wants that guidance), whereas Braze assumes a bit more in-house capability or the use of agencies/consultants.

Lastly, pricing—Braze is likely to be more expensive for equivalent usage. Maestra’s value proposition often is consolidating multiple tool costs (including potentially replacing Braze + a loyalty tool + a personalization tool) into one. If budget is no issue and you already have a modular stack, Braze’s pure-play excellence is attractive. But if you want more built-in capabilities and potentially lower total cost of ownership, Maestra could be a better fit.

Essentially, Maestra is built for commerce-first use cases end-to-end, while Braze is an omni-industry engagement platform with tremendous power but narrower scope of built-in features.

Tool #3: MoEngage

Best for Mobile-Focused Customer Retention (Especially in Asia)

MoEngage is another full-stack customer engagement platform that often goes head-to-head with WebEngage, particularly in India, Southeast Asia, and the Middle East. It offers a very similar value proposition: consolidate your channels (push, email, SMS, etc.), understand user behavior, and automate targeted campaigns to drive retention and conversion.

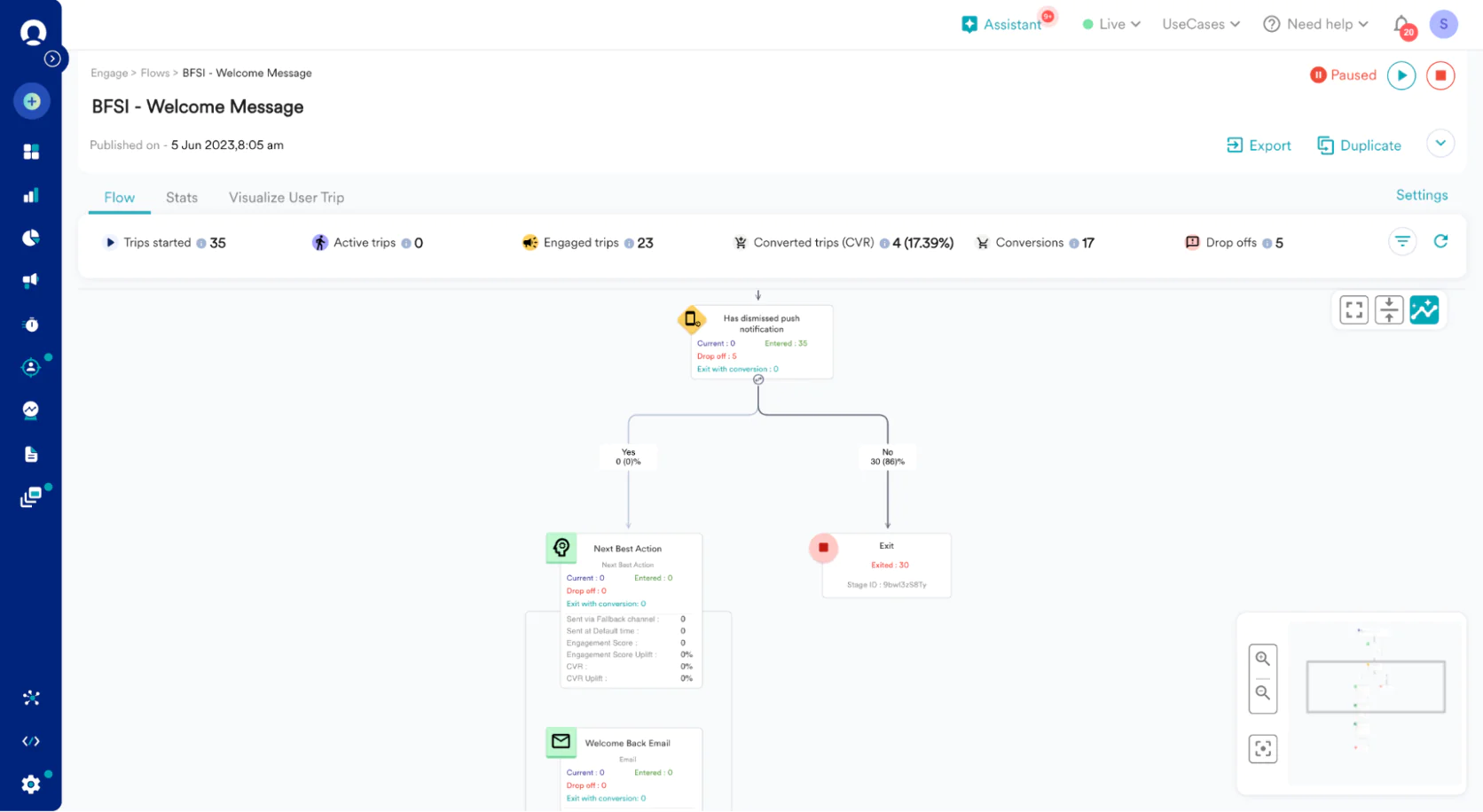

MoEngage’s flow builder

Over the years, MoEngage has invested heavily in push notification technology and mobile app analytics, making it popular with app-first e-commerce businesses and fintech apps. It also positions itself with AI-driven optimizations under a feature-set called Sherpa (which handles things like optimal send time and content variation suggestions).

Key Features:

- Multi-Channel Journeys: MoEngage provides a visual journey builder like WebEngage’s, enabling marketers to set up flows with triggers (like app opens, purchase made, cart abandoned) and actions (send push, send email, etc.). It supports cross-channel branching (user doesn’t open a push notification → you follow up with an email). This journey orchestration is central to MoEngage and includes templates for common flows.

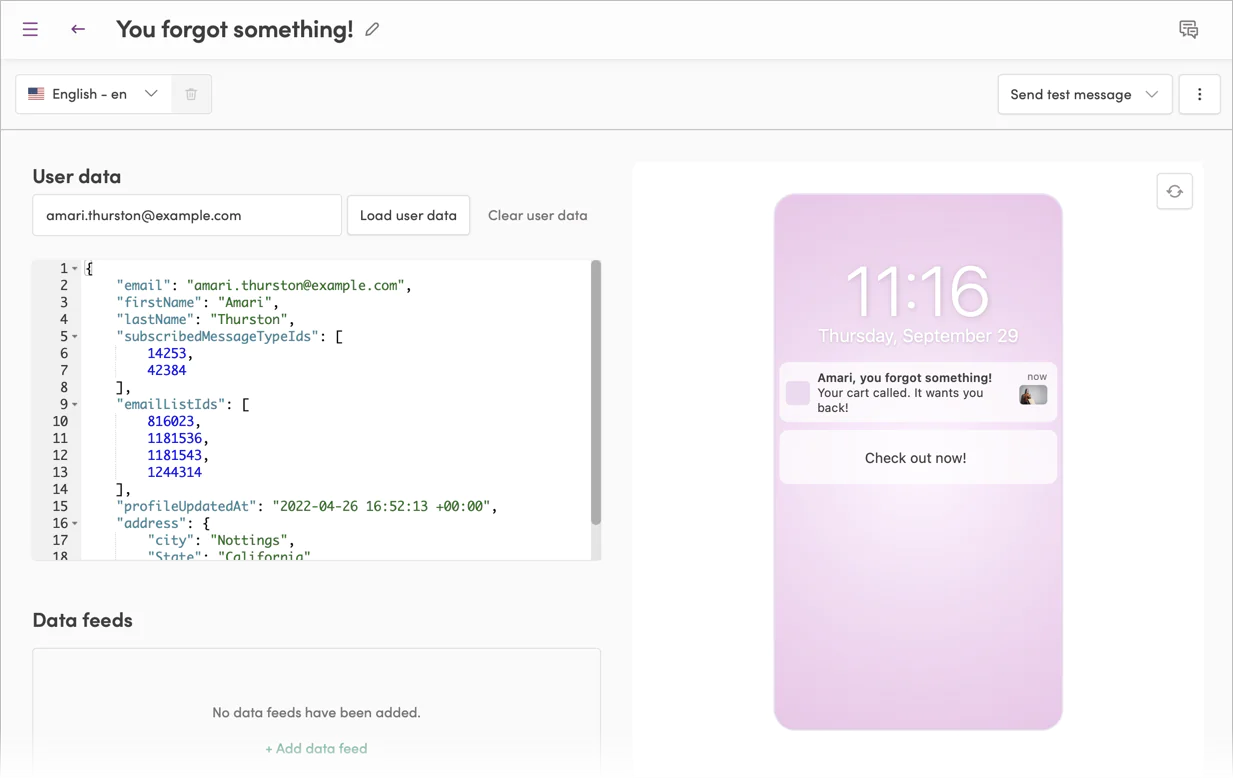

- Mobile Push and In-App Messaging: Push notifications (for mobile apps) are a core strength. MoEngage ensures high deliverability for pushes with features like push amplification (to reach users even in tricky device scenarios). It also supports rich notifications (images, buttons) and has an in-app messaging module to show pop-ups or banners inside your app targeted to specific user segments or behaviors. If a large portion of your traffic is on a mobile app, MoEngage’s specialized capabilities here shine.

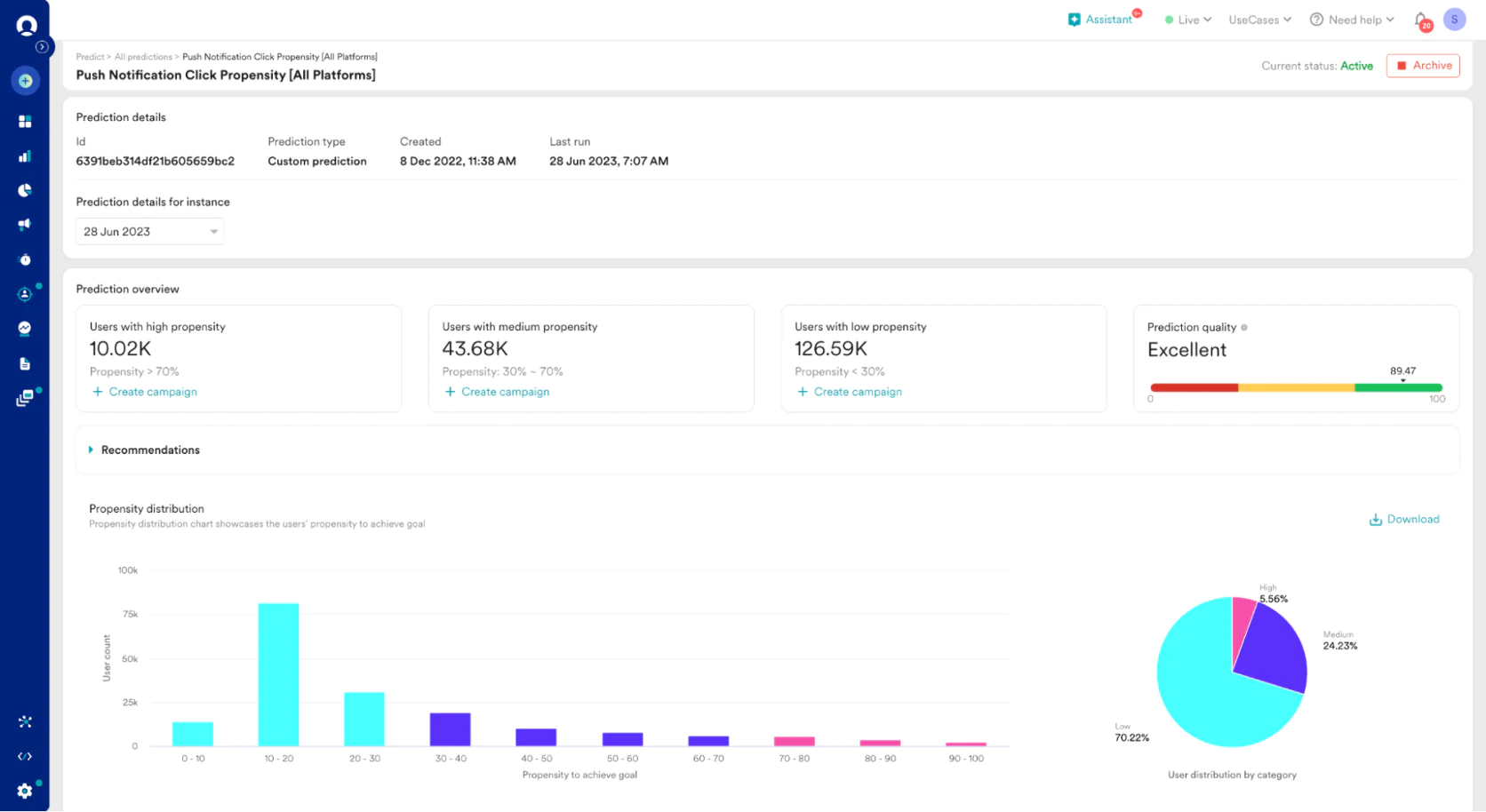

MoEngage’s push notification click propensity

- Analytics and Insights: MoEngage includes built-in dashboards for behavior analytics—you can track funnels (e.g., product view to purchase conversion funnel), cohorts, and trends of user actions over time. This eliminates the need for a separate mobile analytics tool in some cases. For instance, you can see retention curves or the impact of campaigns on key metrics right within MoEngage. The platform also provides an RFM analysis (Recency, Frequency, Monetary) tool to help segment users by their engagement/value level, which is useful for targeting VIP customers differently from at-risk ones.

- AI Optimization (Sherpa): Under the marketing buzzword AI, MoEngage offers a few practical tools: Dynamic Product Recommendations can be integrated into messages if you feed MoEngage your product catalog and events, Optimal Send Time prediction which learns when each user is most likely to engage (so you can send messages at individualized times), and Content AI which can experiment with different message variants to see what works best. These are not entirely unique to MoEngage (Braze and others have similar), but it’s notable that MoEngage packs them in a user-friendly way for marketers.

- Personalization and Localization: MoEngage supports personalization tokens and conditional content in messages. It also has strong multi-language support—important in Asia where campaigns often need to go out in several local languages. You can manage translations and variant content within the platform. Additionally, MoEngage’s segmentation can use location data or device info to tailor experiences, like sending region-specific campaigns.

Strengths and Weaknesses

MoEngage’s key strength is being a well-rounded, cost-effective engagement platform for companies operating at scale in mobile-centric markets

Another strength is their focus on customer support and success in emerging markets. MoEngage is known to be quite customer-centric, providing guidance and resources especially for clients new to marketing automation. They also have a Startup Program (similar to WebEngage’s) that gives new startups credits or discounts, building goodwill early on.

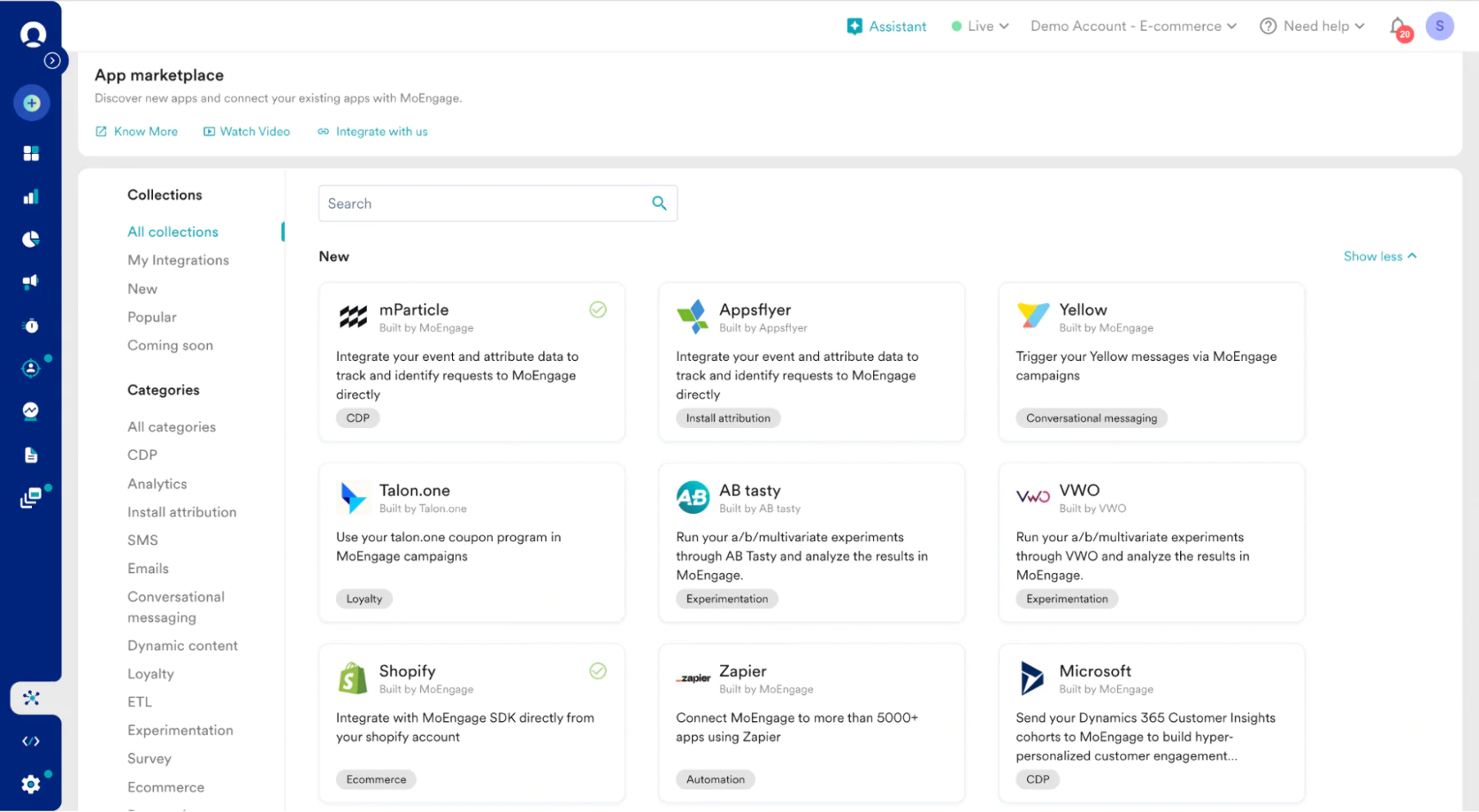

MoEngage’s App Marketplace

On pricing, MoEngage is generally considered reasonable. Sources indicate plans starting around $750-$999/month for modest usage, which undercuts many Western competitors. This flexible pricing (and willingness to negotiate) can be a big plus for mid-size brands.

In terms of weaknesses, MoEngage can still face stiff competition on the higher-end. For example, its email capabilities, while solid, might not be as advanced in deliverability or design as dedicated email platforms; some users integrate MoEngage with external email delivery for this reason.

Also, while MoEngage has improved its analytics, a dedicated analytics tool might still do deeper explorations; MoEngage’s UI sometimes limits how far you can drill down.

Compared to WebEngage

The comparison between MoEngage and WebEngage is natural—both arose around the same time targeting similar customers. They are very closely matched on features, to the point that for many use cases they can be substitutes.

Both have strong push notification modules, journey builders, and cater to multi-channel campaigns. If anything, MoEngage has pulled ahead on UI friendliness and some AI features, whereas WebEngage might have an edge on on-site engagement tools (like WebEngage’s original web feedback widgets are something MoEngage doesn’t emphasize).

WebEngage also touts slightly more focus on web personalization nowadays, whereas MoEngage is still more app-first in reputation.

One tangible difference: some reviews note MoEngage’s customer support can be more responsive, which matters if you’re in a region where WebEngage’s support team is smaller.

Also, MoEngage’s pricing has been cited as more accessible internationally, which can be decisive if budgets are tight. WebEngage’s brand is strong in India, but MoEngage has expanded globally with offices in multiple countries, so it positions itself as a more international solution.

In summary, WebEngage vs MoEngage is often a close call—they leapfrog in features often. If you are currently on WebEngage and finding issues in segmentation speed or needing slightly better predictive capabilities, MoEngage is a logical alternative to test (and vice versa). Many emerging market e-commerce players evaluate both and sometimes even switch between them depending on pricing and service.

Compared to Maestra

MoEngage and Maestra differ more significantly in approach. MoEngage is an engagement platform that you integrate into your stack, while Maestra aims to be an all-in-one marketing engine.

For an e-commerce brand, one immediate difference is loyalty program support—Maestra has it built-in, MoEngage does not. If loyalty marketing is key, with MoEngage you’d be using a separate loyalty system and then connecting it to MoEngage to send rewards notifications, etc., whereas Maestra would handle both issuance of points and the messaging around it in one place.

Another point: data unification. Maestra’s CDP means it can ingest not only marketing events but sales, in-store, support data, etc., to use in segmentation. MoEngage largely focuses on digital interaction data (app/web events, campaign responses). If you wanted to do something like segment customers by their offline purchase history or customer service tickets, you’d need to pipe that into MoEngage via custom events—possible, but more effort. Maestra’s platform is built to accept and use that kind of data more readily in its CDP.

Also, Maestra’s on-site personalization vs MoEngage’s focus on messaging: Maestra can, for example, change your website’s content for a user in real-time (show different homepage banners, product recs, etc.), which is not something MoEngage does (MoEngage would integrate with an external personalization tool or rely on you to handle on-site changes via its API triggers). For a retailer wanting to truly unify marketing and onsite experience, Maestra has an edge.

Finally, service model: Maestra’s dedicated CSM vs. MoEngage’s standard support. MoEngage offers good support, but Maestra basically partners with you on strategy. This might mean Maestra can drive results faster if your team is small. Conversely, if your team has strong marketers who want to self-serve and experiment on their own, MoEngage’s interface will let them do that (as will Maestra’s, but Maestra will also be giving advice actively, which some teams might or might not prefer).

In essence, choose Maestra if you want a more holistic commerce marketing solution with high-touch guidance and you’re aiming to integrate loyalty, personalization, and multi-channel comms in one; choose MoEngage if you’re specifically looking to optimize app and mobile engagement with a proven tool and perhaps already have other systems handling things like loyalty or advanced personalization.

Tool #4: CleverTap

Best for Mobile App Analytics & Engagement Combo

CleverTap is a platform that blurs the line between analytics and engagement. It originally started with a strong focus on mobile app analytics and user retention for apps, and later expanded to include campaign orchestration (similar to how others added analytics).

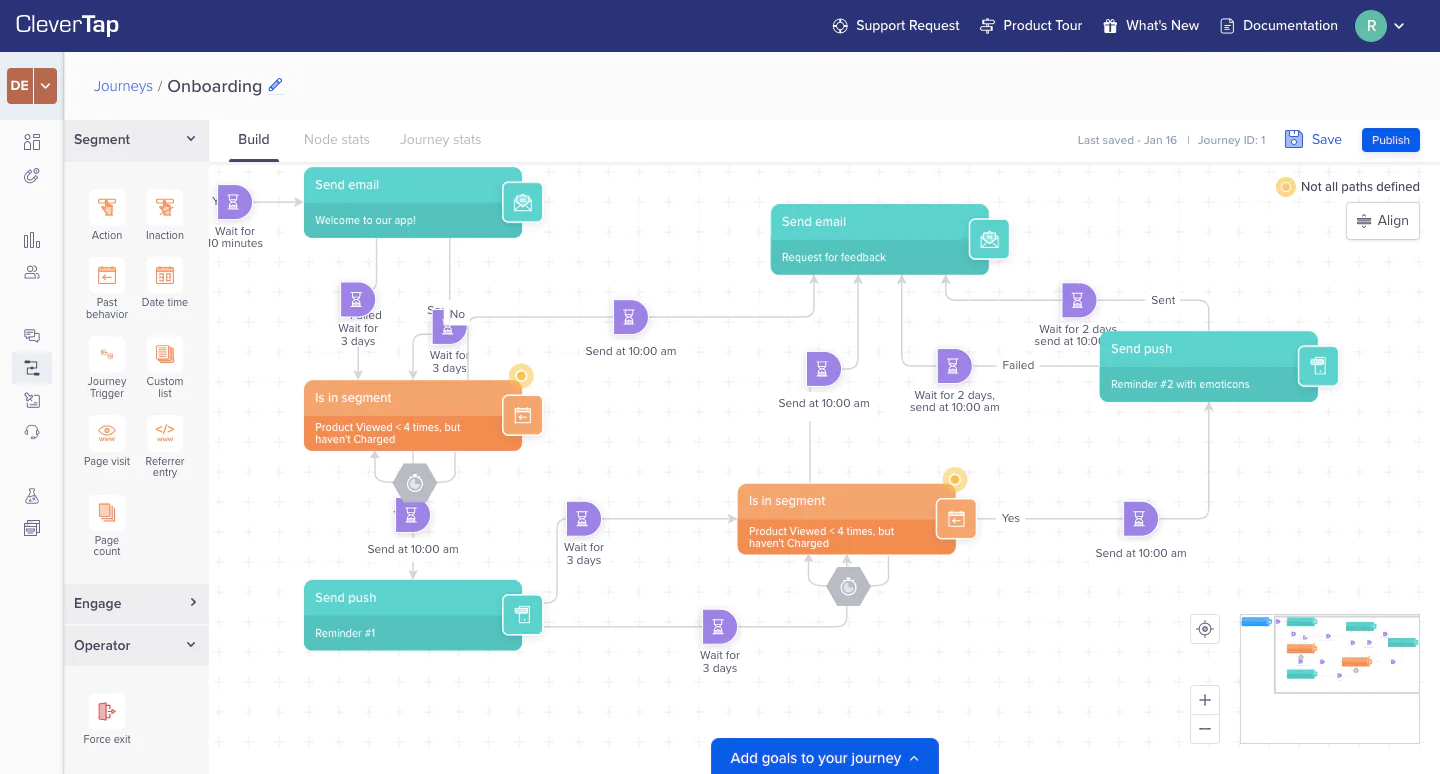

CleverTap’s flow builder

As a result, CleverTap is often favored by product teams and marketers who want a single solution to both understand user behavior deeply and act on it. It’s used by many mobile‑first businesses (streaming apps, fintech apps, as well as e‑commerce apps) to drive upsells, retention, and lifetime value.

Key Features:

- Advanced Mobile Analytics: CleverTap provides out‑of‑the‑box dashboards for active users, session tracking, uninstall tracking, and more. You can create funnels (e.g., app launch → product view → add to cart → purchase) and see drop‑off at each step, perform cohort analysis (how retention or behavior changes for users who joined in week X vs week Y), and run unbounded queries on event data. It’s akin to having an integrated Mixpanel or Firebase Analytics. This analytics depth is something not all marketing automation tools have built‑in.

CleverTap’s funnel dashboard

- Event‑Based Segmentation and RFM: You can segment users by any combination of actions (or inaction). For example, “users who viewed product X but didn’t purchase in last 7 days” can be made into a live segment easily. CleverTap also popularized an RFM segmentation model where it auto‑segments your user base into categories like “Champions, At Risk, Loyal, New” based on their Recency, Frequency, Monetary value scores. This helps prioritize who to target with what campaigns (e.g., win back the “At Risk” group with a special offer).

- Omnichannel Campaigns: Over time, CleverTap extended beyond push and in‑app to also support email, SMS, web push, and web pop‑ups. You can create campaigns triggered by events or schedule them. It has a visual journey builder (called “Journeys”) similar to others, so you can automate sequences (e.g., send push, then email if no action, etc.). However, many users still leverage CleverTap primarily for the push notifications and in‑app messages, given its roots.

- A/B Testing and Personalization: CleverTap allows A/B testing of both messages and even app experiences. There’s a feature where you can create variants of in‑app messages or notifications and test which drives better conversions. Also, you can remotely configure certain app UI components for different user segments via CleverTap. Personalizing message content based on user properties is supported, but for heavy personalization you might need to feed data into it or use their partner integrations.

- Lifecycle Optimizer & Automations: The platform has pre‑built campaign types and recommendations based on the user’s stage in lifecycle. For example, it might identify users who have stalled after onboarding and suggest a campaign to re‑engage them. These intelligent nudges can help marketers new to retention strategy.

Strengths and Weaknesses

One of CleverTap’s greatest strengths is the fusion of rich analytics with engagement. Teams love not having to swivel between an analytics tool and a messaging tool—in CleverTap you can find an insight (“users who did X but not Y are dropping off”) and directly convert that into a campaign segment and message within minutes. This speed from insight to action is extremely valuable in fast‑paced environments.

Creating an email with Clever.AI’s recommendations

For mobile product managers, having granular event analysis, retention curves, and attribution in the same interface as engagement campaigns is a big plus.

Another strength is how mobile‑centric features are first‑class citizens. CleverTap was built mobile‑first, so things like tracking uninstalls (and even sending an SMS or email to users who uninstalled your app, to win them back) or running app inbox messages are there.

They also have a clever feature that can send a push notification at the exact moment a user is likely to open the app (by learning usage patterns), which can increase relevance. This focus means if your business heavily revolves around a mobile app, CleverTap speaks your language.

On the downside, if your needs are more weighted to traditional channels like email, CleverTap might not be as specialized. For example, their email builder and email deliverability optimization might not be as advanced as a dedicated email platform or as some other competitors.

Some users report that designing complex responsive emails in CleverTap is a bit less smooth than in, say, Braze or a dedicated ESP. Additionally, CleverTap’s strength in apps means its web engagement features (like web personalization or web surveys) are not as deep as some others—it’s not going to replace tools like Optimizely or full CDPs for web data.

CleverTap also historically did not have a built‑in loyalty or referral program module, nor things like product catalog management. It’s very much an analytics + messaging tool, and you’d integrate other services for those marketing functions if needed.

And while CleverTap has expanded globally, it’s still most popular in Asia; a company in the U.S. or Europe might find fewer local agencies or talent experienced with CleverTap compared to something like Braze or Salesforce, though this is gradually changing.

Compared to WebEngage

CleverTap and WebEngage overlap a lot—both offer journey builders, push notifications, SMS, and RFM segmentation. The key differentiator is analytics. CleverTap’s analytics capabilities are generally considered superior, with more real‑time flexibility and depth, whereas WebEngage might require integrating a separate analytics solution for similar insights.

If a marketing team heavily relies on data exploration to guide campaigns, CleverTap is appealing. On the other hand, WebEngage has unique touches like on‑site survey widgets and a slightly more extensive built‑in channel mix (for example, on‑site notifications) that CleverTap lacks.

In terms of usage, WebEngage is often praised for its easy journey builder and campaign setup for marketers. CleverTap, while fairly user‑friendly, can sometimes feel like an analyst’s tool melded into a marketer’s tool—a complexity that comes with power.

Also, WebEngage’s pricing for a base plan might be lower than CleverTap’s new “Essentials” plan if that $70/month for 5k users is accurate, though CleverTap at $70 is extremely low‑cost (perhaps it’s a very limited plan). Historically, both were priced in the few hundreds to thousands per month range for mid‑size.

If a company is currently on WebEngage and finds themselves exporting data to analyze elsewhere, switching to CleverTap might consolidate that. Conversely, if they are on CleverTap but not using the analytics much, they might consider WebEngage for possibly simpler UI and potential cost savings.

Compared to Maestra

CleverTap is a very different animal compared to Maestra. Maestra is commerce‑specific and all‑in‑one, whereas CleverTap is a horizontal analytics + engagement tool for apps.

For an e‑commerce brand, CleverTap will give you great insight into user behavior and let you run campaigns, but it won’t give you a loyalty program or plug directly into your Shopify store to pull product data or revenue out‑of‑the‑box. Maestra does those things—it syncs product catalogs, attributes revenue to campaigns, and has built‑in loyalty and promotion mechanisms.

Think of it this way: if you need to build a full e‑commerce CDP with personalized emails, maybe include dynamic product recommendations, and manage offers, Maestra is tailored to that. CleverTap would require you to manually set up events for purchases, integrate with your e‑commerce backend to get product info, and you’d have to calculate metrics like CLV yourself or via external tools.

Maestra’s channel coverage (email, SMS, push, on‑site, ads) in an integrated fashion might outdo CleverTap’s if you heavily rely on certain channels. For example, on‑site web personalization—Maestra can target website content changes, while CleverTap doesn’t do that (it might do web pop‑ups but not full content swaps).

However, if you are an app‑first company with a major focus on in‑app engagement and you have a robust data team, CleverTap could be a better fit to deeply analyze in‑app behaviors and fine‑tune them. Maestra doesn’t try to replace full‑fledged product analytics; it tracks events for campaign triggers but an analyst might still want a separate analytics suite with Maestra.

With CleverTap, the analyst and marketer can use the same tool. In summary, Maestra vs CleverTap is holistic commerce marketing vs specialized mobile retention analytics. Choose Maestra if you want an all‑in‑one marketing solution that directly drives revenue with built‑in retail features; choose CleverTap if you need deep user insights and a solid campaign tool focused on mobile app engagement.

Tool #5: Iterable

Best for Flexible Cross-Channel Marketing at Scale

Iterable is a growth marketing platform that’s gained popularity among DTC e‑commerce brands and tech companies that outgrew basic email tools but weren’t ready (or willing) to jump to enterprise giants. Iterable’s hallmark is flexibility—it’s built to be extensible and work with your existing data sources with relative ease.

Iterable’s visual email composer

It covers email, mobile push, SMS, in‑app, direct mail (via partners), and more. One way to think of Iterable is “Braze for mid‑market”: it offers a similar cross‑channel canvas and personalization capabilities, often at a different price point and with a philosophy of being marketer‑friendly and developer‑friendly.

Key Features:

- Visual Workflow Studio (Journey Builder): Iterable offers a visual campaign composer called Workflow Studio. It’s a drag‑and‑drop interface where you define triggers (signup, purchase, etc.), filters, time delays, and messaging actions across channels.

- Catalog Data and Personalization: Iterable has a feature called Catalogs that lets you import structured data (like a product catalog or content feed) and use it in campaigns. For example, you can set up an email that automatically pulls in the specific items each user browsed but didn’t buy.

- Multichannel Messaging and Deep Linking: Iterable supports sending messages on many channels, including some less common ones like in‑app notifications and even direct mail via integration. It also has features for deep linking (so that links in emails or SMS can open directly in the mobile app if installed, improving user experience). This is helpful for brands that want a seamless cross‑channel journey.

Iterable: сreating push notification template

- User‑Friendly and Team Collaboration: The platform’s interface is relatively intuitive, and it allows things like experiments (A/B tests) to be set up within workflows, and a good system for managing templates. It also has role‑based access and workflow approvals, which mid‑sized teams appreciate to collaborate safely.

- Integration and API Strength: Iterable provides robust APIs and supports things like Webhook steps in workflows (to send data to external systems or trigger something outside of Iterable). Many companies leverage Iterable’s API to record custom events or to trigger an Iterable workflow from their backend. Iterable also integrates with many analytics and data tools.

Strengths and Weaknesses

One strength of Iterable is its balance of power and usability. Marketers often find it easier to pick up than enterprise tools like Adobe or SFMC, yet it doesn’t skimp on features needed as you scale.

It’s quite agnostic in terms of data schema—you can define custom events and fields without much limitation, which means it can adapt to many industries (from e‑commerce to media to B2B). This flexibility is cited by customers who have unique data they want to use in campaigns.

Iterable: user segmentation

Iterable’s customer support and community also get positive mentions. They have good documentation and a growing community of users (especially among subscription e‑commerce and online services).

The platform also updates fairly frequently with new features, signaling a strong product development pace.

Now, weaknesses: cost is one. Iterable isn’t as expensive as Braze or SFMC at enterprise scale, but it’s not cheap either. It often requires an annual contract and can easily cost thousands per month for large databases. There’s usually no true self‑serve low‑tier (though occasionally they’ve offered a startup plan). If you’re a small business, Iterable would be overkill both in features and price.

Additionally, while Iterable is strong in cross‑channel, some specialized features might lag best‑in‑class point solutions. For example, its AI capabilities (like send‑time optimization or predictive scoring) have historically not been as advanced as others.

Also, designing very complex segment queries in Iterable can sometimes be challenging if you have to combine many behavioral and profile conditions—some users export to SQL in a data warehouse for really advanced segmentation logic instead of doing it all in‑platform.

One more consideration: Iterable doesn’t include a built‑in visual content editor for on‑site personalization (no web personalization tool) and no native loyalty module. It’s focused on communications. So similar to some others, if you need loyalty or on‑site changes, you’ll integrate with other systems.

Compared to WebEngage

Iterable is a step up for many who have outgrown platforms like WebEngage. A few differences: Iterable’s email capabilities (sender infrastructure, inbox placement tools, etc.) might be stronger given its roots in markets like the US where email volume is huge, whereas WebEngage historically might lean more on push/notifications.

Iterable also shines in multi‑channel parity—all channels are integrated in one workflow builder, whereas WebEngage too does that, but some have noted WebEngage’s strength is push and SMS with email being good but not the primary focus in some cases.

If a company is on WebEngage and finds it limiting to incorporate certain data or to execute certain complex personalization, Iterable might solve that with Catalogs and its Handlebars templating. Iterable’s interface might be more modern‑looking and the ecosystem (partners, how many people know it) in Western markets is stronger, so hiring or contracting help can be easier. WebEngage, on the other hand, might offer a more out‑of‑the‑box solution if you’re specifically in its supported ecosystems (like certain Asian e‑com platforms).

Also, WebEngage vs Iterable pricing—WebEngage is likely cheaper at similar contact counts, especially if you’re in a region they price aggressively. Iterable tends to be priced on par with mid/high‑end tools and may charge based on contact count or message volume.

For a data‑rich e‑commerce, Iterable offers more flexibility in ingesting custom data (like detailed product catalogs or user attributes) which you can then use in campaigns. WebEngage has a CDP but might not have as flexible a data schema or such explicit Catalog feature. In essence, Iterable can adapt to complex data models which some more out‑of‑box tools might not easily handle.

Compared to Maestra

Iterable and Maestra share the omnichannel vision, but diverge in specialization.

Maestra is purpose‑built for e‑commerce, including things like loyalty, product feeds, and on‑site personalization inherently. Iterable is a general cross‑channel platform that you configure for e‑commerce.

For example, if you want to do a loyalty points reminder email via Iterable, you need to make sure you’ve imported each user’s loyalty points into Iterable as a field or event—it can do it, but you’re doing that setup. In Maestra, that’s likely just a native feature to drag into an email (since Maestra tracks loyalty internally).

Maestra’s strength in real‑time site personalization isn’t matched by Iterable; if you want to personalize your website with Iterable data, you’d have to build that with APIs or use an external personalization tool feeding off Iterable’s data. So Maestra offers a more integrated experience across marketing channels and the website/storefront itself.

Maestra tends to want to be the central brain (including data storage). So it depends on your philosophy: Iterable is great if you have or want a modular stack (you use best‑of‑breed for different things and connect them), whereas Maestra is great if you prefer one unified platform for marketing and not worry about stitching tools together.

In terms of support, Iterable gives good support but not necessarily a dedicated person building flows for you. Maestra’s high‑touch approach might lead to faster execution for a lean team.

Finally, for cost, Iterable is typically a significant expense but can be less than Maestra’s starting price if you don’t need all of Maestra’s bells and whistles. Iterable might offer more flexible pricing based on usage (some sources cite starting around $500/month but realistically many spend a few thousand). Maestra starts at around $2,300, but includes more in that price (service and multiple tools’ worth). So for a pure software‑to‑software comparison, Iterable could be cheaper; but if you’d otherwise have to pay separate for loyalty or site personalization with Iterable, the total cost difference may narrow.

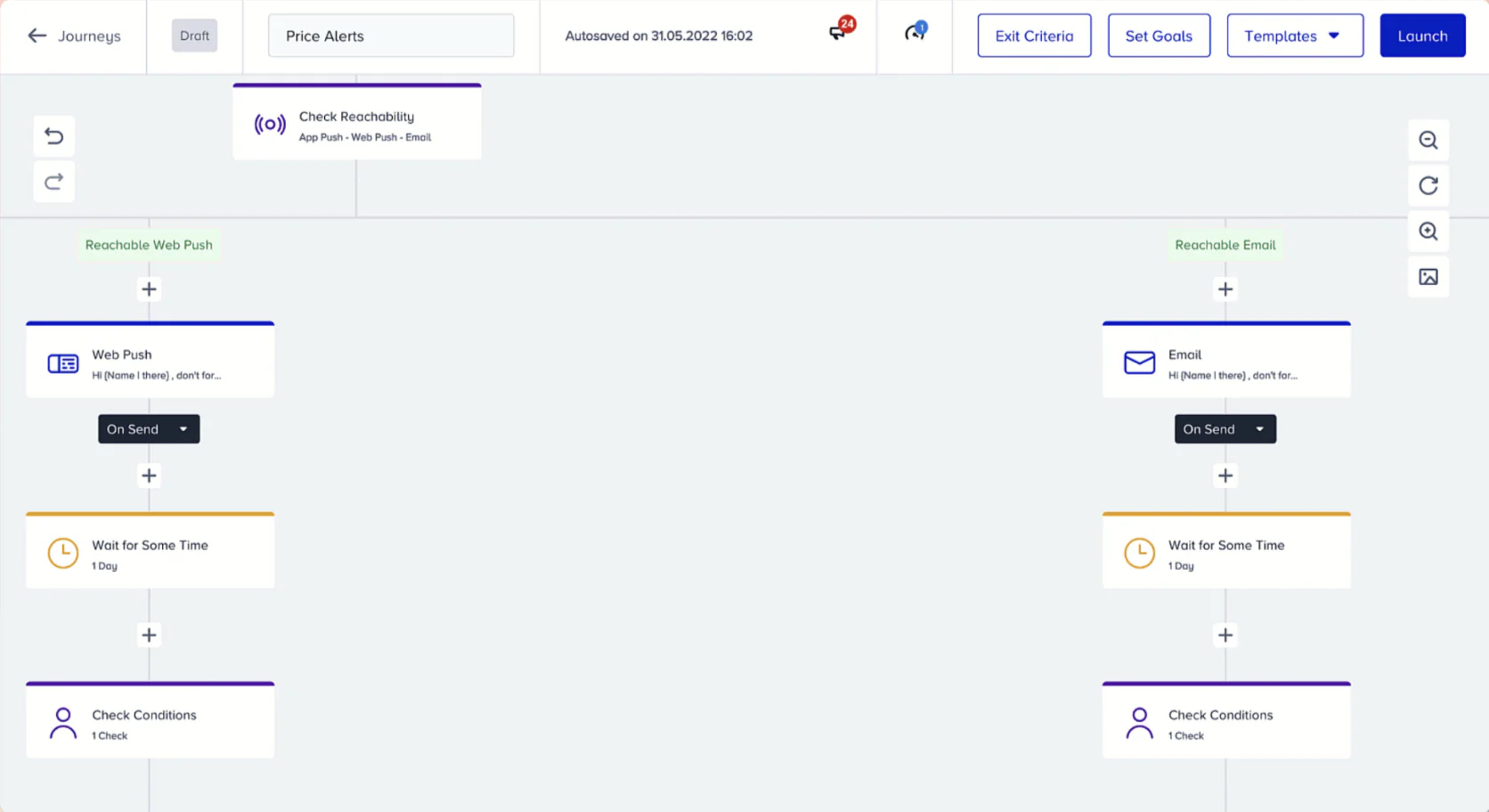

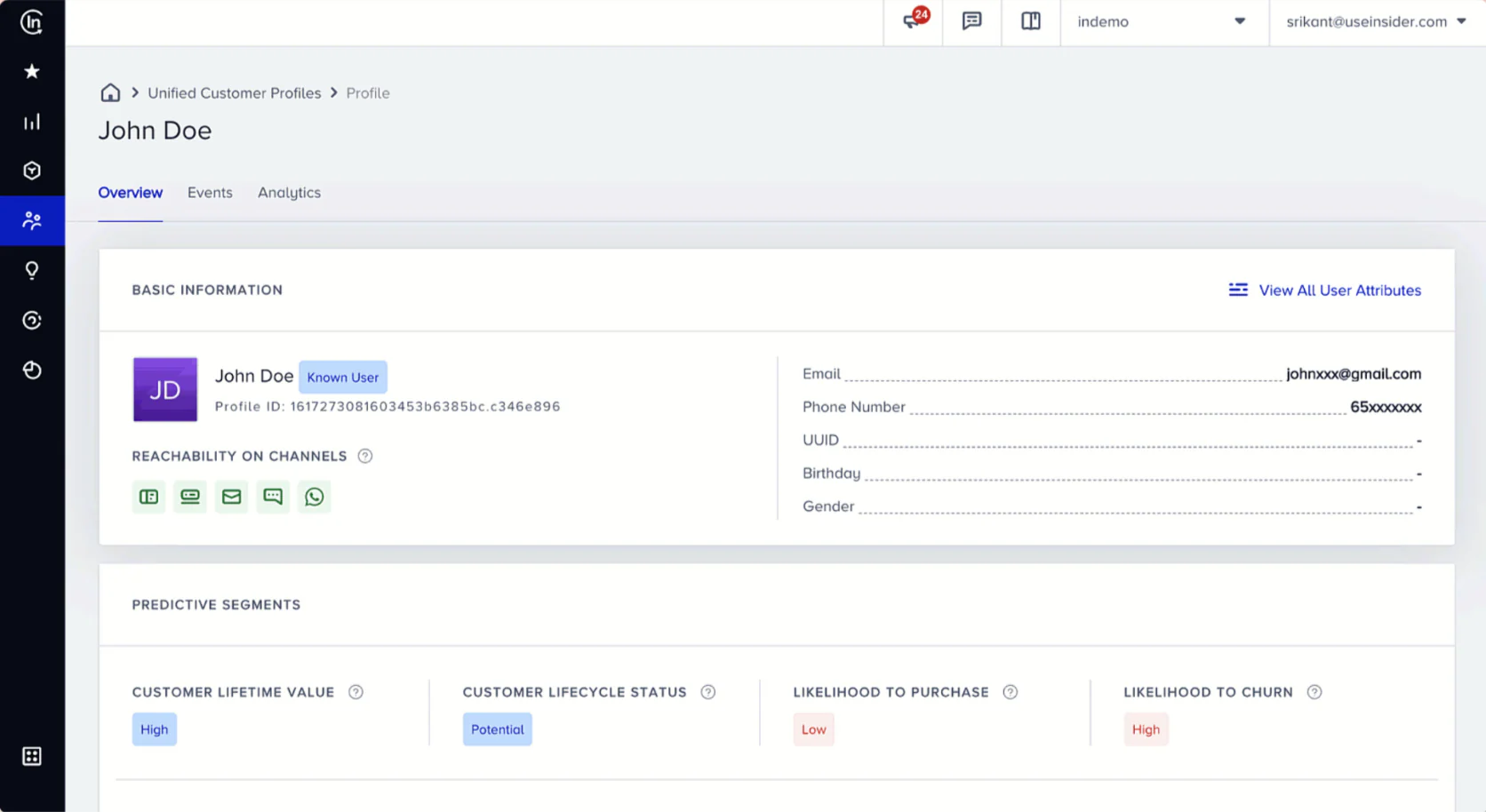

Tool #6: Insider

Best for AI-Powered Personalization and Omnichannel for Enterprise Retail

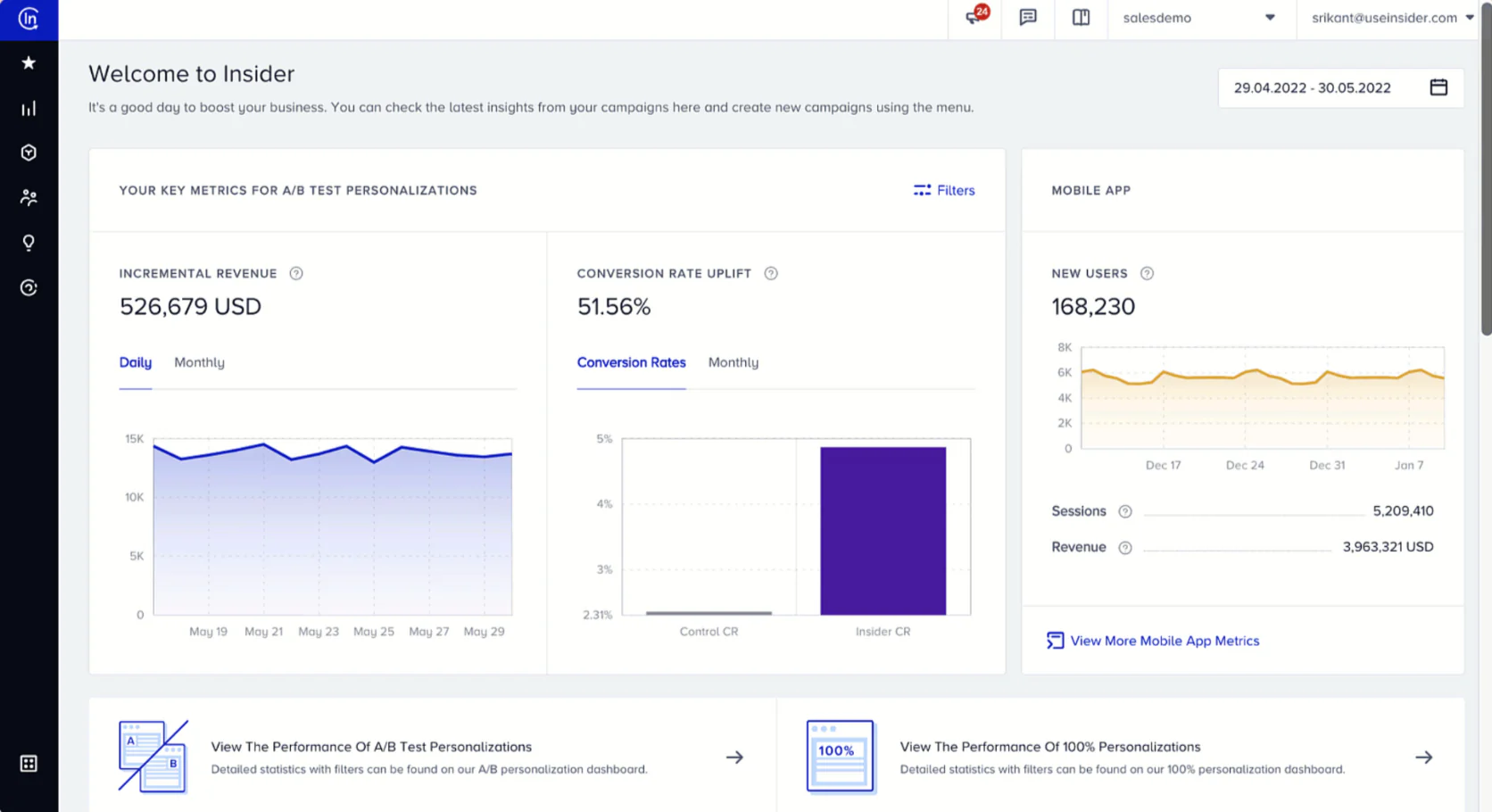

Insider is a platform focused on delivering personalized experiences across channels, with a notable strength in AI-driven recommendations and web personalization. It originally started in the personalization space (web and mobile) and then expanded into the multichannel campaign realm. Insider often markets itself with the promise of driving growth through individualized product discovery and experiences, using its AI engine (called Sirius).

Insider’s flow builder

It’s particularly popular with large retail and travel brands that want to optimize every touchpoint—from onsite content to marketing messages—with intelligent targeting.

Key Features:

- AI Recommendations and Predictive Segments: Insider’s AI capabilities allow brands to show each customer products or content tailored to their behavior and preferences. On websites or apps, Insider can render personalized product recommendations. They also compute predictive scores (e.g., purchase propensity, churn likelihood) and allow you to create segments based on these predictions. Essentially, Insider provides a personalization engine that is both onsite and offsite (you can use it in emails too).

Insider’s segmentation

- On‑site Engagement Tools: Insider includes a suite of on‑site customer engagement tools: web push notifications, slide‑in pop‑ups, exit‑intent offers, social proof widgets (like “X people are viewing this”), countdown timers, and more. These help convert traffic on your site by making it more interactive and personalized without needing separate apps for each function.

- Journey Orchestration and Multi‑Channel Messaging: More recently, Insider has built out its Journey Orchestrator, which is akin to other tools’ journey builders. It can send emails, SMS, mobile push, WhatsApp messages, Facebook Messenger, and even trigger ads, all based on user behaviors and conditions. The journey builder allows condition splits and goal tracking, providing a unified view of cross‑channel campaigns.

- Pre‑built Industry Templates and Use Cases: Insider often highlights their ready‑to‑use templates for common use cases. They can speed up deployment for marketing teams—especially in retail/e‑commerce, as well as segments like travel/hospitality, where they also have specific playbooks.

- Customer Data Platform Elements: While maybe not a full CDP, Insider does unify customer data from various touchpoints. It can ingest data from your site/app (via their SDK), plus import offline or other data. The unified profile is used for personalization and segmentation. It’s not as open‑ended as a dedicated CDP, but it covers most needs by centralizing events and attributes to drive campaigns.

Insider’s customer profile

Strengths and Weaknesses

Insider’s strength lies in its comprehensive approach to personalization. Many tools can send messages, but Insider ensures those messages and the on‑site experience are intelligently tailored by the same brain.

Another strength is their global support and presence. Insider is a global company (originating in Europe/Turkey region, now widespread in Asia and expanding elsewhere) and known for hands‑on support. Much like Maestra’s model, Insider assigns customer success folks to help with strategies and ensuring ROI. They often highlight how quickly clients can launch campaigns on their platform thanks to a combination of these CSMs and the pre‑built templates.

Insider also supports a wide variety of channels including some localized ones (like WhatsApp, Line, etc.) which is a plus if your audience uses those heavily. And for enterprise needs, they tout compliance (GDPR, etc.) and scalability.

Insider’s reporting

In terms of weaknesses: as an enterprise tool, Insider’s pricing is custom and generally on the higher side. It’s likely not feasible for small businesses. They typically target mid‑to‑large enterprises with significant traffic and marketing budgets.

Also, because it’s such a broad platform, fully implementing all aspects (web personalization, mobile SDK, email, etc.) can be a sizeable project—it might require coordination across teams (marketing, IT, product).

Additionally, being a heavy platform with AI, some marketers might find a learning curve in understanding and trusting the AI outputs. It’s not exactly a weakness of the tech, but it requires a mindset of letting the system decide some content (like recommendations) rather than you manually curating everything.

Compared to WebEngage

Insider can be seen as addressing some gaps that WebEngage has.

Notably, Insider’s web personalization and on‑site conversion tools are far more advanced than WebEngage’s. WebEngage has web push and basic survey/feedback capabilities, but Insider offers rich product recs, personalized content blocks, and a variety of on‑site widgets that WebEngage doesn’t.

Moreover, the AI‑driven segmentation in Insider might outshine WebEngage’s relatively rule‑based segmentation. WebEngage has segmentation but doesn’t emphasize predictive scoring in the same way. For example, WebEngage could segment by “purchased 3x and not in last 30 days, ” whereas Insider might just give you “likely to churn” via its model, which could be more sophisticated.

In channel coverage, both overlap a lot (email, push, SMS, etc.), but Insider including emerging channels and ad integrations could be a plus.

On the flip side, WebEngage might be simpler to deploy if you mostly care about messaging and already have something else for personalization. Insider might be overkill if you weren’t going to use the personalization features heavily.

Also, WebEngage might be cheaper or more accessible for mid‑market, whereas Insider goes for the bigger fish with presumably bigger ROI cases.

In summary, if WebEngage’s limitations in personalization and intelligence are holding you back, Insider is an alternative that brings those in spades. But be prepared to invest time and money accordingly.

Compared to Maestra

There’s an interesting overlap between Insider and Maestra in terms of philosophy: both aim to unify the journey across channels and personalize it deeply, and both provide a lot of service support to ensure success.

Feature‑wise, Insider lacks a loyalty program module (though you can integrate loyalty data into it). Maestra includes loyalty natively, which might be decisive if loyalty campaigns are a focus for you.

Both offer robust web personalization, but Maestra’s personalization is tightly integrated with its CDP and promotions—for example, showing a discount banner on the site only for a specific segment as defined in Maestra, or showing product recs based on Maestra’s own data. Insider might have more algorithmic options.

Maestra’s strength in built‑in promotions/loyalty and emails/SMS vs Insider’s strength in AI and on‑site optimization means if you want a marketing platform first, Maestra; if you want a personalization platform first, Insider. But they overlap enough that both could serve a global e‑commerce well.

From a pricing/service perspective, both are premium. Maestra’s dedicated CSM and Insider’s heavy customer success involvement are somewhat similar. A nuanced difference: Maestra tends to commit to doing a lot of the execution work for you, whereas Insider provides strategic guidance and help but usually your team still builds the campaigns.

Also, data approach: Maestra as a CDP might store more types of data readily (e.g., offline sales), whereas Insider’s data is geared towards digital events and attributes relevant to personalization. If you consider data centralization important, Maestra might have an edge by being designed to be a single source of truth.

In short, both are strong, high‑end solutions.

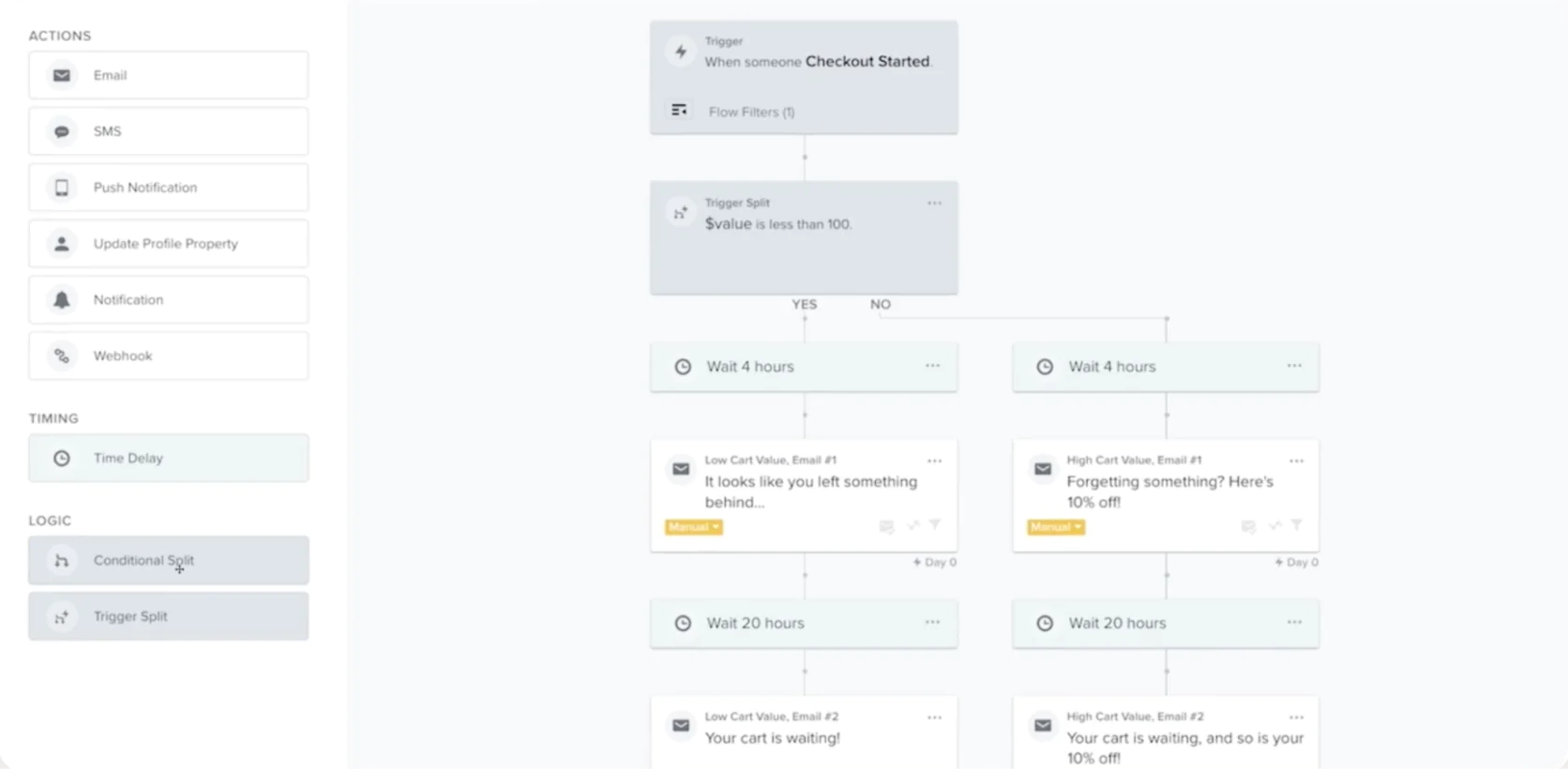

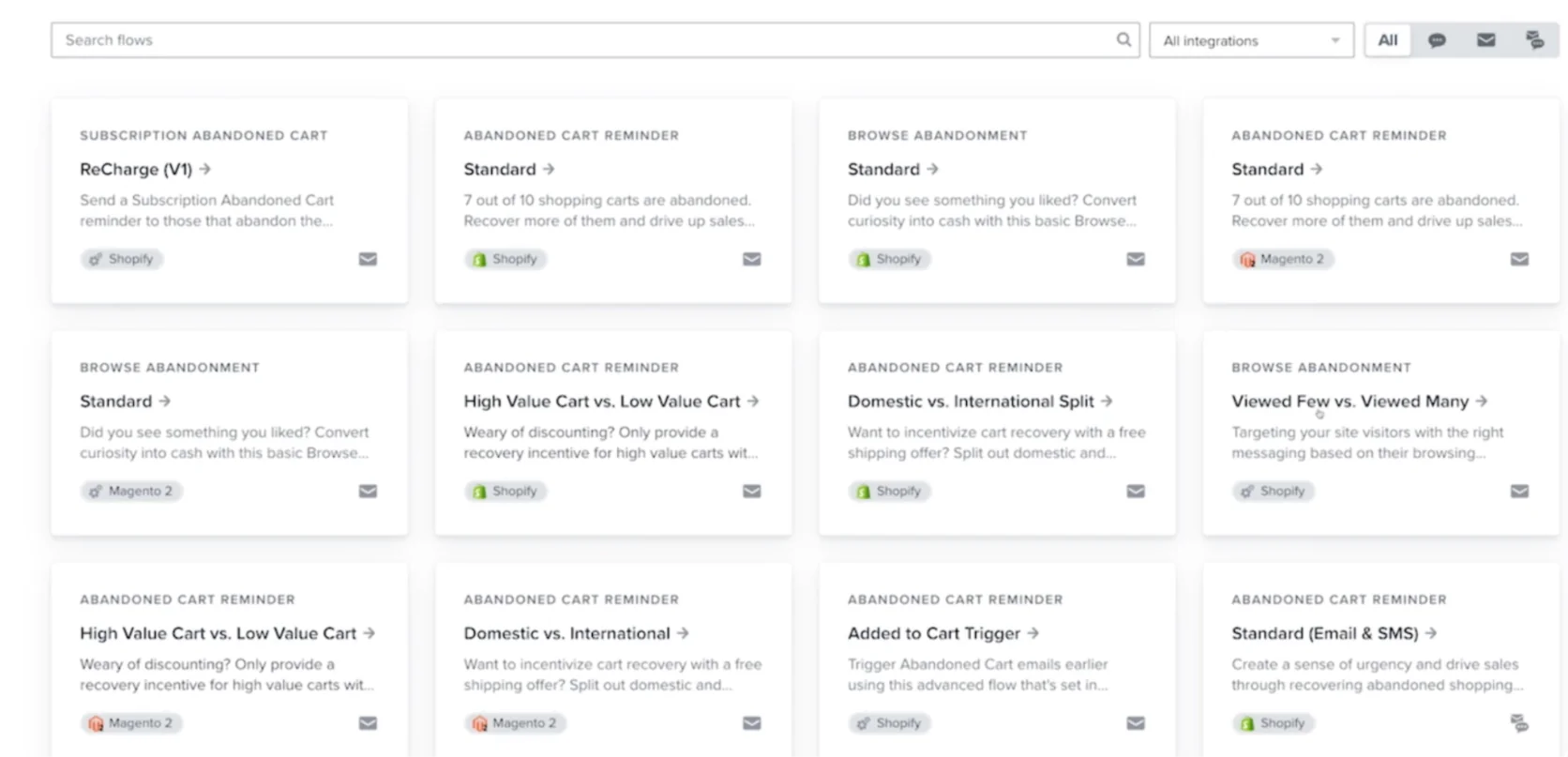

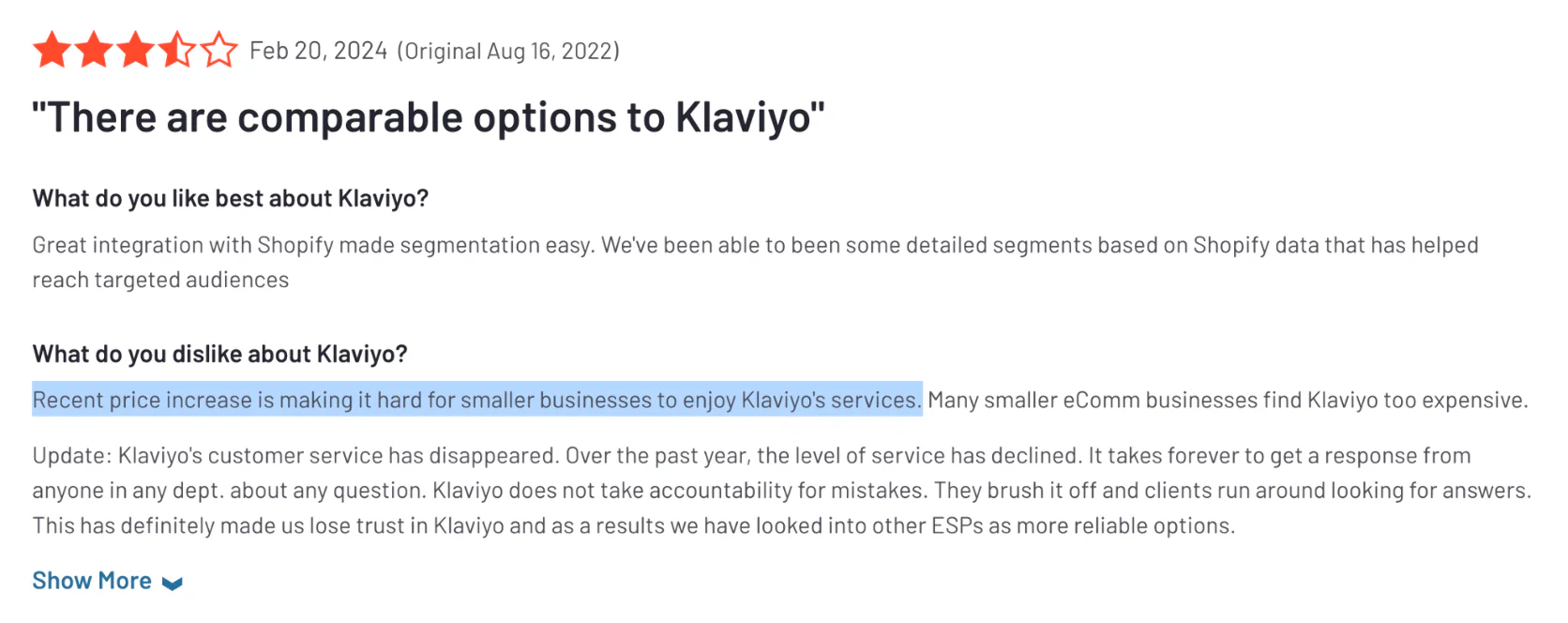

Tool #7: Klaviyo

Best for Shopify Stores and Data-Driven Email/SMS

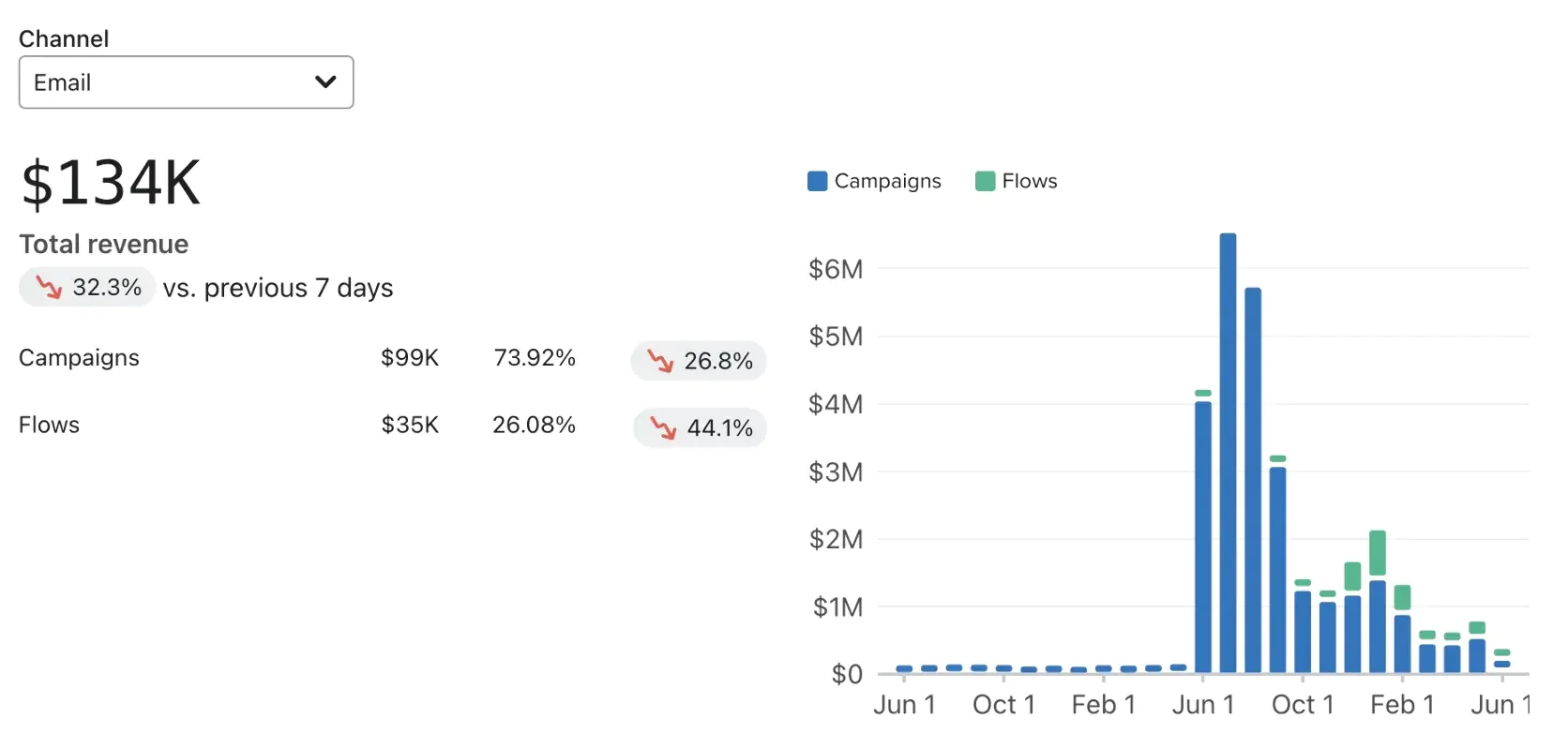

Klaviyo is practically a household name among e-commerce email marketers, especially those on Shopify. It has become the go-to platform for small and mid-sized online stores to run targeted email and SMS campaigns. Klaviyo’s core strength is leveraging e-commerce data (like purchases, browsing events, etc.) for segmentation and automation in a way that’s very accessible.

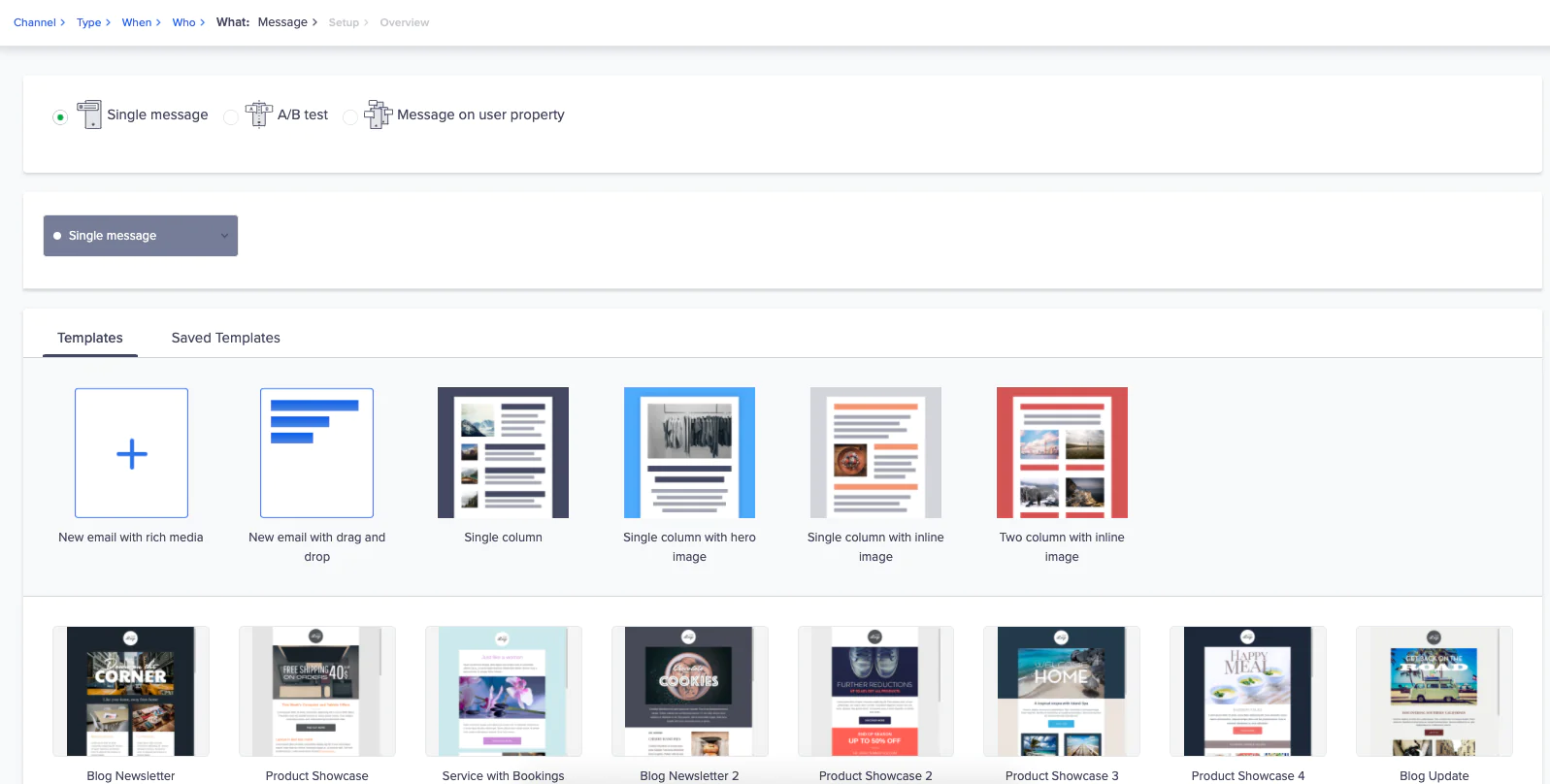

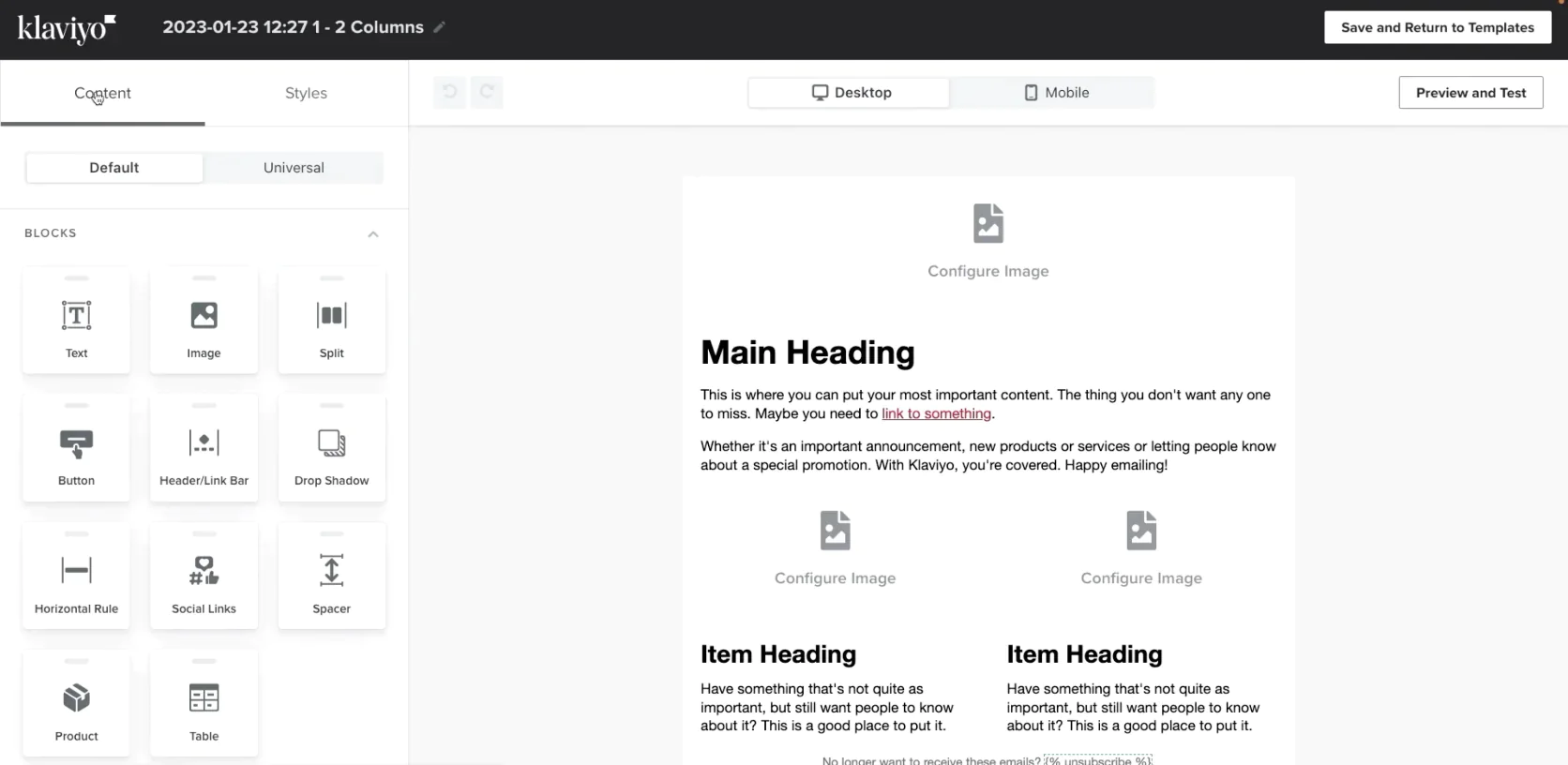

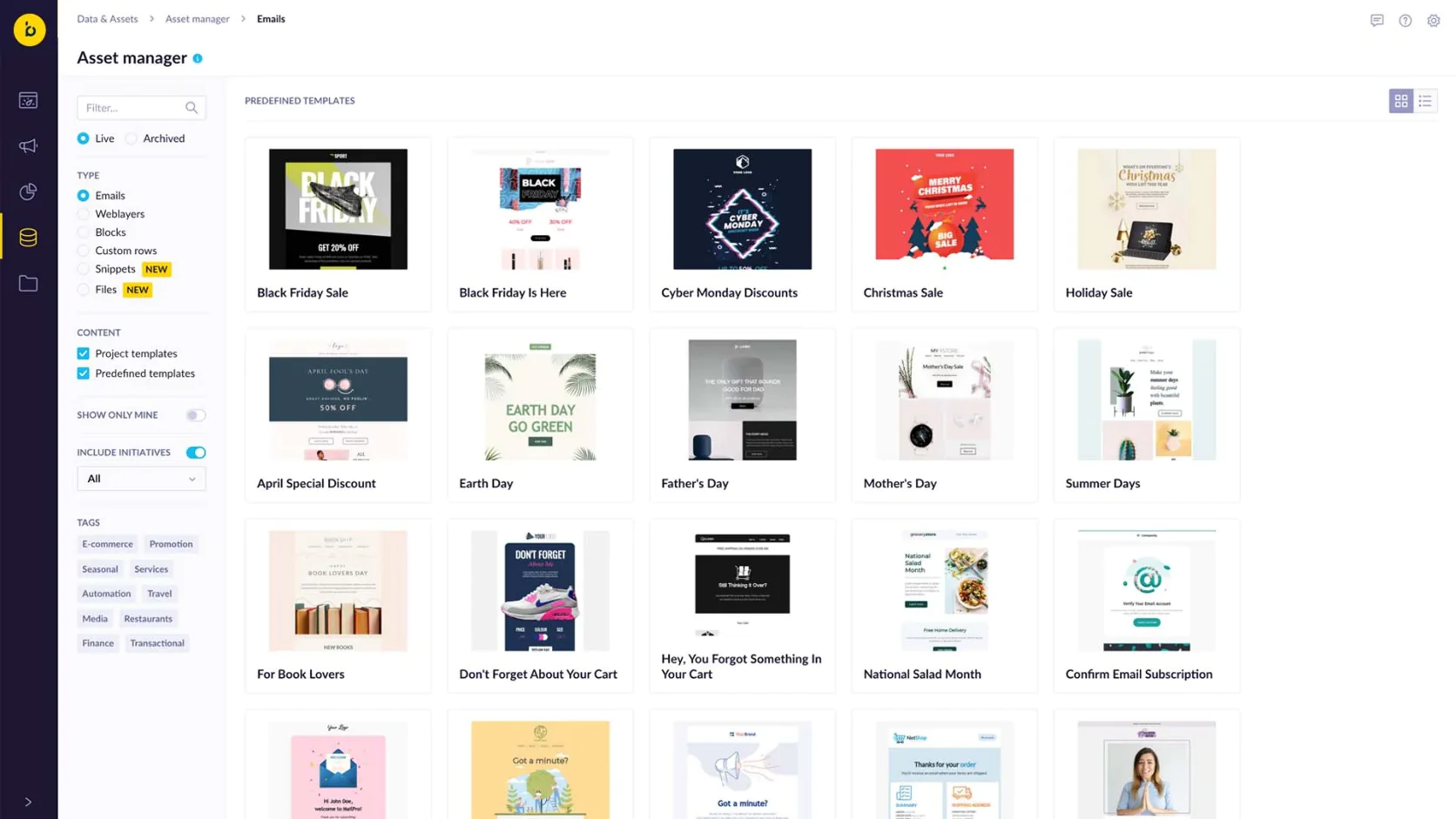

Klaviyo’s flow builder

While Klaviyo started as an email marketing platform, it has evolved to include SMS, and it offers some CDP-like data capabilities focused on commerce. Many growing D2C brands use Klaviyo as the backbone of their customer communications and lifecycle marketing until they reach an enterprise level.

Key Features:

- Deep E-commerce Integrations: Klaviyo integrates out-of-the-box with platforms like Shopify, BigCommerce, Magento, WooCommerce, and others. Upon integration, it automatically ingests customers, orders, products, and even website events (with a script) into Klaviyo. The Shopify integration is especially deep, syncing data in real time and even capturing site browsing behavior to power features like browse abandonment emails.

- Pre-Built Automation Flows: Klaviyo provides templates for common e-commerce flows. You can literally activate an abandoned cart flow with a few clicks and a default template, then customize it. This ease of launching proven revenue-driving campaigns is a big reason new stores flock to Klaviyo. The flows are also customizable with branching (e.g., different paths if VIP customer vs new, etc.).

Flow templates in Klaviyo

- Segmentation and Analytics: Klaviyo’s segment builder is user-friendly but powerful. Klaviyo also does a good job with analytics on revenue—every email or flow shows how much $$$ it generated (by attributing when recipients place orders). It basically ties back to actual sales, which execs love for seeing ROI. There’s also cohort analysis for campaigns vs. control, etc., and lifetime value calculations for segments.

- Email & SMS in One Platform: Initially email-only, Klaviyo added SMS so that you can manage text message marketing alongside emails. It’s not as advanced an SMS platform as specialized ones (like Attentive), but it covers the basics (compliance, two-way replies, segmentation). Having both channels in one place ensures customers don’t get over-messaged.

- Personalization and Dynamic Content: In emails, Klaviyo allows personalization using data fields (name, etc.) and also conditional logic in templates (show X if VIP, else show Y). You can pull in product recommendations, though those are usually simplistic. Additionally, Klaviyo’s email builder is quite flexible for designing branded emails, and it recently introduced features to avoid common issues like Gmail clipping by auto adjusting code.

Klaviyo’s email composer

Strengths and Weaknesses

Klaviyo’s major strength is empowering smaller e-commerce teams to do data-driven marketing easily. You don’t need a developer or an analyst to run fairly sophisticated campaigns because Klaviyo has already mapped the e-commerce data and provided a UI to use it.

Time to value is quick—stores often start seeing cart recovery revenue or welcome series revenue in days after installing Klaviyo.

The learning curve is moderate; non-experts can pick it up and there’s abundant documentation and community tips (Klaviyo has a huge user base in the Shopify ecosystem).

Fragment of Klaviyo’s business review dashboard

Another strength is scalability for mid-market: Klaviyo can handle sizable lists (hundreds of thousands or a few million contacts). And its pricing scales with your contacts—starting free for very small lists then incrementally increasing, so it’s affordable at first and grows as you grow (though see weakness below about cost at scale).

It also offers a rich ecosystem—many third-party apps plug into Klaviyo (for reviews, loyalty, customer support data, etc.) so you can centralize data there even if you use other apps.

On the downside, Klaviyo is primarily email/SMS. It doesn’t do push notifications or in-app messaging (aside from email and SMS that are its core).

It also doesn’t have an on-site personalization tool; it expects you to use maybe Shopify plugins or other means for on-site pop-ups (though Klaviyo does have a basic signup pop-up form feature). So it’s not a full multichannel hub like some others—it’s focused on messaging and related data.

Also, as companies grow large, Klaviyo’s pricing can become a bit steep because it’s contact-count based. For instance, 150k contacts can run near $2000/month just for email. At that point, some consider if an enterprise tool might offer more channels or features for a similar investment.

Klaviyo’s analytics, while great for marketing performance, are not as advanced as a dedicated analytics or CDP for deeper behavior analysis. You can’t, for example, easily do complex multi-event funnels beyond the basics or run predictive models (aside from a built-in CLV prediction they have). So more advanced teams may export Klaviyo data to a warehouse for analysis eventually.

Compared to WebEngage

The key differences between Klaviyo and WebEngage are channel scope and specialization. Klaviyo is best if email and SMS are your main channels and you want maximum ROI from those with minimal fuss. WebEngage might be chosen if push notifications and in-app engagement are equally important, or if you operate in channels Klaviyo doesn’t serve (like WhatsApp perhaps, which WebEngage supports via API).

Another difference: WebEngage could handle non-e-commerce use cases better since it’s broader, whereas Klaviyo is laser-focused on e-com. For an e-com store though, Klaviyo’s focus can be an advantage. WebEngage’s interface might not be as tailored to a specific vertical, which is both a pro (flexible) and con (not as optimized for, say, Shopify).

If a brand has a global audience and needs multi-lingual, multi-channel beyond email/SMS, WebEngage might have an edge. If the brand is primarily DTC online sales through their site and wants best-of-breed email marketing, Klaviyo’s probably superior in that niche.

Compared to Maestra

Klaviyo vs Maestra is interesting because Maestra can be seen as an upgrade when companies outgrow Klaviyo’s scope. Maestra covers Klaviyo’s ground (emails/SMS) but also adds push, on-site personalization, loyalty, etc.

The tipping point is usually scale and needs: if you find that email+SMS are not enough and you want an integrated loyalty program or more complex cross-channel orchestration, that’s when Maestra shines.

One clear difference: Maestra has built-in loyalty and promotions, and more advanced automation logic. For example, Klaviyo flows can branch on conditions and have some back-population, etc., but Maestra’s flows might react in real-time to events and update across channels more fluidly (Klaviyo flows, while real-time triggered, sometimes have slight delays or are limited in cross-channel triggers).

Also, Maestra’s CDP means you could incorporate data Klaviyo doesn’t naturally handle (like in-store sales or customer service interactions) into one place, enabling omnichannel strategy. Klaviyo mostly lives in the online store realm unless you pipe in other data manually.

However, Klaviyo’s simplicity and cost at the lower end is a strength. A small brand doing a few million in revenue might find Klaviyo does everything they need for far less cost than Maestra. But a rapidly scaling brand might see Maestra as a justified investment (especially if they are also paying for separate loyalty or personalization tools—consolidating could even out costs).

Another difference: service and support. Klaviyo has support and lots of agencies that can help, but you largely self-serve on the platform. Maestra gives you more hands-on help via a dedicated CSM. If a company doesn’t have a full marketing ops team, Maestra’s model could relieve a lot of workload that, in Klaviyo, would rely on your internal team or hiring consultants to set up advanced flows or analyze improvements.

In conclusion, for a growing e-commerce evaluating these: choose Klaviyo if you need a e-commerce-centric email/SMS platform. Consider Maestra if you’re hitting the ceiling of what you can do with just email/SMS and you want to add loyalty, richer personalization, and more channels under one roof to push your retention and customer LTV to the next level.

Tool #8: Netcore Cloud (Netcore Customer Engagement & Experience Platform)

Best for All-in-One Marketing in Emerging Markets

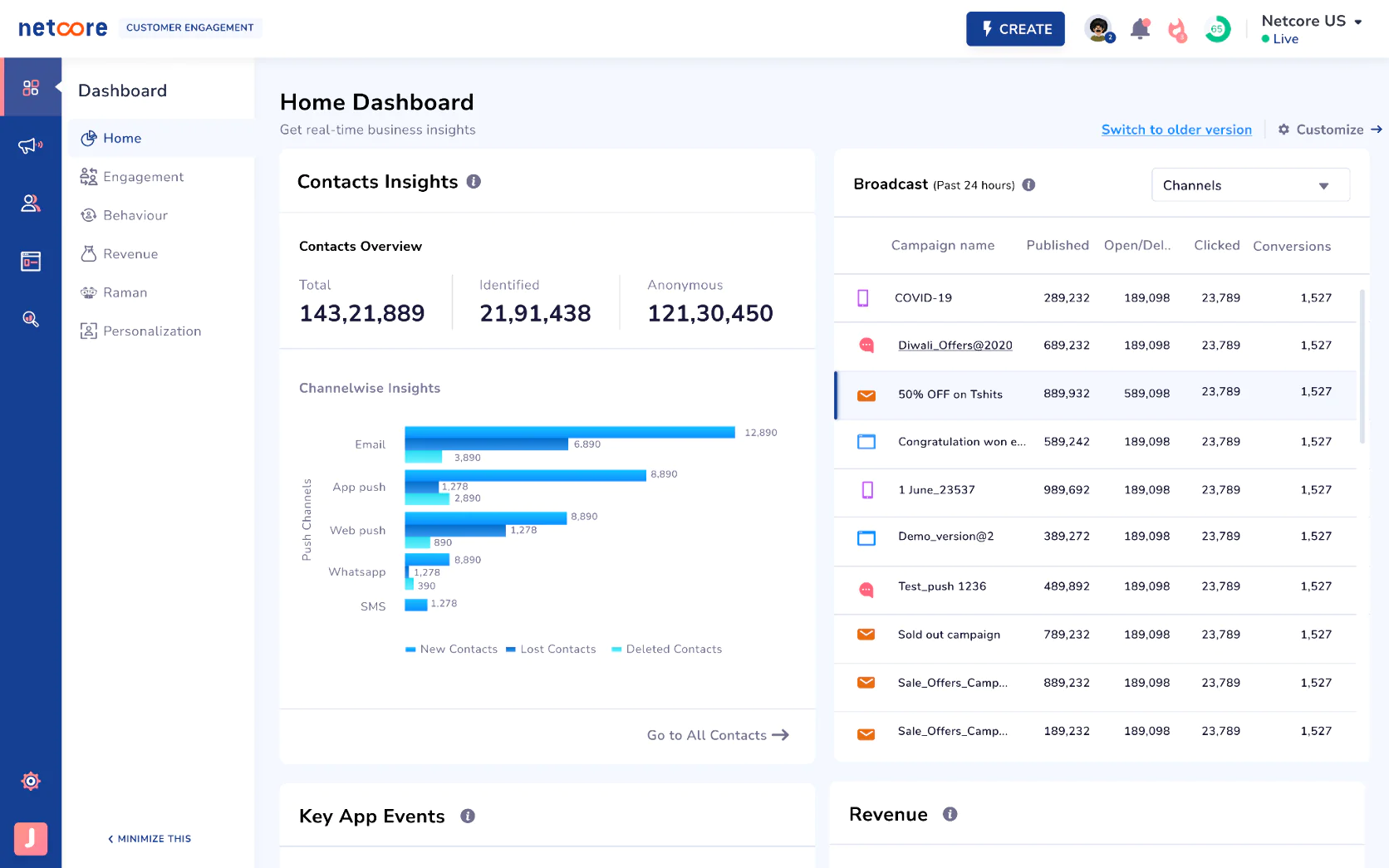

Netcore is a bit of a hidden giant in the marketing automation space, especially renowned in India and other emerging markets. It offers a broad suite under one roof—from multichannel campaign management to product experience and even email delivery infrastructure.

Netcore’s email editor

Netcore’s Customer Engagement Platform, in particular, is aimed at providing an all-in-one solution similar to WebEngage or MoEngage, but it’s part of a larger product family that includes email API services, personalization (Netcore acquired an AI personalization company, Unbxd), and more. Now Netcore is positioning itself strongly with AI features and a full-stack approach to customer communication.

Key Features:

- Unified Multi-Channel Suite: Netcore’s platform includes email marketing, SMS, push notifications, in-app messaging, web push, WhatsApp messaging—you name it—all accessible through a unified dashboard. You can design customer journeys that coordinate across channels similarly to other journey builders. This one-vendor approach reduces dependency on multiple tools and ensures data consistency.

- Email Deliverability and API (Pepipost): Netcore originally is known for its email delivery (Pepipost was its email API service). So as part of its offering, you get a robust email infrastructure. If email is a big channel for you, Netcore brings expertise in deliverability (inboxing, reputation monitoring) that some other engagement tools might not focus on.

- Personalization and Product Recommendations: Netcore’s acquisition of Unbxd (an AI-powered product recommendation and search platform) means that within Netcore, you have capabilities for on-site personalized search results, product recommendations, and dynamic content on your website or app. These can be deployed via a drag-and-drop editor for web personalization.

- Journey Orchestration and AI Optimization: Netcore provides a visual journey designer to craft campaigns. They also infuse AI for optimization tasks—such as send time optimization (sending messages when each user is most likely to engage), channel optimization (figuring out which channel a user responds to best), and even content optimization.

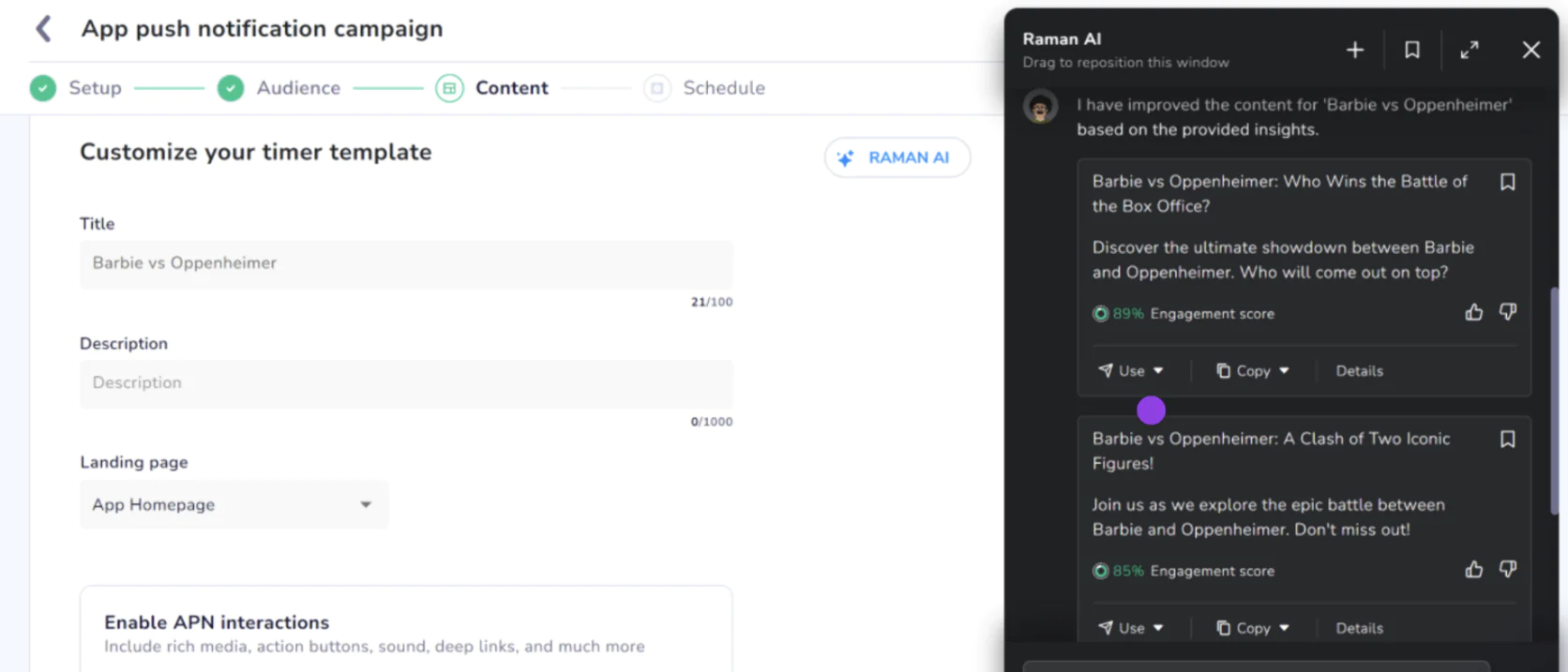

Writing push notification with Netcore’s AI

- On-Site Engagement (WebExperiments, Nudges): Netcore includes tools for on-site user experience like nudges (little tips or prompts in-app or on-site), walkthroughs (guiding new users), and A/B testing for on-site changes. This blurs into the realm of product experience. Essentially, beyond just sending communications, Netcore can also help shape the user experience on owned channels in real time.

Strengths and Weaknesses

Netcore’s strength is definitely in being a one-stop marketing ecosystem, especially suited for companies that want to consolidate vendors. If you can get your email, SMS, push, WhatsApp, analytics, and personalization all from one platform, it simplifies vendor management and potentially lowers cost (one suite license vs many).

It also means a single view of the customer across all these interactions. Netcore stands out in emerging markets because it tailors solutions for those contexts (like regional messaging apps, local SMS regulations, etc.) and often at a cost that’s more palatable than Western enterprise tools.

Netcore’s reporting

Another strength: deliverability and infrastructure expertise, particularly in email and SMS. Because Netcore runs large-scale email systems, they have insight into ISP relations, anti-spam, etc. This is a plus if you’ve struggled with email delivery on other platforms.

Also, Netcore’s platform is known to handle huge volumes (many banks, OTT apps, etc., with tens of millions of users in India use it), so scalability is proven.

Netcore has been actively adding AI features and touting them, which shows it’s keeping up with industry trends and perhaps even leading in some.

On the weakness side, Netcore’s all-in-one nature can mean the interface is a bit sprawling or not as slick as more specialized tools. Some users mention that certain parts of the UI or workflows could be more intuitive—which is a common trade-off when a product does so much.

Historically, Netcore’s presence was heavily in India and Southeast Asia; if you’re a company in North America or Europe, you might find less community or third-party expertise around it, though they have been expanding globally. It’s getting on analysts’ radars now.

Compared to WebEngage

Netcore and WebEngage target a very similar customer profile, especially in their home market. The differences: Netcore is bigger in scope due to its email infrastructure and product experience components. WebEngage is largely marketing communications and customer data; Netcore covers that plus some product analytics and on-site search/recommendation features via Unbxd.

WebEngage might be considered a bit more nimble or startup-friendly (with its startup program and focus). Netcore, being a slightly older and larger company, sometimes gave an impression of catering to very large senders (banks, big retailers). But both have clients across sizes.

Pricing between them can be competitive—a company might get quotes from both and find them in a similar ballpark for the needed features, though Netcore’s modular nature might allow more flexible packaging.

WebEngage’s UI and user experience vs Netcore’s—hard to declare, but some user feedback suggests WebEngage’s journey builder is quite user-friendly. Netcore’s combined toolset might have a steeper learning curve just because there’s more under one hood.

In terms of support, both companies emphasize support; Netcore has been around longer and has more employees, which could translate to a larger support team.

Compared to Maestra

Netcore’s vision of an integrated stack is akin to Maestra’s, but Netcore grew from an infrastructure + marketing angle, whereas Maestra is newer, built cloud-native with a CDP core and marketing on top.

For an e-commerce brand choosing between them, a few points: Maestra has loyalty/promo engine built-in, which Netcore doesn’t explicitly mention. Netcore has the on-site search (via Unbxd) that Maestra doesn’t provide as a built search solution (Maestra does recommendations and personalization, but not a full site search engine).

Both have AI-driven personalization and recommendations. Maestra’s differentiation is perhaps the service model (CSM doing heavy lifting) and its real-time CDP which is very retail-focused. Netcore also has real-time segments and such, but Maestra is likely more focused on ease-of-use for marketers since it was designed in a later era with UX in mind. Netcore might feel more “enterprise software”-like.

Also, region might factor: if you’re in a region where Netcore has a strong local team and presence, that local touch could be valuable.

Ultimately, both aim to reduce the need for multiple tools. If a brand has a large presence in, say, India or SEA, they might naturally consider Netcore due to its track record there. If they’re looking at best-of-breed new entrant and are impressed by Maestra’s specific focus on commerce and high-touch service, they might lean that way.

Tool #9: SAP Emarsys

Best for Retail-Centric Omnichannel Marketing (Enterprise)

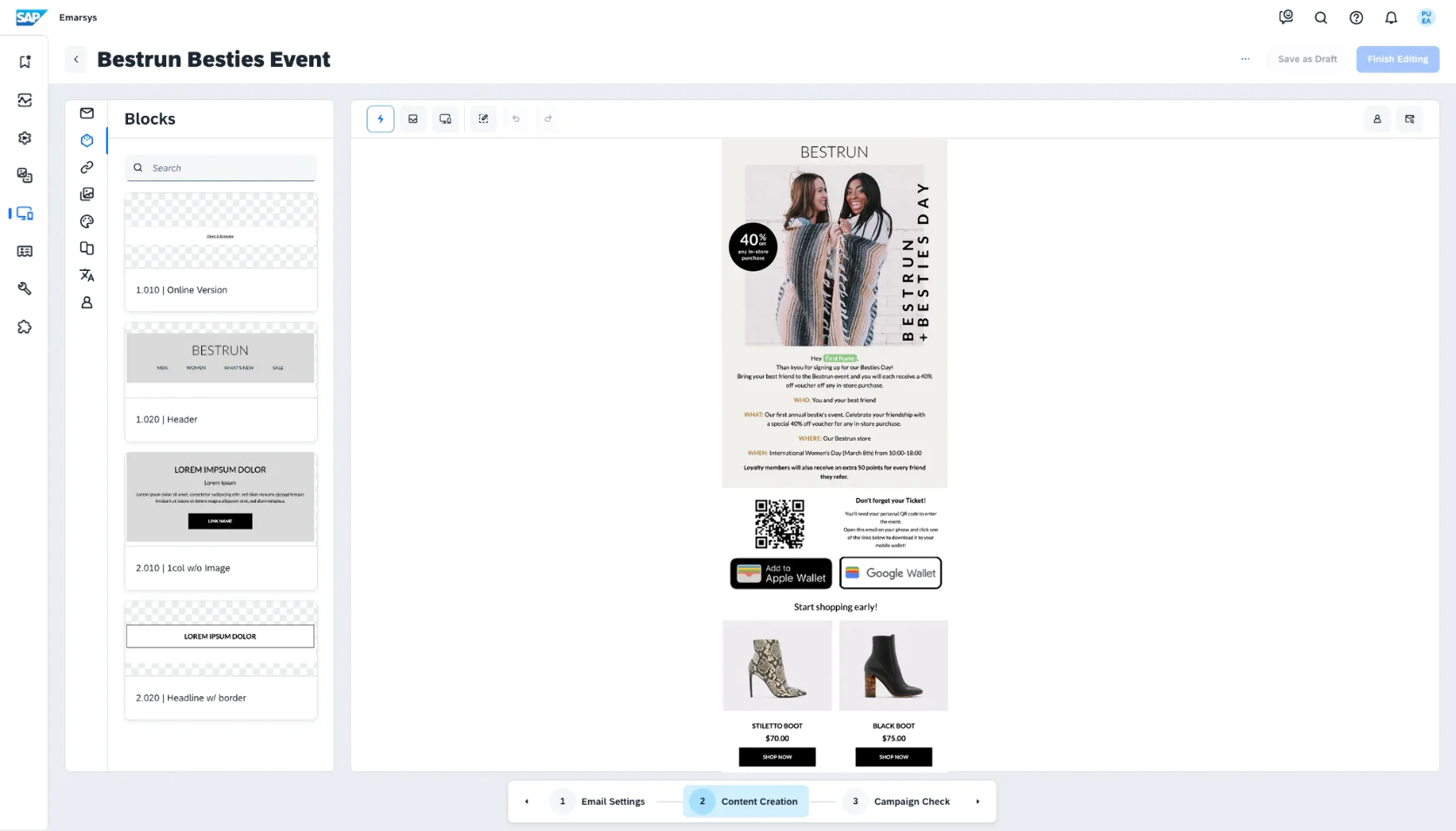

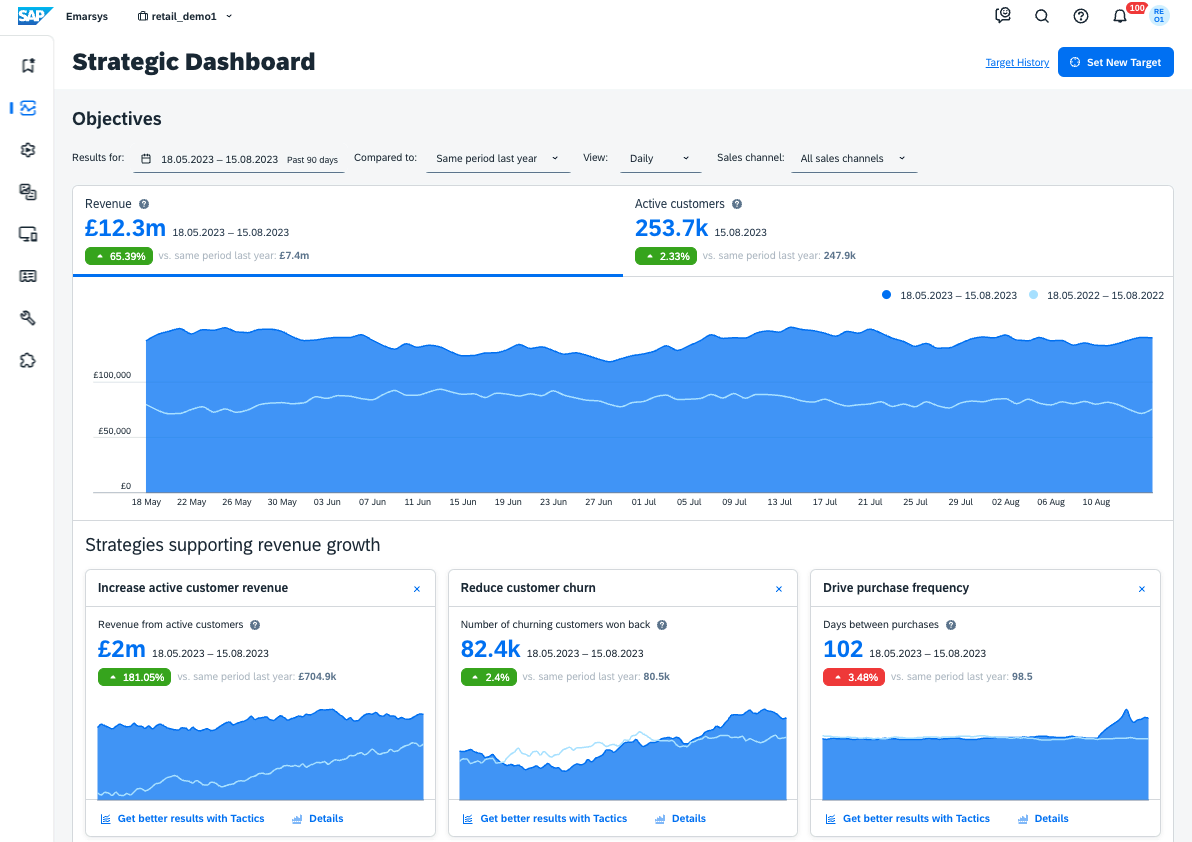

Emarsys is a well-established marketing platform that was acquired by SAP in 2020. It has a strong heritage in retail and direct-to-consumer marketing. Emarsys’s value prop is to help businesses deliver personalized, 1:1 experiences across email, mobile, social, and more, with a lot of out-of-the-box tactics for commerce.

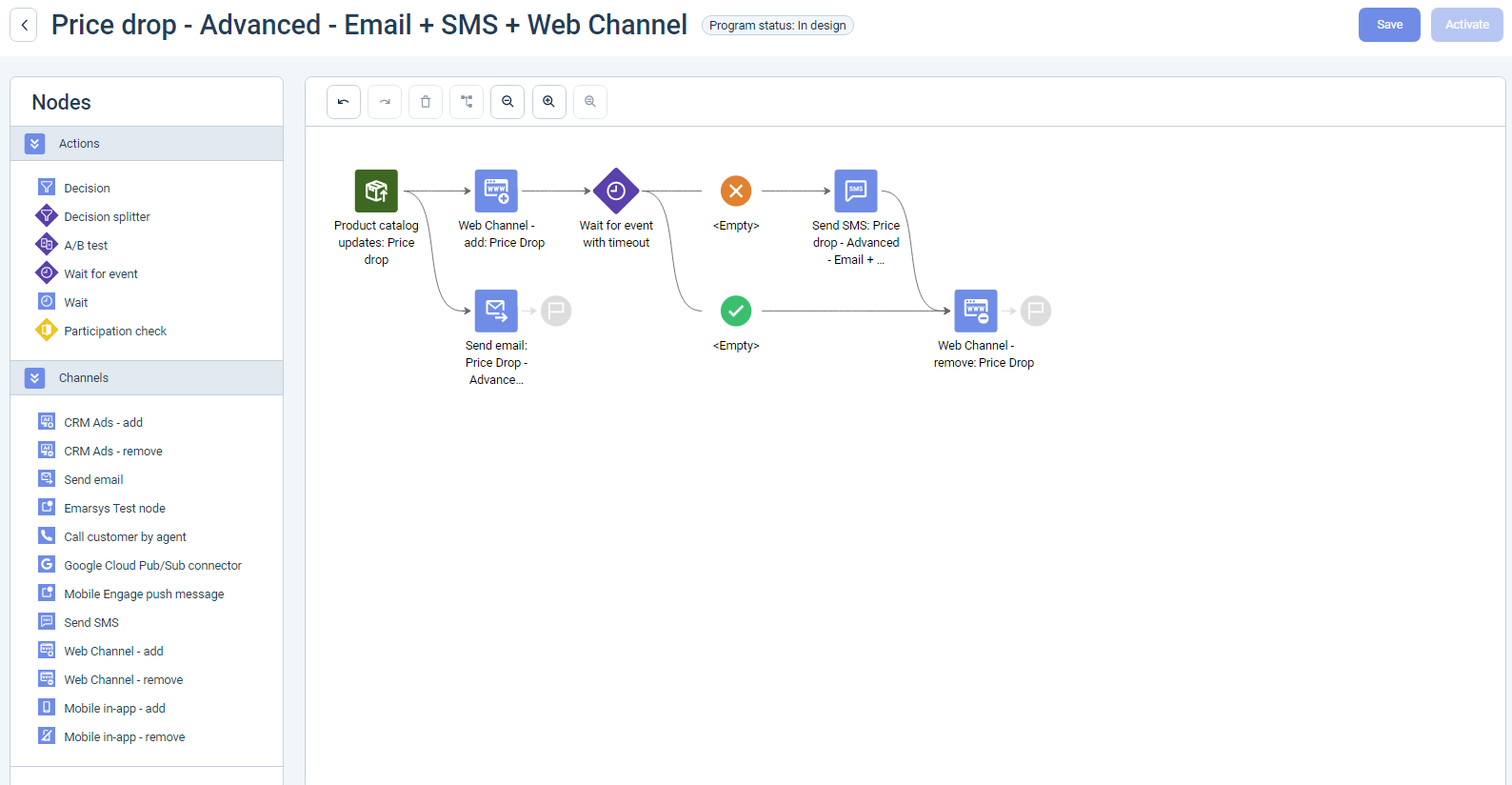

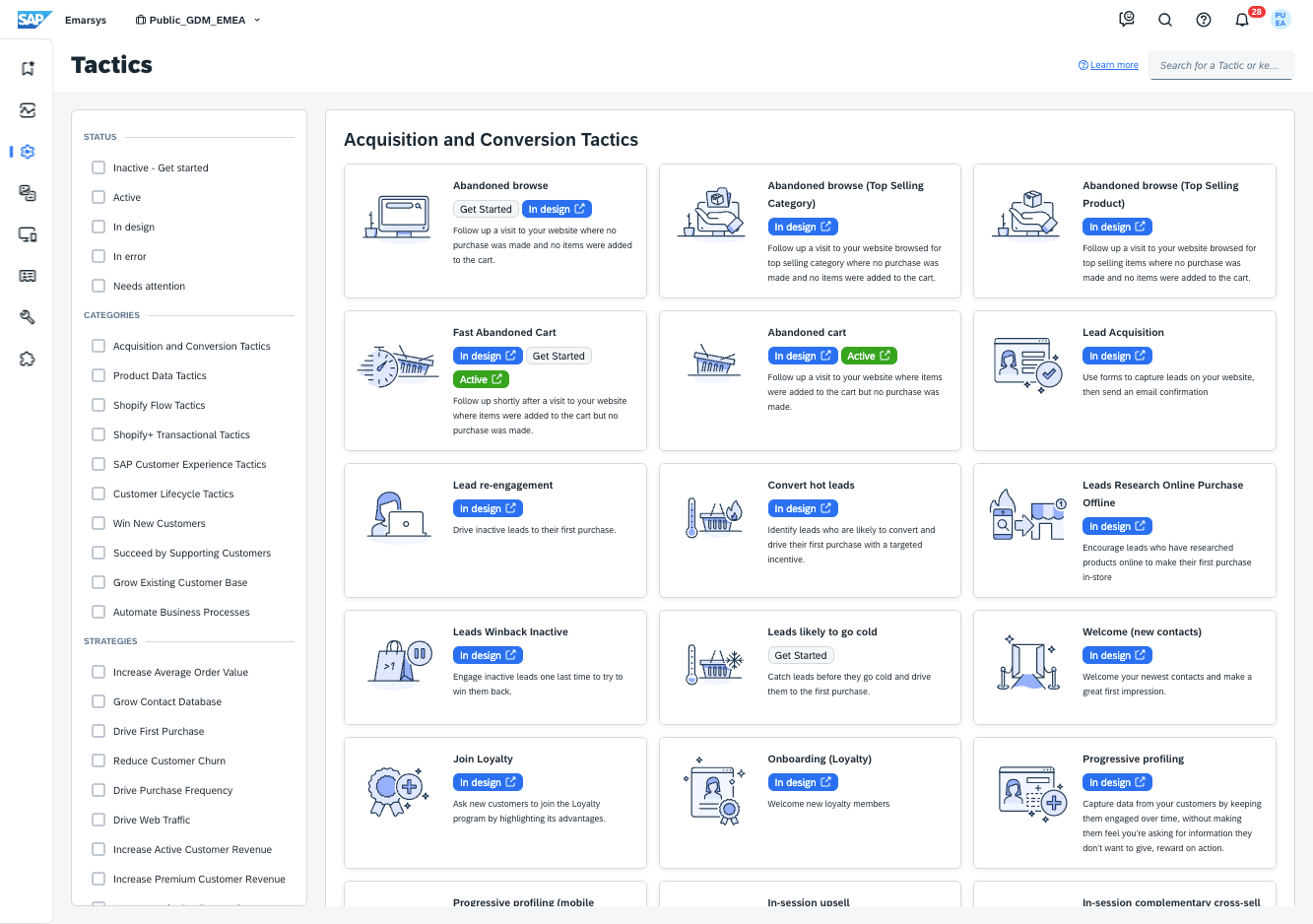

Emarsys’s flow builder

Now under SAP, it’s often positioned as the customer engagement component for SAP’s commerce suite, but it’s still available as a standalone and used by many brands across industries. Emarsys shines in giving marketers ready strategies (their tagline often: “tactics, not just tools”) so they can plug in campaigns for common goals.

Key Features:

- Pre-Built Strategies and Tactics: Emarsys comes with a library of pre-built campaign workflows and segments tailored to industries like retail, e-commerce, travel, etc. These aren’t just templates; Emarsys often includes recommended segmentation and multi-step flows as starting points. This approach helps teams execute quickly by leveraging best practices embedded in the tool.

Emarsys’s flow templates

- Omnichannel Execution: Emarsys supports email, SMS, push, in-app, web, direct mail (through partners), and social media audiences. You can coordinate a campaign that, say, sends an email, waits, then adds the user to a Facebook Custom Audience if no purchase, etc. They also integrate with Google and Facebook to allow running ad campaigns as part of customer journeys.

- Customer Data and Segmentation: Emarsys provides a unified customer profile that aggregates data from various sources (online, offline if fed in, etc.). It has flexible segmentation and can do things like RFM segmentation. They also have AI-driven segments like likely to churn, highest value, etc., using machine learning on customer behavior.

- Personalization and Content Blocks: Emarsys offers personalization tokens and conditional content in messages. They also have a product recommendation engine you can use in emails or on-site. Additionally, Emarsys supports multilingual campaigns and localization well, as it served many global brands.

Emarsys’s email editor

Strengths and Weaknesses

One strength of Emarsys has been its focus on marketer-friendly outcomes. It doesn’t just give raw tools; it tries to give blueprints. Busy marketing leads appreciate logging in and seeing strategic dashboards (e.g., “Your customer lifecycle health” with segments) and suggestions for what campaigns to run next.

Emarsys’s reporting

Emarsys is also known for reliability at scale, especially in email. Many big retail brands in Europe used Emarsys for years to send millions of emails and messages with solid deliverability. They have good customer support and domain expertise in retail, which is why their clients often include recognizable B2C brands.

However, one weakness historically mentioned is complexity in initial setup and integration, especially for the full omnichannel suit. Some users found it tricky to integrate certain data sources or get the most out of the platform without significant effort. Also, Emarsys’s UI, while powerful, wasn’t always the most modern or intuitive compared to newer entrants.