Discover how to optimize customer engagement with RFM segmentation and analysis, enhancing your marketing model.

RFM Analysis for Effective Customer Segmentation

Question

Answer

If you need to unlock the potential of a fragmented audience, the solution lies in RFM (Recency, Frequency, Monetary) Analysis, a technique that originated from direct mail marketing in 1995. The RFM model has since evolved into a well-established method, empowering brands to leverage customer behavior, segment it effectively, and craft impactful marketing campaigns.

Let’s explore what RFM is and how to use the RFM model to improve your overall marketing strategy.

What is RFM Analysis?

RFM is a marketing analysis method used to quantitatively rank and segment customers based on their purchasing patterns. The acronym RFM stands for:

- Recency: How recently a customer made a purchase. This metric helps in understanding which customers are currently active. The more recent the purchase, the more likely the customer is to be responsive to new offers.

- Frequency: How often a customer makes a purchase within a specific time frame. Frequent buyers are usually more engaged and loyal customers, and they may respond differently to marketing strategies compared to infrequent buyers.

- Monetary Value: How much money a customer spends over a given period. This helps in identifying high-value customers who contribute more to the revenue compared to others.

RFM Analysis is essential for businesses seeking to optimize their marketing efforts by focusing on customers who are more likely to engage and make purchases. By segmenting customers based on these three dimensions, companies can tailor their marketing messages, offers, and promotions to specific groups, thereby enhancing customer engagement, improving retention rates, and increasing overall profitability. This method is particularly effective due to its simplicity, ease of implementation, and the actionable insights it provides, making it a staple in customer relationship management and targeted marketing campaigns.

Benefits of RFM Analysis

Implementing RFM Analysis into your business strategy can result in numerous advantages such as:

Enhanced Customer Experience

RFM Analysis transforms the way businesses understand their customers by enabling more effective personalization and targeting based on behavior and preferences. RFM is particularly effective in managing the customer lifecycle, allowing businesses to contact customers with the right message at the right time, increasing engagement, satisfaction, and efficiency.

Increased Marketing Efficiency

Improved segmentation and personalization results in communication that is relevant and effective, which not only benefits customers, but businesses as well.this strategy also benefits the marketing team by enabling them to better allocate internal resources and focus both effort and investment on areas that offer the highest potential return — for example, sending discounts and offers to customers who need the extra incentive as opposed to everyone in the database, including those who will purchase without this incentive. Here are some widespread practices when it comes to working with RFM segments (we’ll explore this in more detail below):

- To maintain loyalty among valuable customers, a good approach is to regularly inform them about new products and current promotions.

- Customers who made a one-time purchase a long time ago can be reactivated through a special offer or a promo code.

- Those who make infrequent purchases but spend large amounts can be motivated to make more frequent purchases using bigger bonus point rewards (either through increased rewards for every purchase or a time-limited reward such as “500 extra points until [X] date”).

- Dormant customers can be reactivated through targeted advertising.

More Opportunities for Upselling and Cross-Selling

By clearly identifying different customer segments, businesses can spot opportunities for upselling and cross-selling. This targeted approach not only increases the chances of additional sales but also helps in developing effective retention strategies. Keeping high-value customers engaged and satisfied leads to an increase in the overall lifetime value of the customer base, driving long-term revenue growth.

Streamlined Decision-Making

The actionable insights provided by RFM Analysis simplify complex business decisions — by translating customer data into clear, actionable information, businesses can make informed decisions quickly and effectively. This method also lays the groundwork for predictive analytics, allowing companies to anticipate future trends and customer behaviors, which is essential in strategic planning and long-term business development.

How to Segment Customers Based on RFM Analysis

First, you will need to determine the scale you’d like to use — depending on the number of customers in your database, we recommend selecting one of the following options:

- A 1-3 scale for businesses with less than 30,000 customers.

- A 1-4 scale for businesses with 30,000-200,000 customers.

- A 1-5 scale for businesses with more than 200,000 customers

For ease of understanding, let’s use the more basic 1-3 scale to explore how to segment using RFM.

You can use Excel to perform a simple RFM analysis using data about customers and all their purchases. Using a pivot table, you can determine when a customer last made a purchase, how many total purchases they made over the last year, and the total amount spent. Each customer is assigned a score from 1 to 3 for each of the characteristics — recency (how recent the purchase was), frequency (how often purchases are made), and monetary (the total amount of the customer’s spending) — following the example from the table:

Purchase recency

Purchase frequency

Monetary total

1 — Most recent

1 — Most frequent

1 — Highest spend

2 — Average recency

2 — Average frequency

2 — Average spend

3 — Least recent

3 — Least frequent

3 — Lowest spend

It’s important to note that there are no universal rules for determining the boundaries of each criterion, as this depends on the specific business sector and its characteristics:

- A car bought six months ago is considered a recent purchase, while a face cream bought six months ago would be considered an old purchase.

- Purchasing furniture four times a year can be considered frequent, while purchasing baby care products four times a year is infrequent.

- For a stationery supplies brand, $200 from a customer can be considered high income, but in the electronics sector, this would be average or low.

Once each customer is assigned a score for each criterion, they can be placed into a specific RFM group. For example:

- 111 — customers who have recently made purchases, buy frequently, and bring high income to the company. This is the most loyal portion of your audience.

- 311 — customers who used to buy actively but have stopped. This segment is best-suited for re-engagement efforts.

- 333 — the most inactive segment, including customers who made a purchase once and did not return.

This approach to segmentation using the RFM model allows for more strategic and targeted marketing, sales, and customer service efforts.

Engagement Strategies for Different RFM Segments

When it comes to direct marketing efforts, the RFM model is instrumental in distinguishing customer segments for targeted engagement. The segmentation of customers into discrete groups facilitates the development of tailored communication strategies that resonate with the varying needs and behaviors of each category.

These segments can typically be categorized into three broad groups: “churn, ” “passive customers, ” and “active customers.”

Churn Segment

This segment encompasses customers who have either not engaged with the brand since their first purchase or have not purchased in a long time, indicating a high probability of churn.

Score

Description

Strategy

331, 332, 333

These are customers who have not continued their interaction with the brand after their initial purchase.

These customers are not likely to return on their own. It may be beneficial to attempt reactivation with a targeted promotional campaign. If they remain unresponsive and do not engage with communications for an extended period, over a year for instance, it might be time to consider removing them from the database.

321, 322, 323

These customers rarely purchase and may be shopping with competitors.

Understanding what drives these customers is key. Tailored incentives such as cumulative discounts or special offers could sway them away from competitors and increase their loyalty to your brand.

311, 312, 313

Customers who once purchased frequently and enjoyed the brand but have ceased to do so.

Re-engagement of these customers is essential. Informative communications detailing new discounts, updates to loyalty programs, or other benefits could reignite their interest and encourage repeat business.

Passive Customers

Passive customers represent an opportunity for re-engagement: they’ve interacted with your brand recently enough to remember it, but not so recently as to be considered active.

Score

Description

Strategy

221, 222, 223, 231, 232, 233

These include relatively new customers who have varied in their purchase frequency and amount spent. They reside in a middle ground and could either become loyal customers or slip into the churn segment.

Strategic engagement through personalized recommendations and tailored discount offers is essential to encourage interest and guide them towards becoming regular customers.

213, 212, 211

Relatively recent customers who were purchasing frequently but have since halted.

Investigating the reasons behind their inactivity is crucial. A well-orchestrated communication plan with targeted offers and rewards may motivate them to resume their purchasing habits.

Active and Loyal Customers

This category covers loyal customers and those who are new to the brand or have made recent purchases.

Score

Description

Strategy

131, 132, 133

These are new customers who have recently made their first or second purchase.

Newcomers should be sent informative content that thoroughly introduces them to the brand, its values, and benefits (i.e., what makes you as a brand or your product (s) different from the competition).

121, 122, 123

These customers are characterized by their active but irregular purchasing patterns, with spending that fluctuates.

Sustaining customers’ interest in products is crucial: sharing updates about new arrivals, sending offers related to products they’ve bought before, or accessories that complement their purchases keeps the brand relevant to them.

111

Core loyal customers who make regular purchases.

Incentivizing these customers to increase their spending through strategic actions, such as offering a gift or a discount when a certain purchase amount is reached, can further solidify their loyalty.

112

Core loyal customers who make regular purchases.

Sending personalized selections and timely promotions can help in maintaining their interest and encouraging repeat business.

113

Core loyal customers who make regular purchases.

VIP customers deserve exclusive attention, perhaps through tailored loyalty programs or even personalized account management to enhance their buying experience.

Developing communication plans using RFM-based segmentation is a nuanced process that varies with each business model. For instance, a grocery store and a clothing retailer would employ distinct marketing tactics, but the underlying concept remains the same: some customers require steady engagement to keep the brand relevant, while others may need extra motivation through incentives to re-engage and resume purchasing.

Examples of Using RFM Analysis in Campaigns

Let’s explore how brands employ RFM segmentation in their customer marketing strategies.

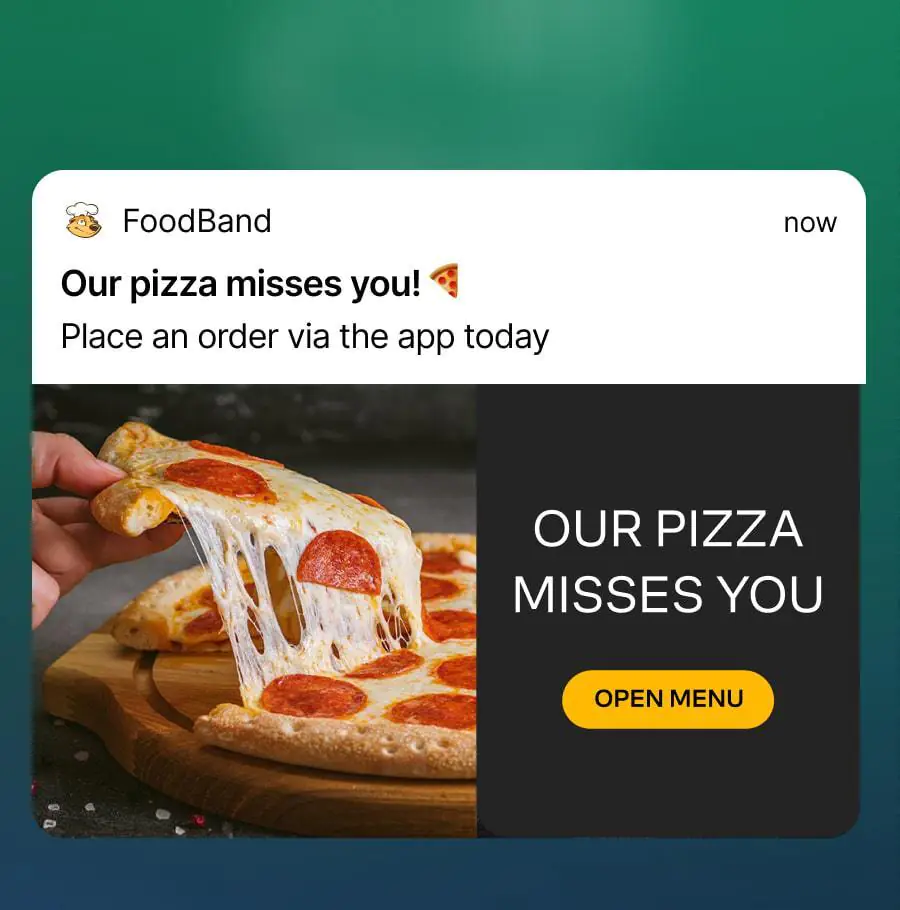

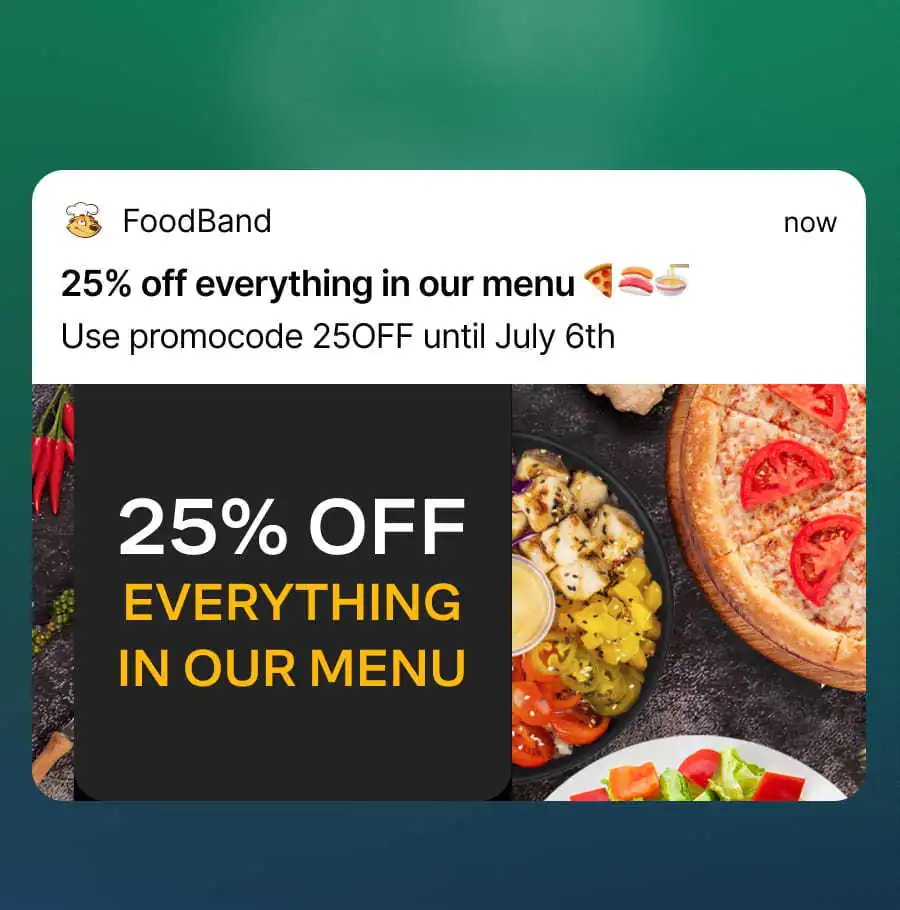

Food delivery service Foodband has crafted a sophisticated reactivation strategy employing a mix of push notifications, email campaigns, and text messages to re-engage customers who have not purchased in a while. This tactic specifically targets “recency” group 3 in the RFM model, which includes customers whose last purchase was a long time ago.

Using push notifications, Foodband tries to recapture the customer’s attention — first, they send a push notification without an additional discount. If the customer does not place an order, they then send a notification with a promo code

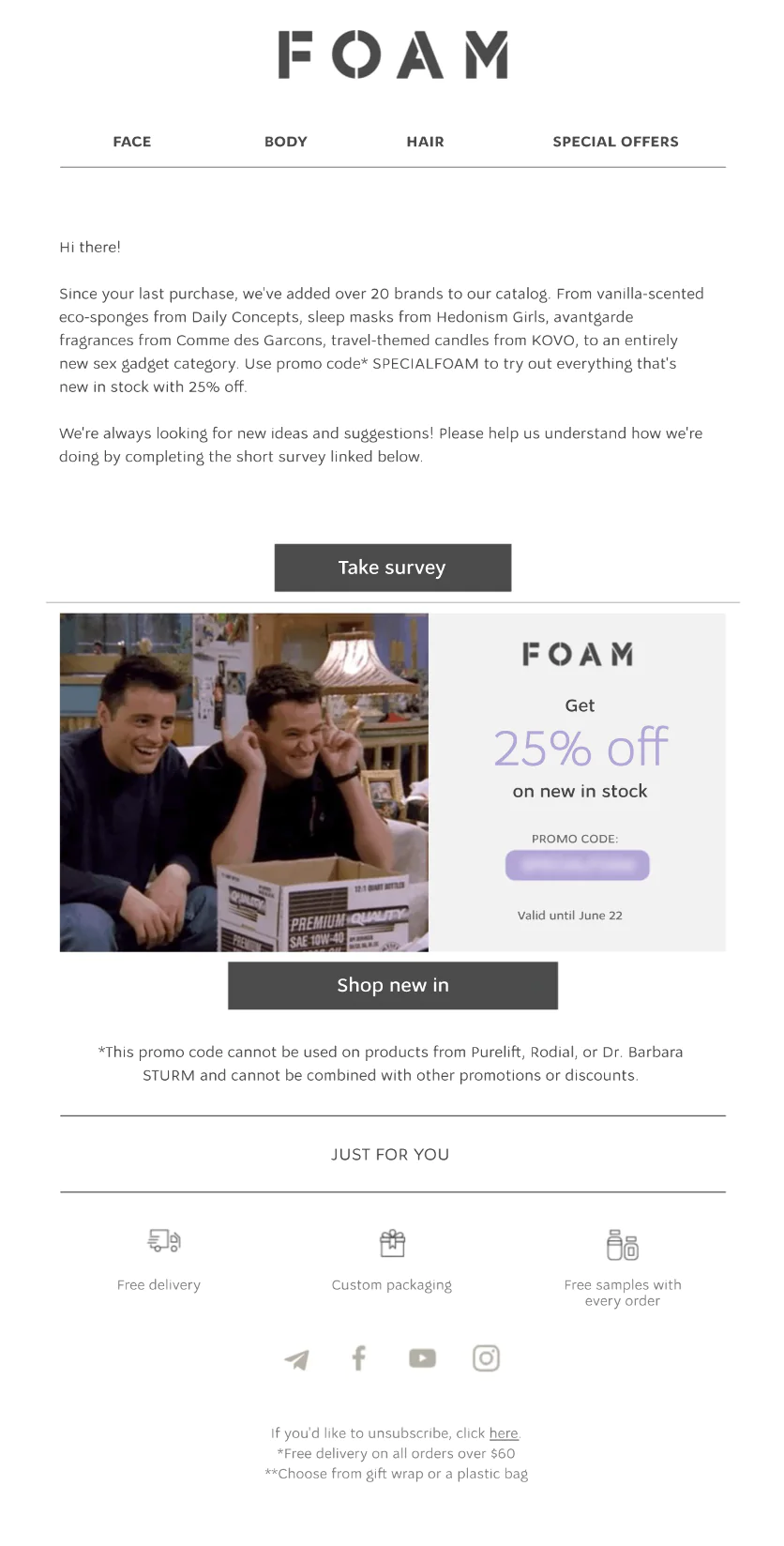

Similarly, the FOAM brand takes the initiative to reconnect with customers who have ordered within the last six months but have been inactive for the past three months. By sending out a discount offer coupled with a survey, FOAM is effectively reaching out to those categorized as R=3 in the “recency” aspect of RFM:

FOAM’s email campaign targeting inactive customers

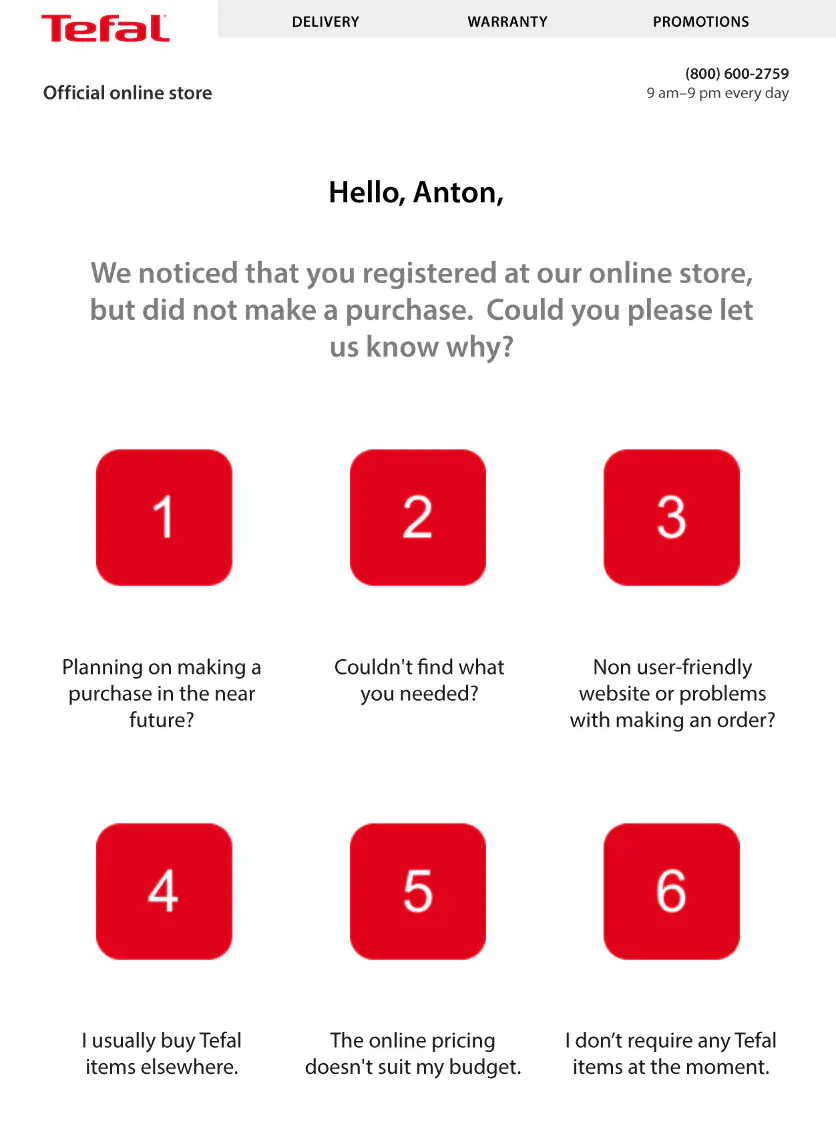

Tefal has designed a complex RFM approach to cater to various customer segments. One of the segments includes customers who registered on their online store more than 30 days ago but haven’t yet made any purchases, indicated by RFM scores of R=2, F=3, M=3 (recency here refers to the date they signed up). To probe into the reasons for their inactivity, these customers are sent a survey. As a token of gratitude for their feedback, they receive a “thank you” email containing a promo code for a discount.

A survey asking customers why they have not yet made a purchase

A "thank you" email post-survey

This method has proven effective, with an average of 15% of customers responding to the survey. Most importantly, it serves a dual purpose, giving Tefal deeper insights into this specific segment while helping build a positive relationship with them, incentivizing future purchases through the promo code.

Big box retailer METRO targets passive customers (segments with an R=2 score) with a discount code once every 90 days:

This email also contains personalized product recommendations to encourage customers to shop

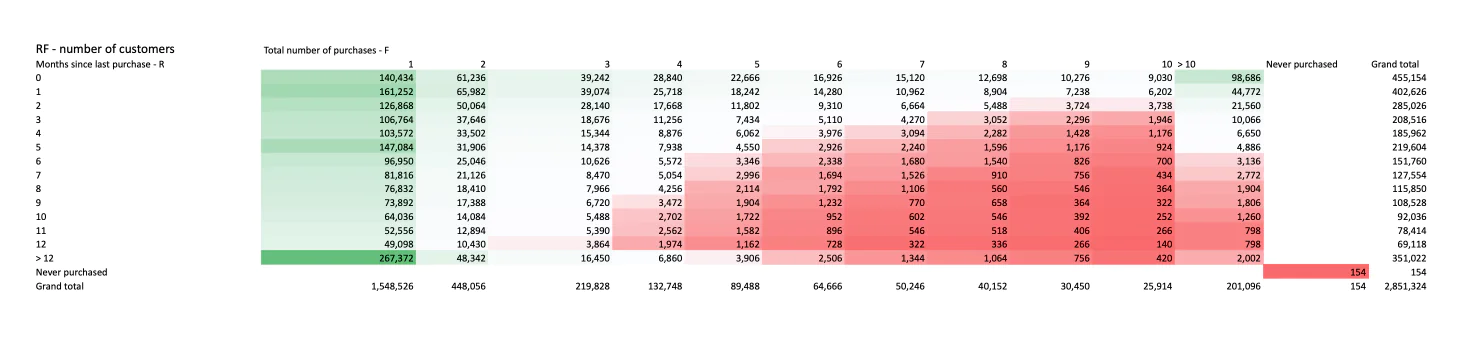

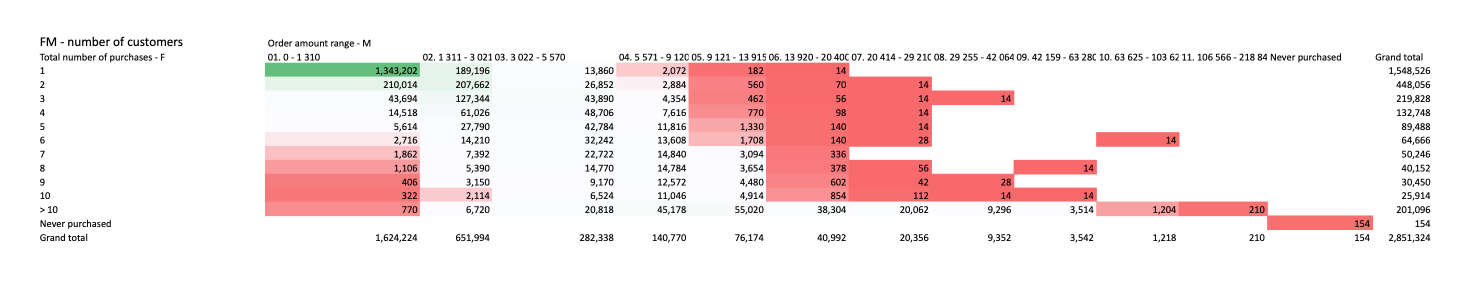

RFM Analysis in Maestra

Maestra features a built-in RFM report that automatically segments the customer base. To use the report, customer order history must be uploaded into the system. The report sheds light on various metrics such as:

- Average purchase frequency.

- Average order value.

- How many purchases a customer makes on average over their lifetime.

- Segment sizes based on the number of purchases, recency, and spend. Based on this, you can determine the current number of customers who:

• have never made purchases,

• are loyally inclined,

• are churning.

Using the insights from this report, businesses can establish segment thresholds to refine and effectively target their marketing communications.

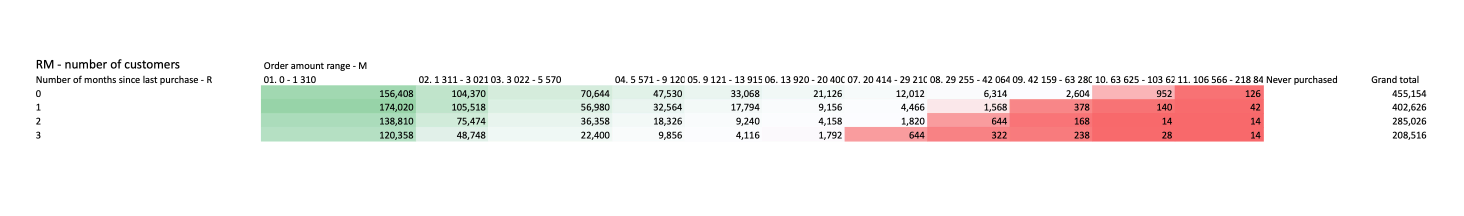

Example of an RFM analysis on Recency and Frequency within Maestra

Example of an RFM analysis on Frequency and Monetary Value within Maestra

Example of an RFM analysis on Recency and Monetary Value within Maestra

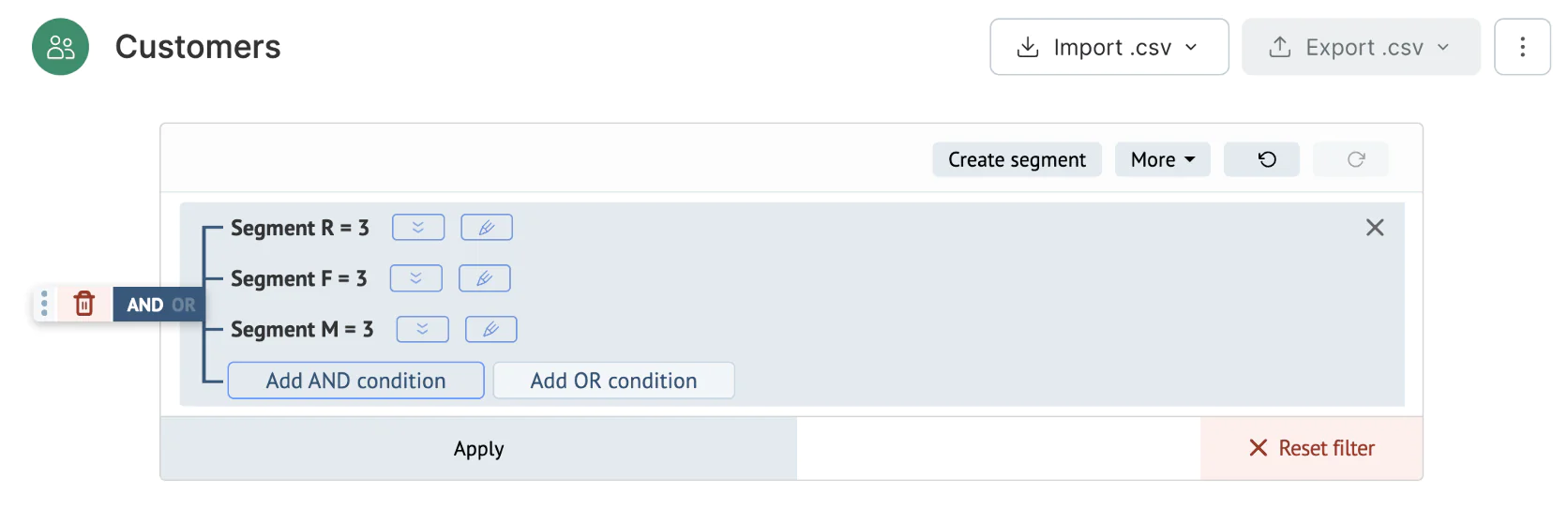

Once thresholds are determined, segments can be created for each individual RFM criterion, after which broader segments can be established based on the combination of these criteria. For example, a customer segment with R=3, F=3, and M=3 according to the RFM analysis is composed of three distinct segments:

If you need to adjust the threshold for the 333 RFM segment, all you have to do is modify parameters for the R=3, F=3, and M=3 segments, and the overarching segment will be automatically updated based on these revisions.

Implementing RFM Analysis in Everyday Tasks: Step-by-step

Use these steps as a rough guide on how to incorporate all the benefits of RFM analysis into your business:

- Collect customer purchase data.

- Define threshold values for segments based on your business and its current metrics: what you consider an average transaction value and average time between purchases.

- Based on the threshold values, segment the customers as described above.

- Utilize customer segments to fine-tune direct communication strategies, engaging active customers to sustain their interest and reactivating those who are on the verge of disengagement.

- Continuously reassess and update the threshold values used in the analysis to align with the evolving dynamics of your business.

Final Thoughts

RFM Analysis stands out as an pivotal tool for enhancing customer engagement and segmentation. It ensures customer interactions are not left to chance, enabling businesses to craft communications based on solid data. This leads to increased effectiveness in campaigns, higher customer satisfaction, and boosted revenue. Ultimately, incorporating an RFM approach is essential for businesses of all sizes and across all industries looking to thrive in today’s competitive landscape.