9 Best Sailthru Alternatives for 2025: Smarter Customer Engagement

Managing personalized marketing in today’s e-commerce landscape can feel like a high-wire act. You’re juggling email campaigns, mobile messages, website personalization, and customer data—one slip and you lose the audience’s interest.

The tools meant to help often fall short. Some can’t scale with your growth, others have outdated interfaces or siloed data. The wrong platform ends up feeling like duct tape holding together a fraying customer experience. You need a solution that not only handles the complexity but turns it into a competitive advantage.

That’s why we’re breaking down 9 top Sailthru alternatives for 2025. Some will save you money or time, others bring innovative approaches—and one Maestra—is the clear standout. It’s not just another option; it’s the Sailthru alternative for brands ready to ditch patchwork tools and deliver truly seamless, data-driven engagement.

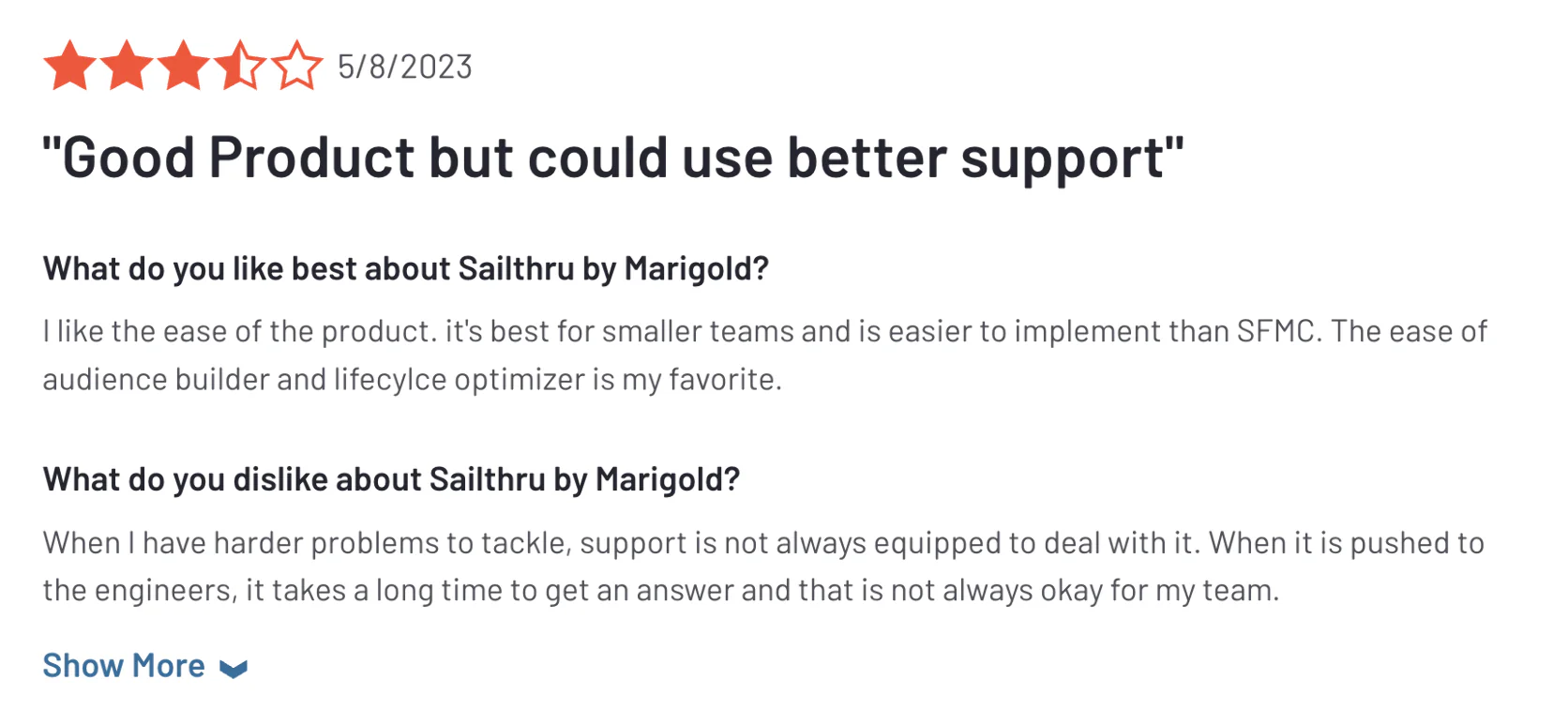

Sailthru (now part of Marigold) is a marketing automation platform focused on personalized, cross-channel campaigns. It captures rich consumer insights—like individual interests and purchase patterns—to tailor messaging for each customer across email, mobile, and more.

With advanced machine learning personalization and real-time content recommendations, Sailthru excels at predicting what content or products to show each user. Marketers can build dynamic customer profiles and segments, then deliver messages triggered by behaviors or preferences.

Sailthru also emphasizes long-term strategic support, offering a dedicated customer success team and training resources (like Sailthru Academy) to help clients get the most out of the platform.

Cross-channel campaign management

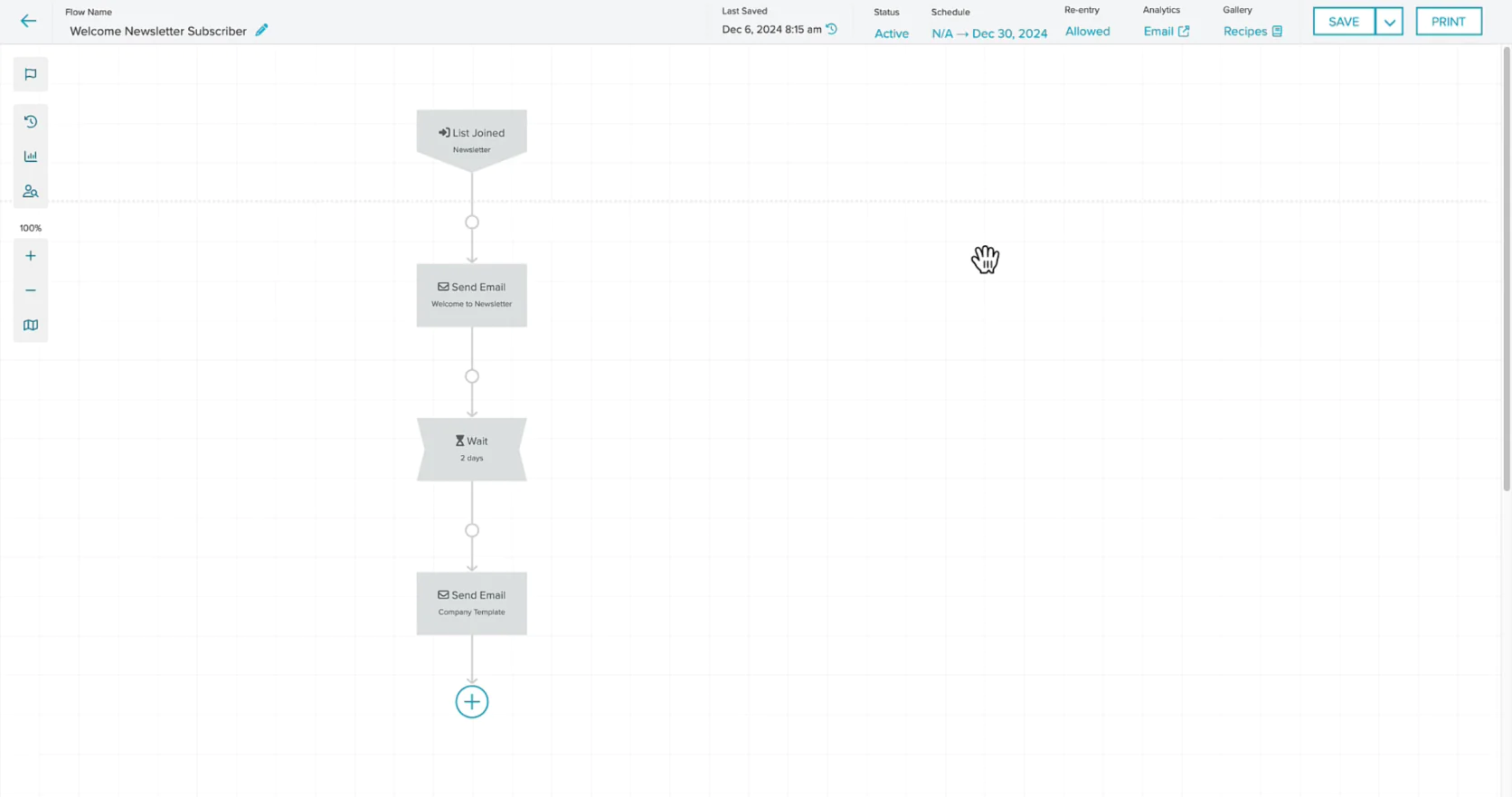

At its core, Sailthru enables omnichannel messaging with a strong foundation in email marketing. Brands can design automated email flows, such as welcome series or cart abandonment, using Sailthru’s Lifecycle Optimizer.

The platform extends beyond email with support for mobile push notifications and SMS (often via integrations), allowing you to engage customers on their preferred channels. Sailthru’s strength is using its customer data to coordinate these channels—for example, sending a push notification if a user doesn’t open an email, or syncing messaging frequency across email and mobile to avoid over-contacting.

It’s about reaching the right customer with the right message on the channel they’re most likely to respond to.

Predictive personalization and analytics

Where Sailthru really differentiates is in its predictive analytics and personalization engine. The platform’s AI analyzes each customer’s behavior and interests to make predictions—such as who is likely to purchase or churn—and to generate personalized content.

For instance, Sailthru can dynamically recommend products or articles in emails based on a user’s browsing history or past purchases. It optimizes send times for each individual and can even adjust email content in real time as inventory or prices change. These predictive capabilities help marketers move beyond one-size-fits-all campaigns to more tailored experiences that drive engagement.

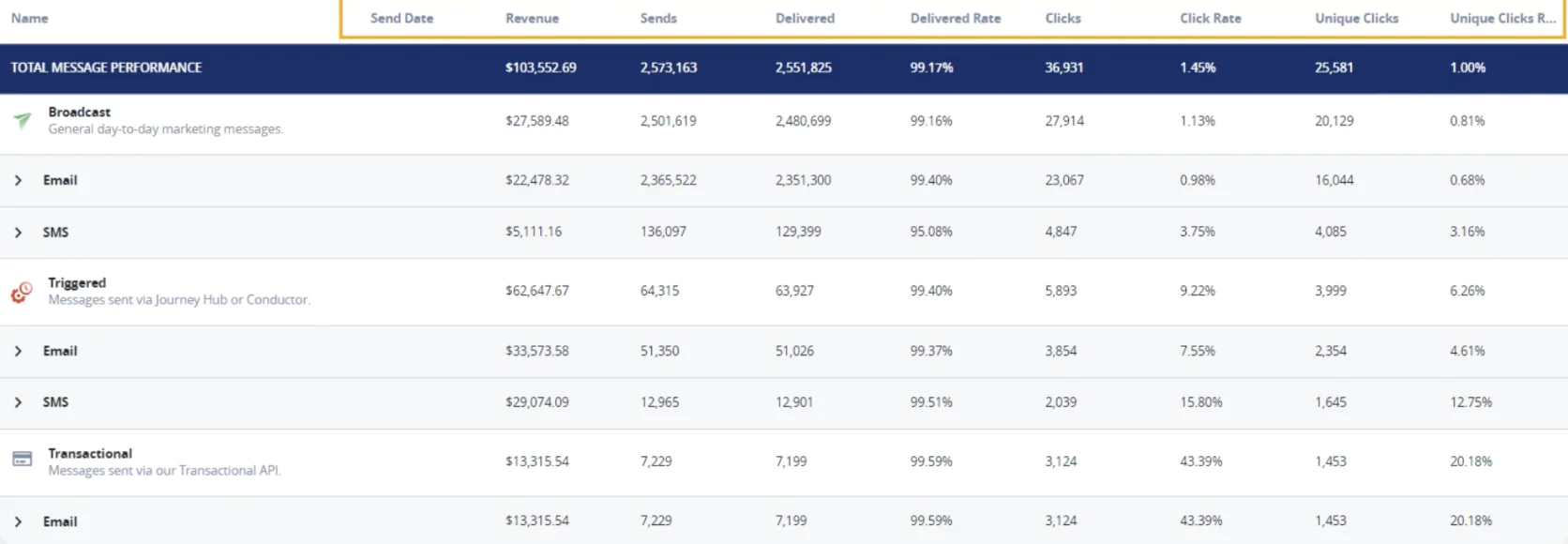

Sailthru provides dashboards and reports to track performance, so teams can see how personalization is impacting revenue or customer lifetime value.

Sailthru’s realtime dashboard

Customer data and integration

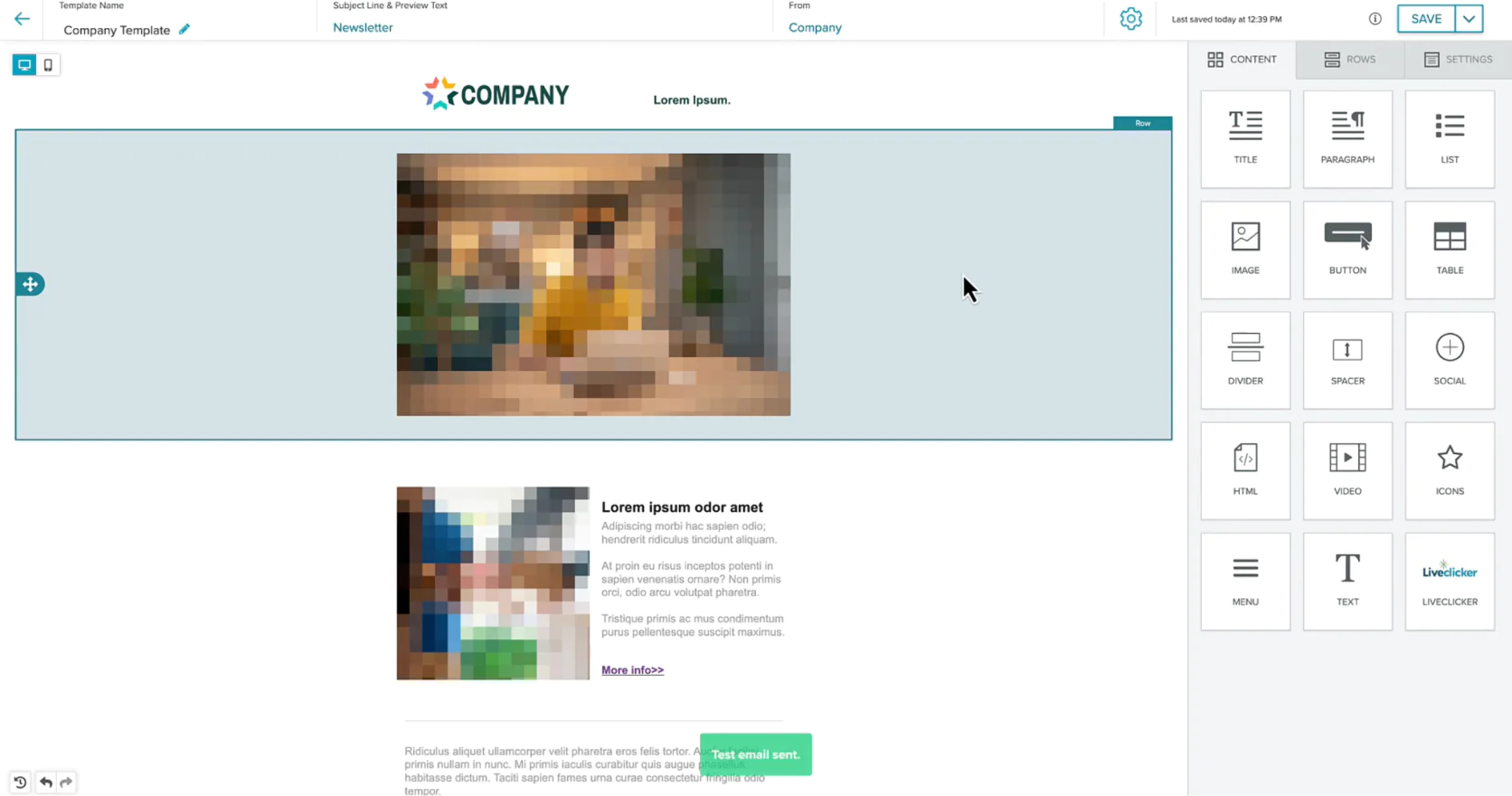

Sailthru acts as a mini customer data platform: it builds a unified profile for each shopper by aggregating data from various touchpoints (website behaviors, email clicks, purchases, etc.). Marketers can segment audiences using these rich profiles—for example, targeting high-value customers who haven’t purchased in 90 days with a win-back campaign.

Customer profile in Sailthru

Integration, however, can be a mixed bag. Sailthru offers APIs and some plug-ins to connect with e-commerce platforms and other tools, but users report that integrating external systems or new data sources can be challenging due to limited API flexibility. In practice, getting all your data flowing smoothly into Sailthru may require developer effort or workarounds.

Pain points with Sailthru

Sailthru isn’t perfect—far from it. For all its powerful personalization, many businesses eventually find cracks in the armor that have them considering alternatives. Let’s break down a few common pain points:

If you have to ask the price, you probably can’t afford it. Sailthru’s pricing is not transparent (you have to contact them for a quote) and lacks flexibility, which some users find frustrating.

There’s no free tier or self-service plan—it’s an enterprise-level investment from the start. For mid-sized companies on a tight budget, committing to Sailthru can feel like overkill. Annual contracts are the norm, often with six-figure price tags for larger databases.

In short, Sailthru can deliver results, but you’ll pay a premium for the privilege. Smaller teams may end up questioning if they’re utilizing enough of the platform’s features to justify the high cost.

Complexity and integration challenges

While Sailthru markets itself as a marketer-friendly platform, there’s definitely a learning curve. This isn’t a simple plug-and-play email tool for beginners—it’s a sophisticated suite with many moving parts. New users often need time (and training) to master the interface and fully leverage advanced features.

Additionally, integrating Sailthru with the rest of your tech stack can cause headaches. Connecting external systems or data sometimes requires custom solutions due to API limitations. Marketers without dedicated developer support might struggle when trying to sync Sailthru with, say, a homegrown ecommerce platform or a complex POS system.

Over time, these integration gaps can leave you with siloed data—exactly what you were trying to avoid.

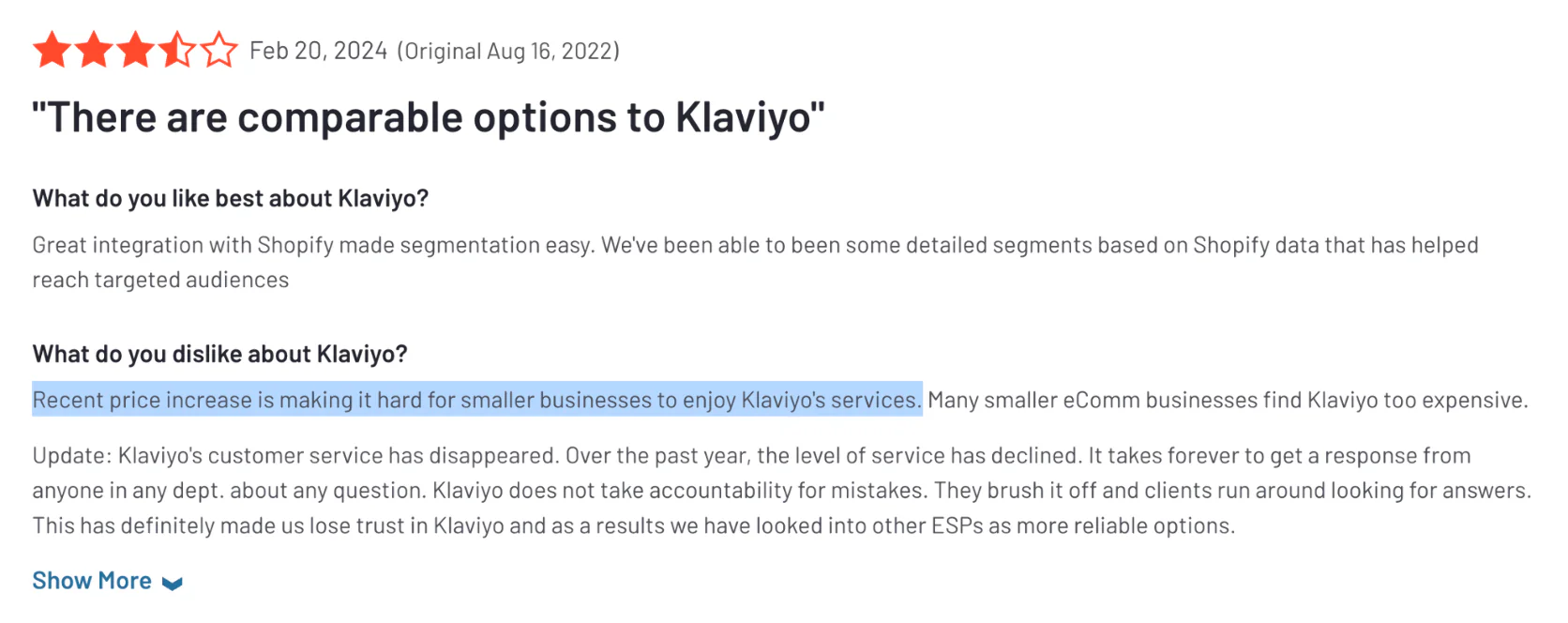

Customer support challenges

Enterprise software comes with enterprise support—which isn’t always as responsive as you’d hope. Users report that Sailthru’s customer support can be slow to resolve complex issues.

When you’re running big campaigns or dealing with deliverability quirks, waiting days for a support ticket reply is less than ideal. The platform does provide a dedicated success manager for strategic guidance, but for day-to-day troubleshooting some brands feel left in the lurch.

This frustration is magnified during onboarding, where every delay feels costly. If your team isn’t extremely technical, limited support and documentation can make the ramp-up period tough.

Why (and When) to Consider Alternatives

Sailthru is a solid starting point for businesses that need an advanced personalization engine and are willing to invest in an enterprise solution.

It works best for organizations with the resources to fully implement its capabilities. But as your company grows, you may find Sailthru’s limitations holding you back. Scaling your marketing shouldn’t mean scaling your headaches.

If you’re hitting walls on integration, chafing at costs, or finding that you need more agility and support than Sailthru provides, it’s probably time to explore your options. In 2025, brands are laser-focused on creating connected, real-time customer journeys—flexibility and swift execution are a must.

The Alternatives at a Glance

With that in mind, let’s look at some popular alternatives and what they offer:

Maestra

Full-funnel marketing for ambitious e-commerce brands

• Real-time CDP for behavior-driven segmentation

• Hyper-personalized omnichannel flows

• Built-in loyalty program and promotions engine

• Real-time site personalization

• Dedicated Customer Success Manager

Emarsys

Enterprise omnichannel customer engagement

• Orchestrate campaigns across email, SMS, push, ads, and more • AI-powered product recommendations & predictive analytics

• 100+ prebuilt campaign “Tactics” for quick launches

• Optional built-in loyalty program module

Custom pricing (enterprise-tier)

Salesforce Marketing Cloud

Large enterprises needing CRM-integrated marketing

• Comprehensive suite: Email, Mobile, Social, Ads, and more • Journey Builder for complex, multi-step automations

• Einstein AI for send-time optimization & predictive scores

• Native Salesforce CRM and Commerce Cloud integration

Custom pricing (enterprise, annual contracts)

Klaviyo

SMB and DTC brands for email & SMS marketing

• Email & SMS in one platform with unified customer profiles • One-click integrations with Shopify, Magento, WooCommerce

• Pre-built automation flows (welcome series, cart abandonment, etc.)

• Free plan available; scalable pricing as you grow

Free tier; paid plans from ~$20/month

Braze

Mobile-centric brands focusing on real-time engagement

• Real-time messaging across app, web, email, and SMS • In-app messages & push notifications for mobile apps

• Flexible APIs & SDKs for custom event tracking

• Highly granular segmentation & personalization at scale

Custom pricing (enterprise; usage-based)

Iterable

Mid-market teams needing flexible cross-channel campaigns

• Unified cross-channel campaigns (email, SMS, push, in-app) • Visual workflow builder for multi-step automations

• Flexible data integration via APIs and webhooks

• Built-in experimentation (A/B tests, control groups)

Custom pricing (typically mid-market/enterprise)

Dotdigital

Mid-market brands seeking user-friendly automation

• Combined email and SMS campaign management • Drag-and-drop email editor (with HTML option for flexibility)

• Pre-built connectors for popular e-commerce platforms

• Basic personalization and segmentation tools

Custom pricing (quote-based)

Listrak

Retailers looking for specialized customer retention tools

• Retail-focused automation across email, SMS, and more • AI-driven product recommendations and predictive analytics

• Unified 360° customer profiles for cross-device tracking

• Specialized flows for cart abandonment, bounce recovery, etc.

Custom pricing (enterprise-level)

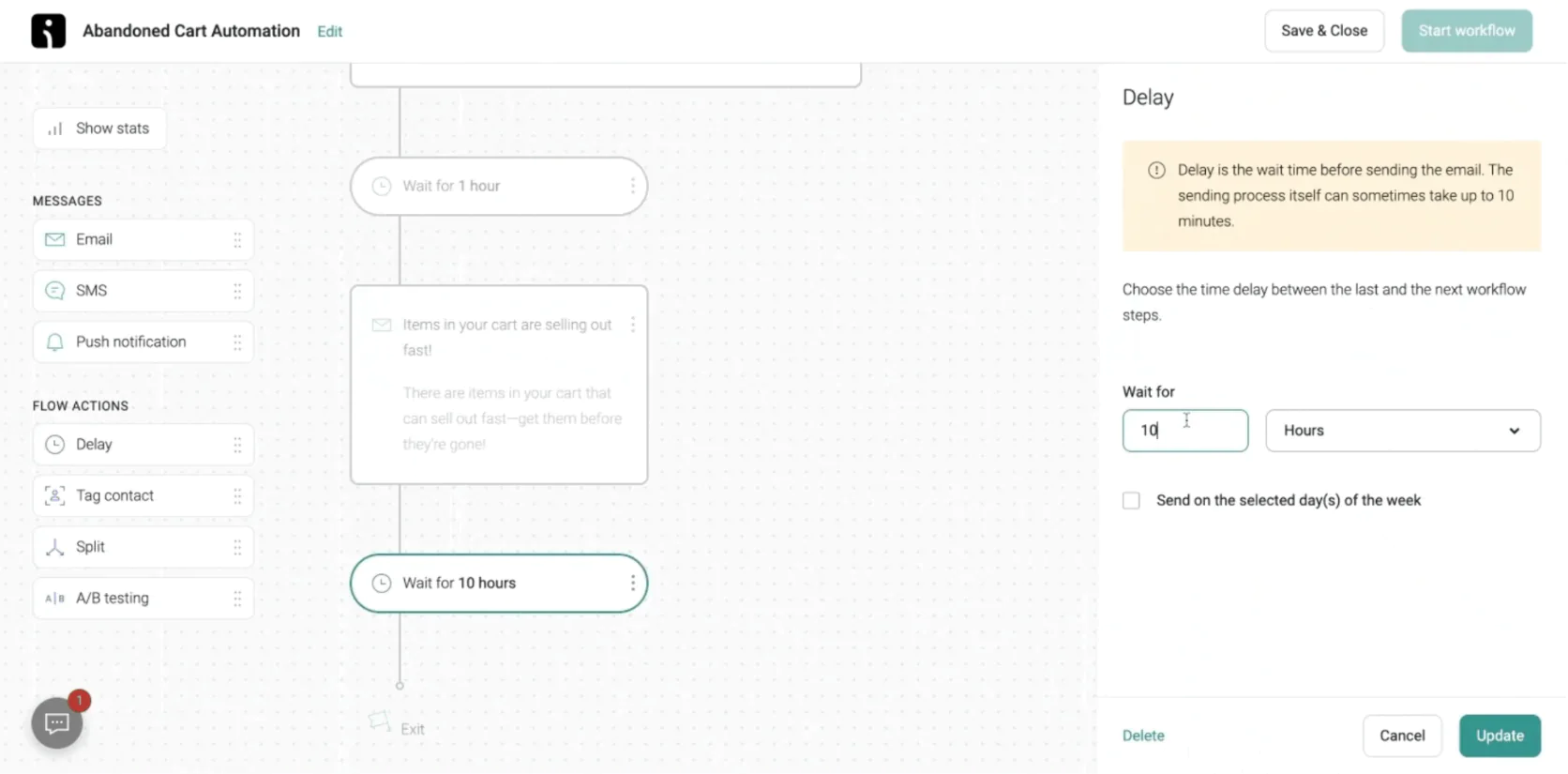

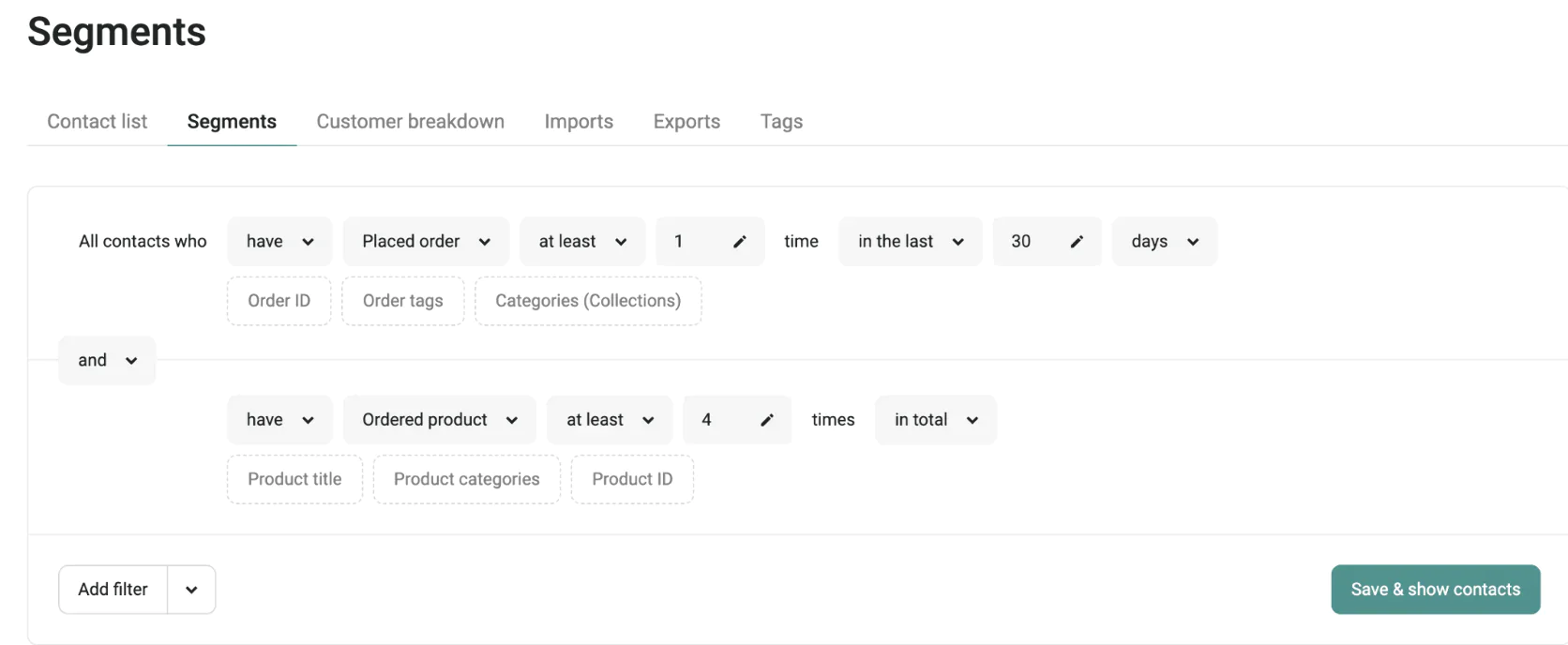

Omnisend

Small e-commerce teams on a budget

• All-in-one email, SMS, and push platform for SMBs • Easy drag‑and‑drop builder with pre-built workflows (cart recovery, welcome, etc.)

• 24/7 customer support (even on free plan)

• Strong Shopify and ecommerce integration focus

Free plan; Pro plan from ~$59/month

Best Sailthru alternative for comprehensive e-commerce marketing

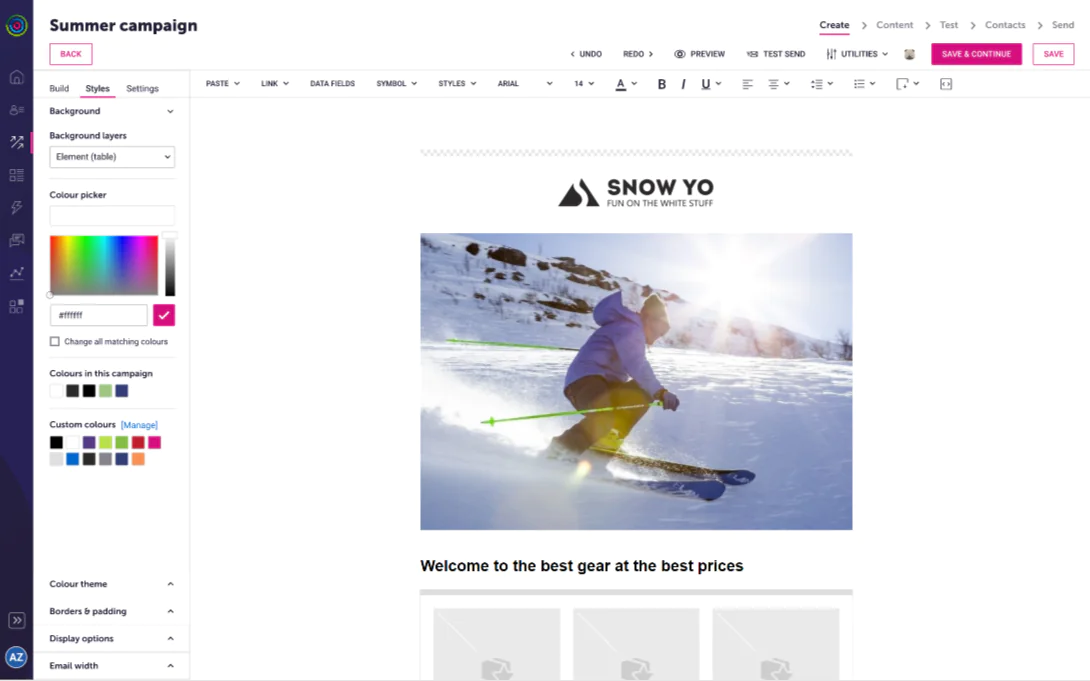

Maestra is an all-in-one omnichannel marketing platform built for e-commerce marketers ready to leave cobbled-together tools behind. It combines email, SMS, push notifications, onsite personalization, and even a full loyalty/rewards program engine in one hub.

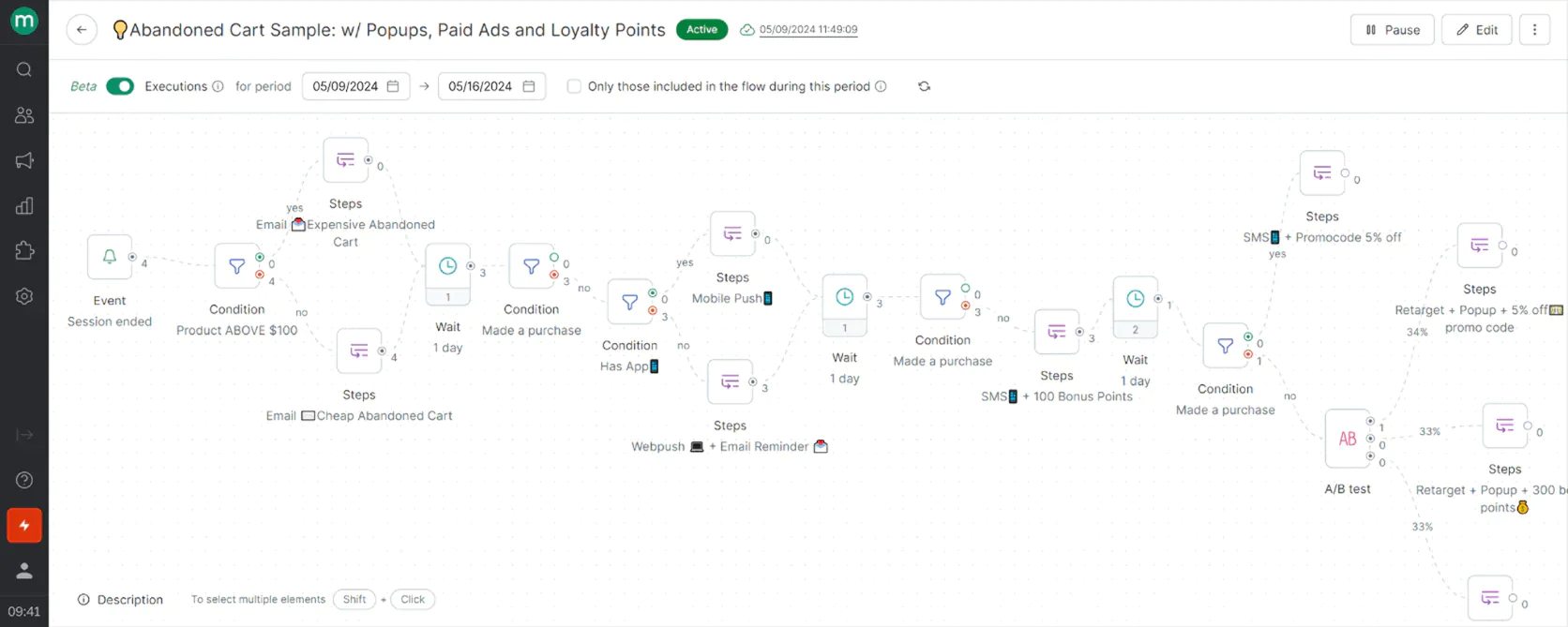

Maestra’s flow example: abandoned card flow with emails, mobile and web pushes, pop-ups, paid ads and loyalty points

With Maestra, you get a real-time unified customer profile for each shopper, letting you orchestrate campaigns that adapt on the fly. The platform’s mission is to make sophisticated marketing feel straightforward—so brands can create revenue-driving customer journeys without needing a PhD in data science (or a squad of engineers).

In other words, Maestra doesn’t just help you keep up with big players’ capabilities; it helps you lead with agility and intelligence.

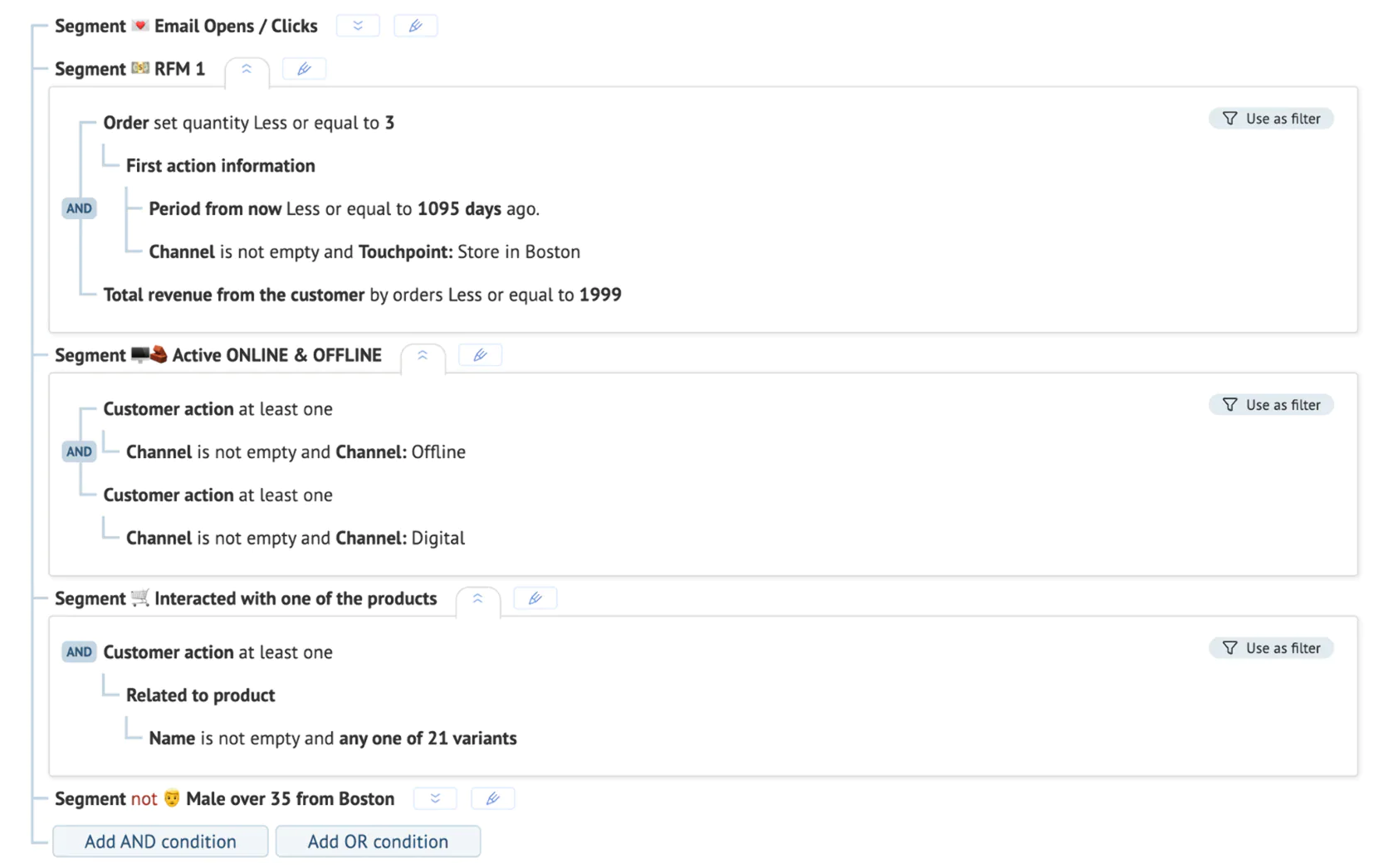

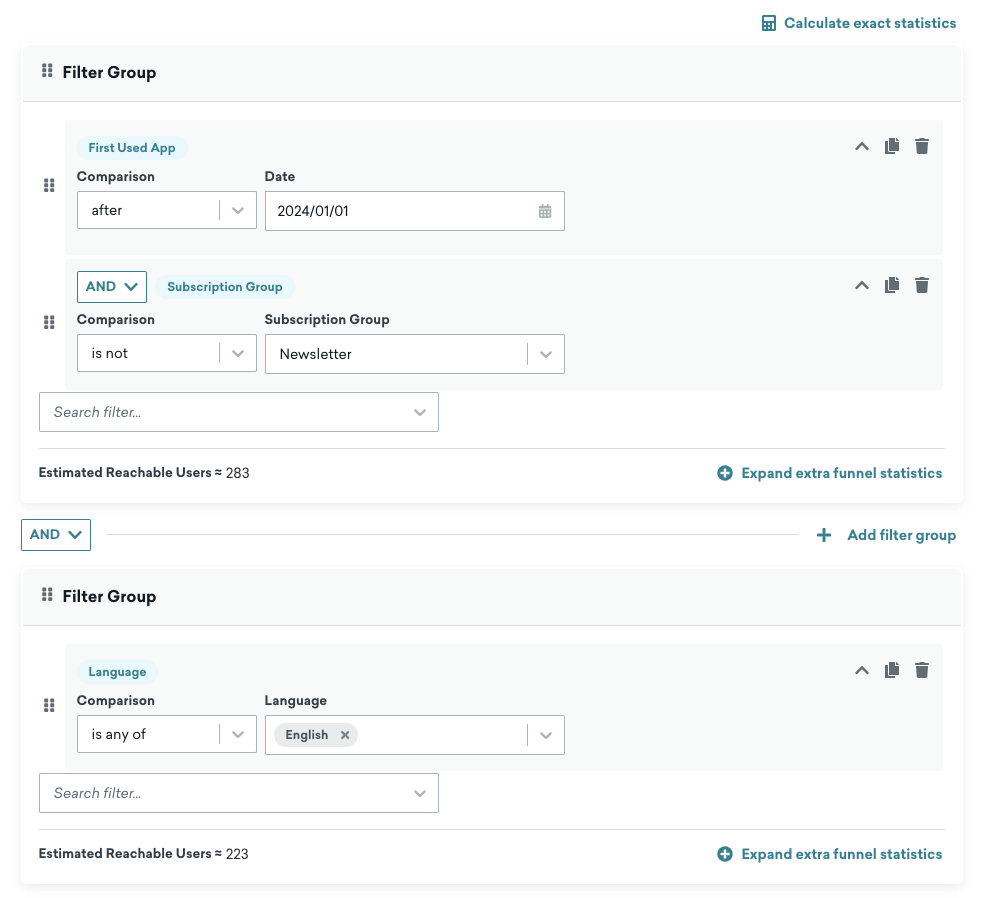

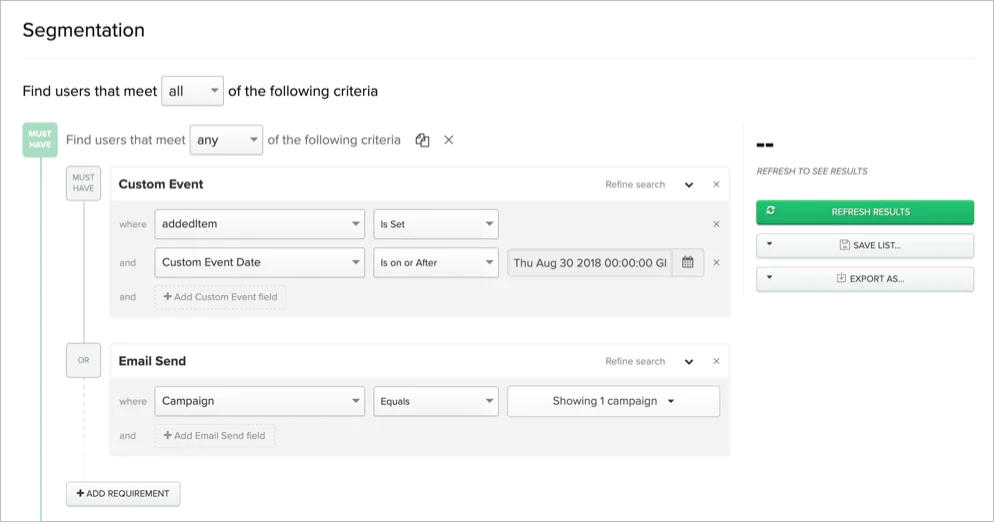

Real-time CDP and Segmentation: Maestra includes a built-in customer data platform that updates in real time. Every click, browse, and purchase feeds into the CDP instantly, powering behavior-driven segmentation. You can target customers based on up-to-the-moment actions—e.g. “viewed product X but didn’t purchase”—without delay. This real-time data is a critical advantage for fast-moving campaigns (like flash sales or back-in-stock alerts).

Maestra: user segmentation

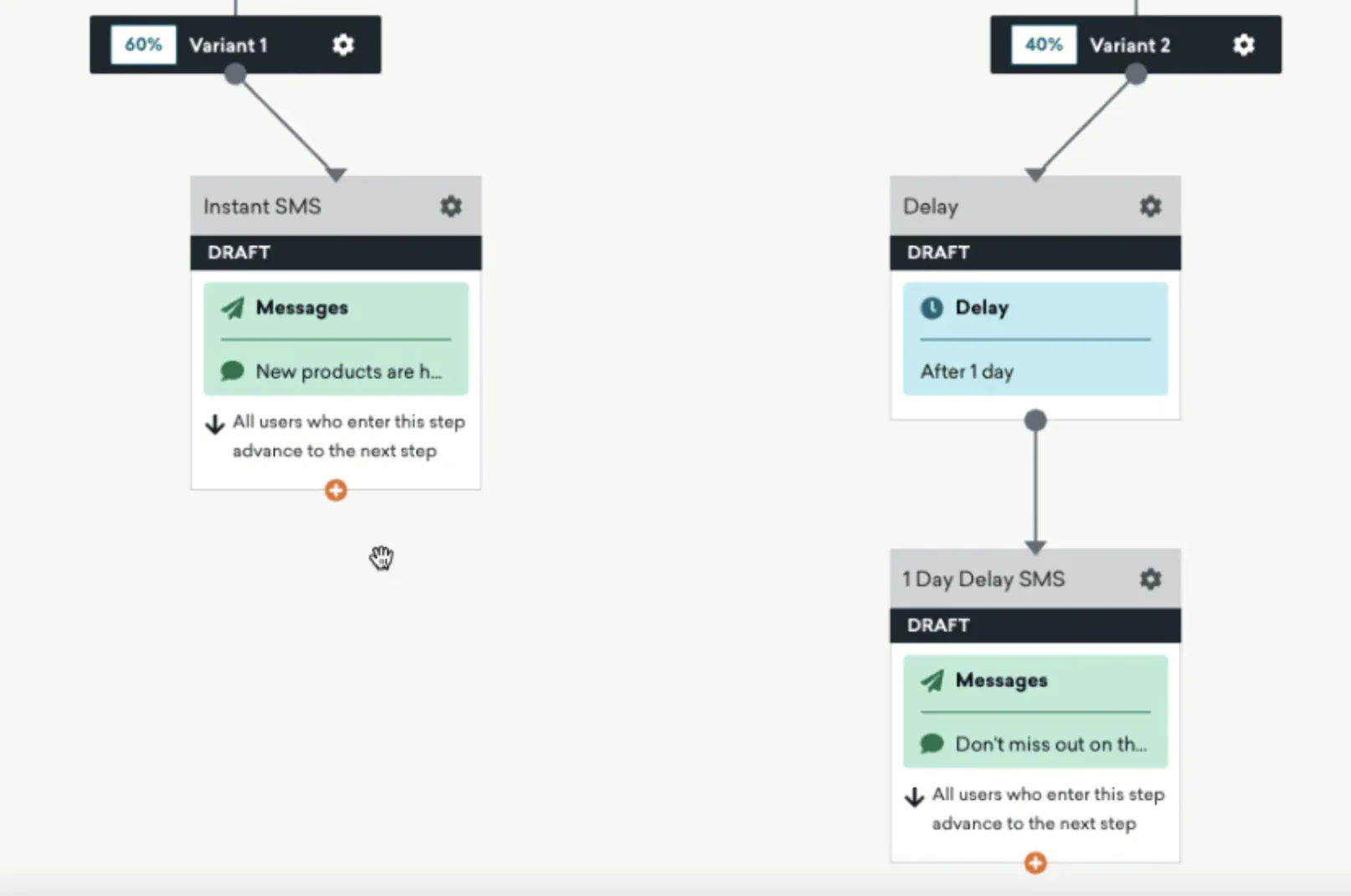

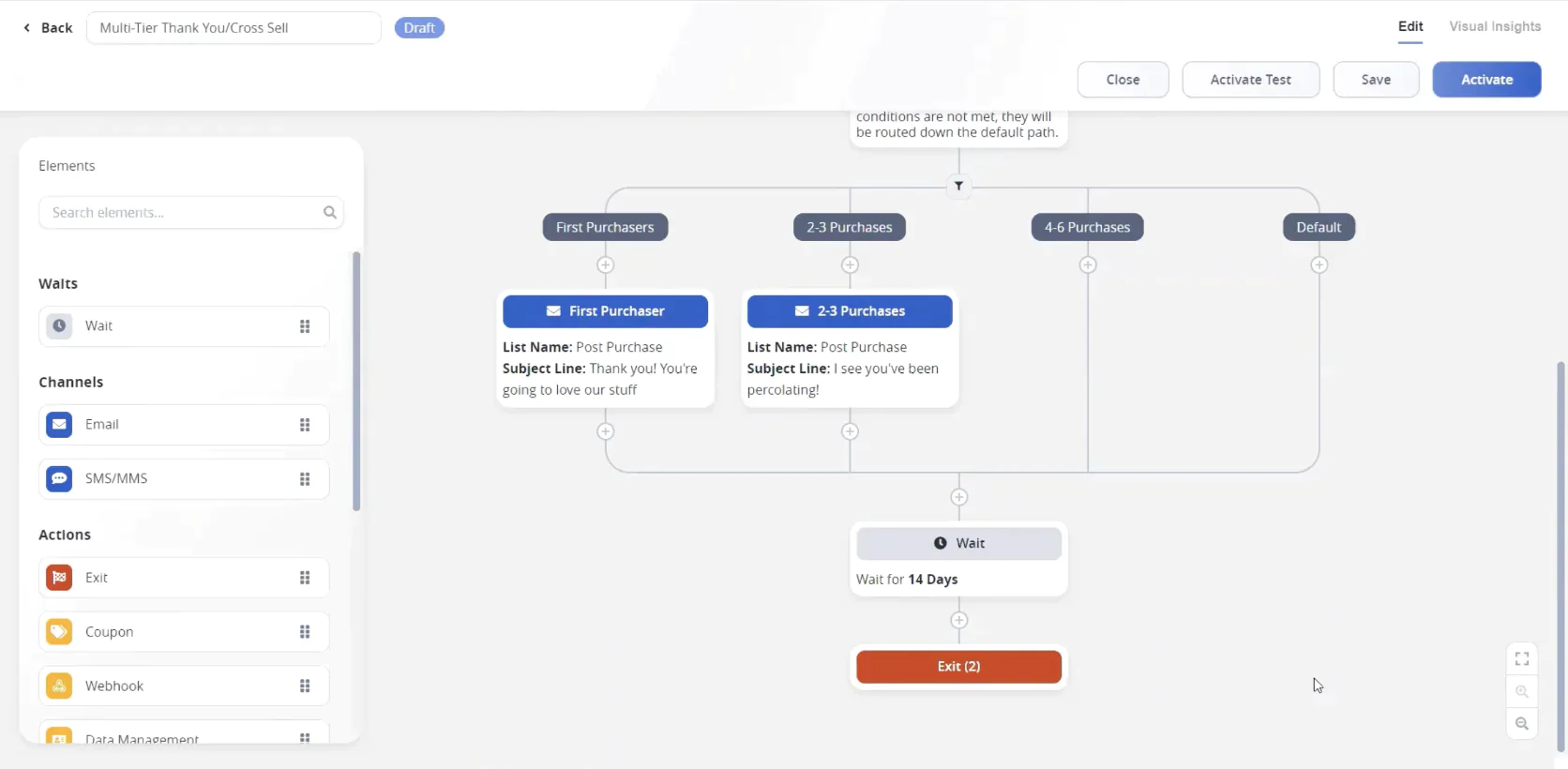

Omnichannel Journey Builder: Designing customer journeys in Maestra is as easy as dragging and dropping. The visual flow builder lets you create hyper-personalized omnichannel flows that might start with an email, follow up with an SMS, then show a personalized website banner—all based on how the customer interacts. Crucially, all channels are native in one platform, so you’re not stitching together separate tools.

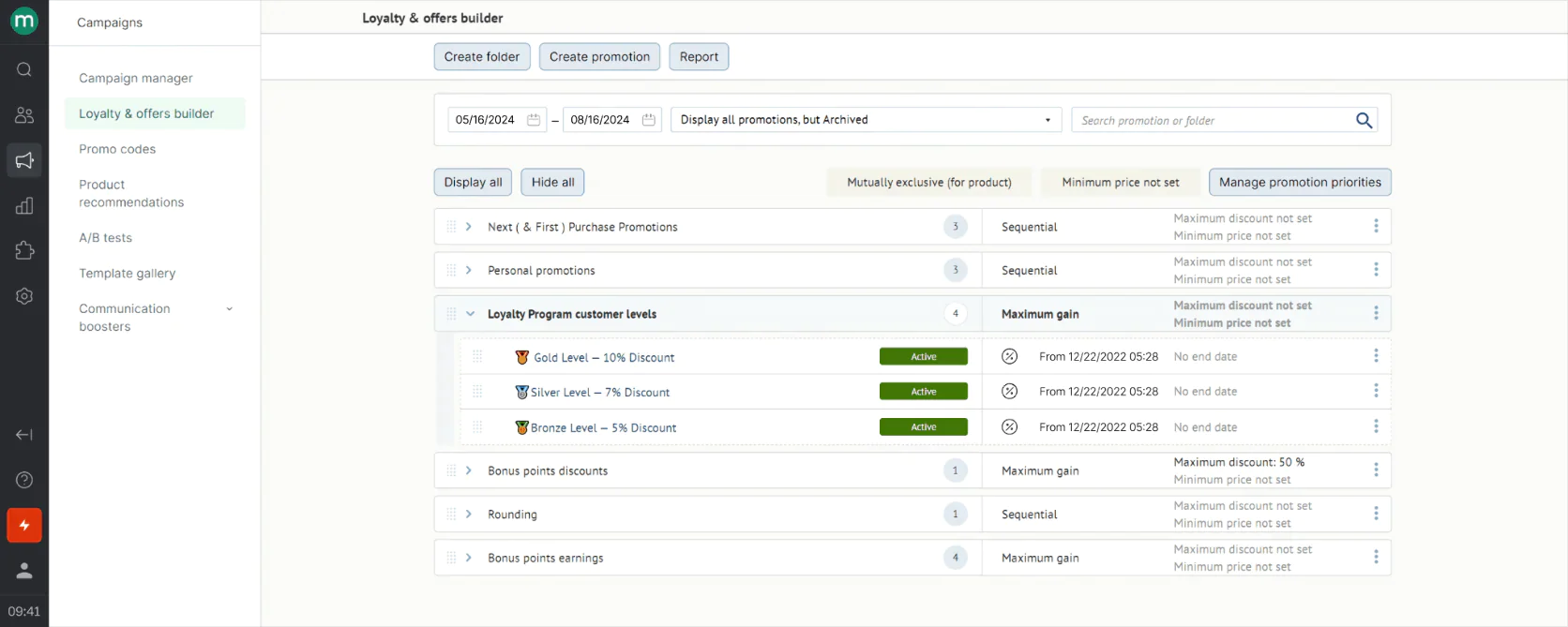

Built-in Loyalty and Promotions: Unlike most marketing platforms, Maestra has a loyalty program engine baked in—no need for a separate loyalty software. You can reward customers with points, set up VIP tiers, run referral programs, and drop unique promo codes, all from Maestra. You can trigger campaigns based on loyalty data (e.g. SMS a customer when they’re 10 points away from the next tier) and even insert loyalty info dynamically into emails (“You have 50 points!”).

Maestra’s promotions rule engine

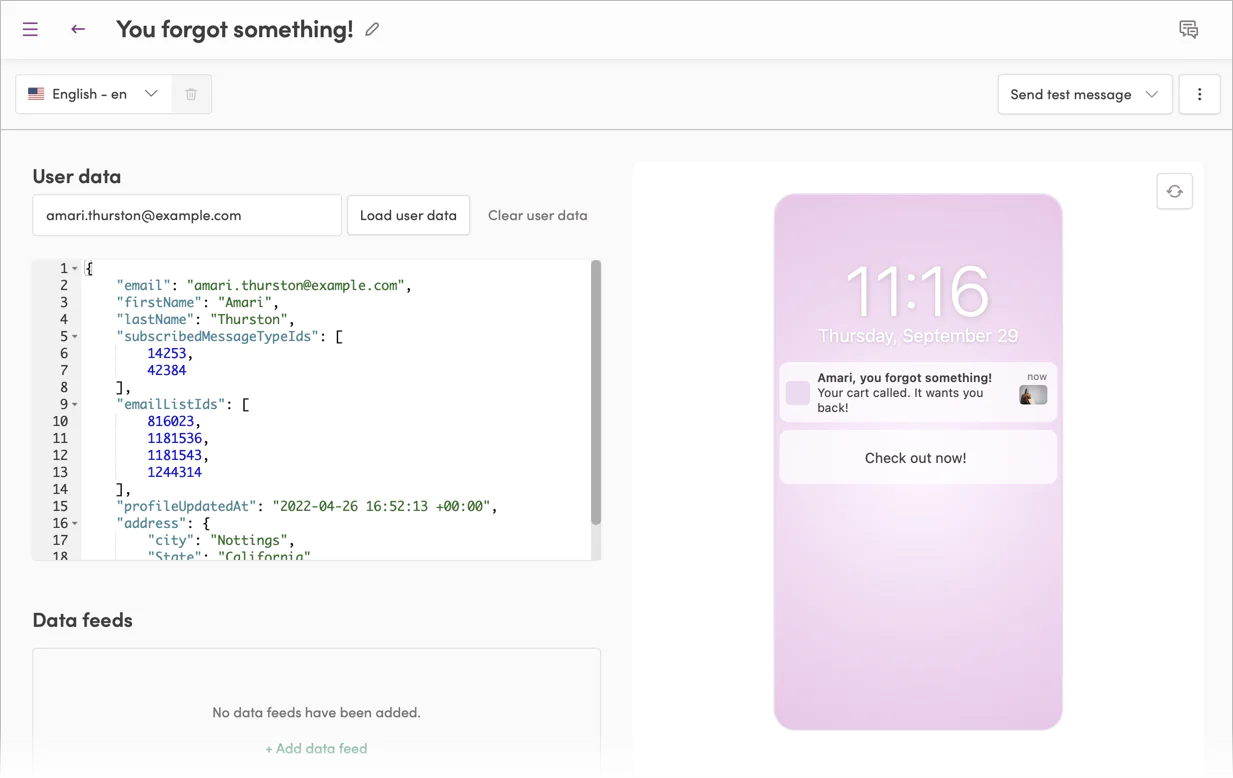

Real-Time Personalization: Maestra brings personalization beyond email and into onsite experiences. It can personalize content on your website for each user—for example, showing dynamic product recommendations or tailored homepage banners based on that user’s profile. These in-session personalizations use the same real-time CDP data, so a shopper’s browse behavior right now can influence what they see next.

Dedicated Customer Success: Choosing Maestra is like adding an expert to your team. Every client gets a dedicated Customer Success Manager. This person isn’t just there for technical support—they help with strategy, migration from older systems, and optimization of your campaigns. This high-touch support means you’re never flying solo when using the platform.

Maestra’s Strengths and Weaknesses

Maestra’s biggest strength? Making every customer interaction feel personal and effortless for your team. It’s not about just hitting “send” on more messages—it’s about hitting the mark with each message.

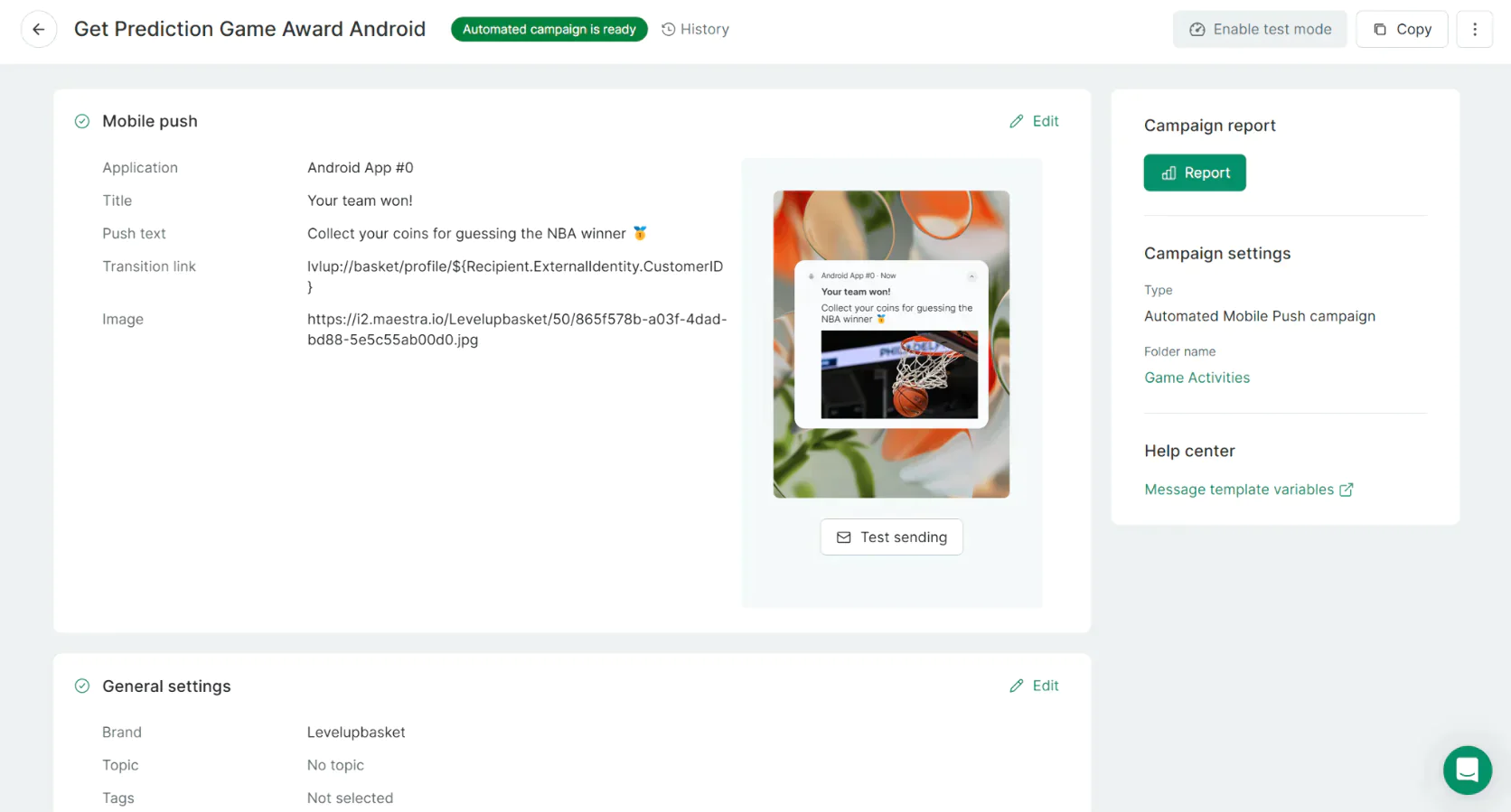

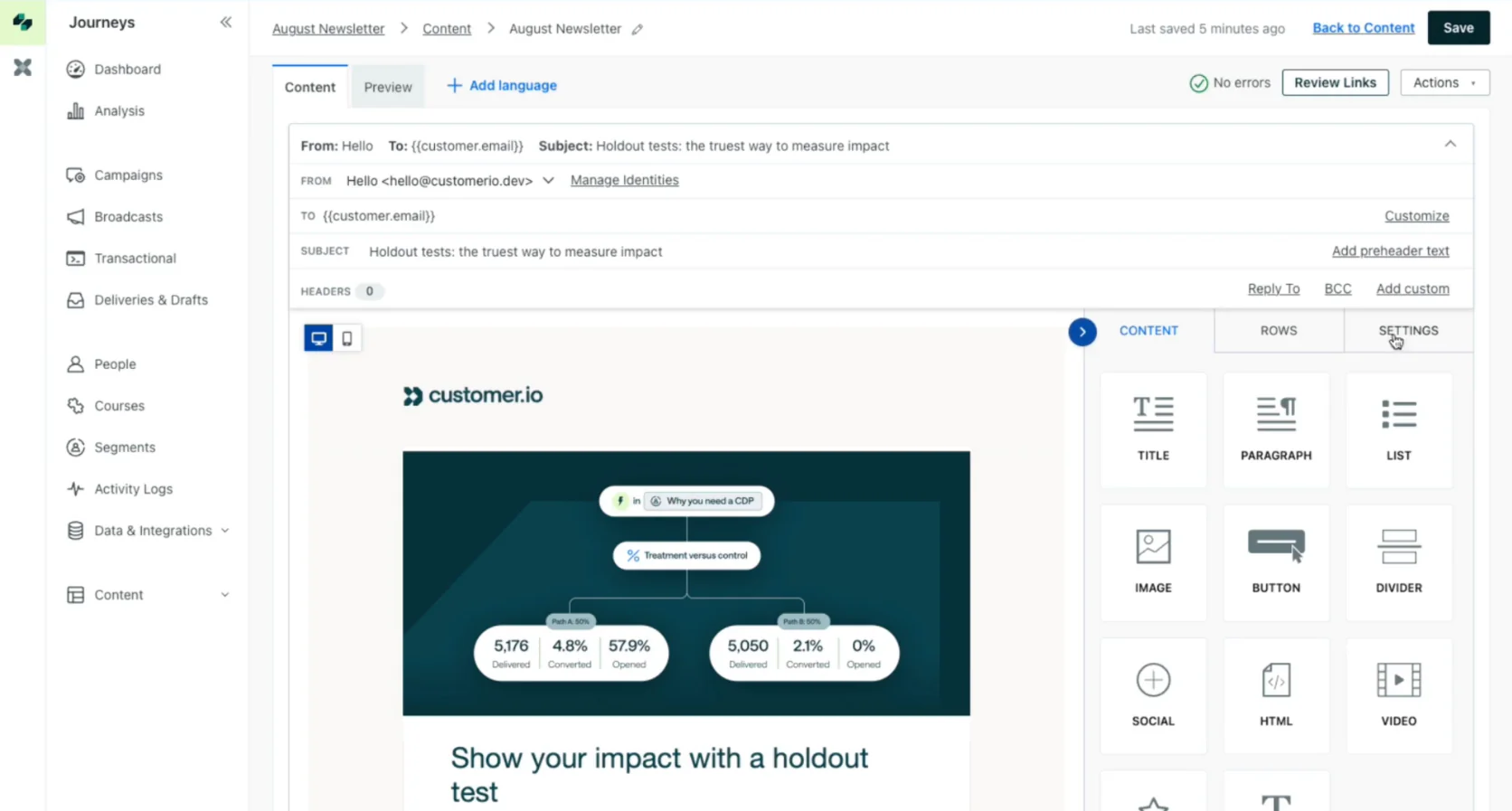

Maestra’s mobile push builder

The platform’s real-time data and drag-and-drop simplicity give you the power to create complex, nuanced campaigns without complexity for the user. For example, you can set up a flow that detects when a high-value customer’s favorite item is low in stock and automatically sends them a personalized “last chance” email or SMS—that kind of reactive marketing is built in, not a hack or custom script.

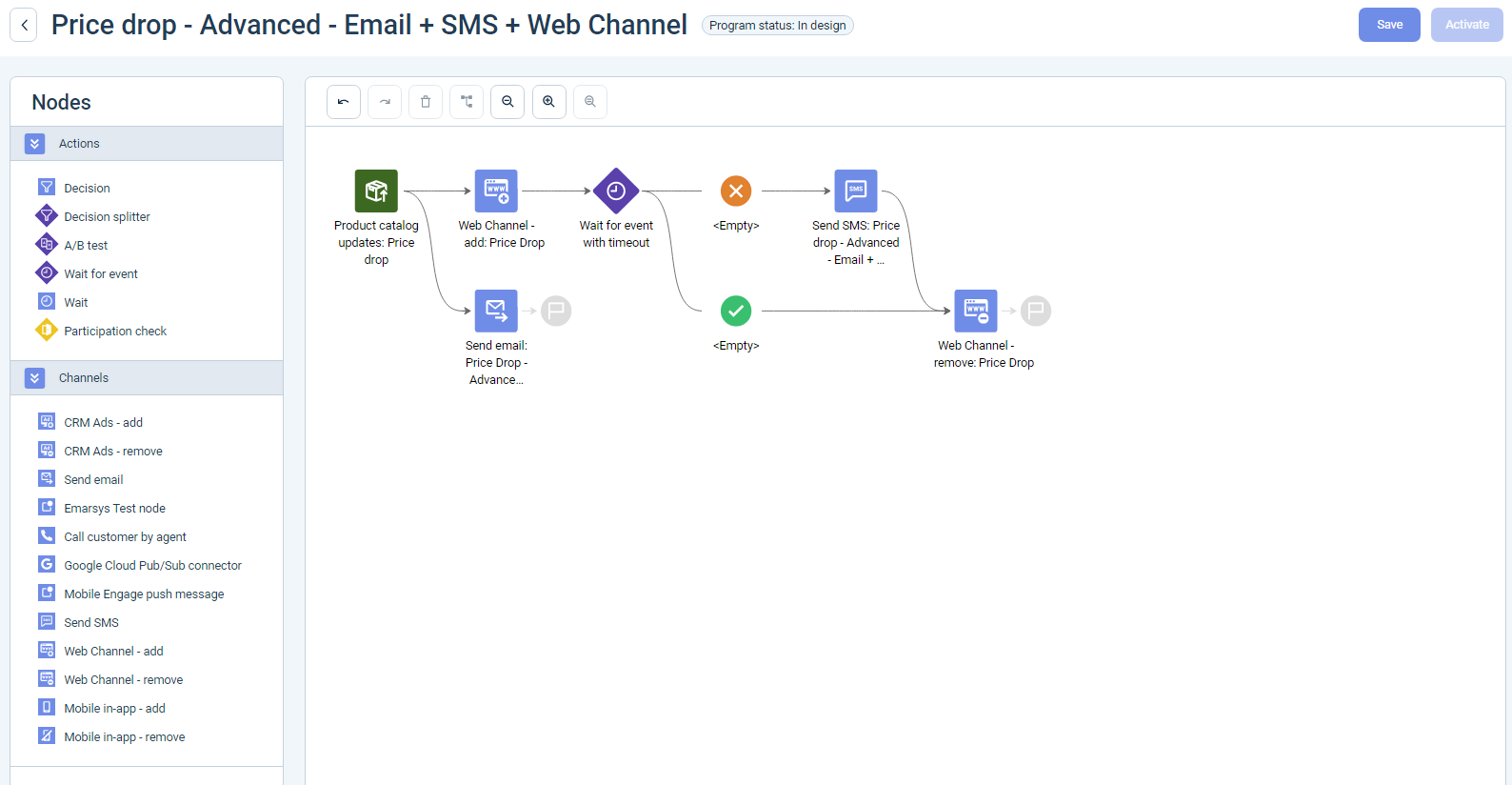

The level of detail Maestra enables is where it shines. Another example: using real-time triggers like “price drop” alerts. If a product a customer showed interest in gets discounted, Maestra can fire off a notification at that moment.

These timely, tailored touches turn what could be just another campaign into a conversion, all automated by Maestra’s intelligence.

On the flip side, Maestra’s pricing starts at $2,990 per month, which means it’s geared more toward mid-sized and enterprise brands than scrappy startups. There’s no free plan or super low-tier, so very small businesses might find it out of reach.

However, the cost reflects the value—this isn’t just software access, it’s practically a full-service solution. That monthly fee includes your dedicated success manager, hands-on onboarding, and even ongoing strategy support. Maestra is a partner in your growth, not just a vendor.

In terms of product gaps, Maestra is continuously expanding features, but it doesn’t try to do everything. For instance, Maestra excels at incentivizing reviews and leveraging social proof within campaigns, but it doesn’t have its own module to manage and display UGC on your site. The thinking is you can integrate a dedicated reviews platform if needed.

That said, because Maestra can integrate incentive campaigns (like “review this product for 100 points”) into its flows, you still get the benefit of UGC, just not a standalone gallery feature.

Sailthru is powerful in personalization, but it can feel rigid and piecemeal when it comes to executing across channels. Many Sailthru users rely on additional tools or custom work to handle things like SMS, on-site personalization, or advanced data management.

Maestra eliminates that patchwork. It’s a one-stop shop: real-time CDP, email, SMS, push, loyalty, site personalization, and even ad audiences are all under one roof. This means no more cobbling together data from different apps—which was a common pain with Sailthru.

Maestra’s flexibility is another contrast: where Sailthru might require a developer to set up a complex triggered campaign, Maestra lets a marketer do it via an intuitive interface.

Plus, Maestra’s dedicated support outshines the more general support Sailthru provides.

In short, Sailthru brought the idea of personalization to the forefront, but Maestra modernizes it by making it real-time, omnichannel, and marketer-friendly.

Discover Maestra—

schedule a demo today to transform your business. Unlock smarter customer engagement, boost retention, and achieve unified marketing excellence with Maestra by your side.

Best Sailthru alternative for AI-driven omnichannel engagement

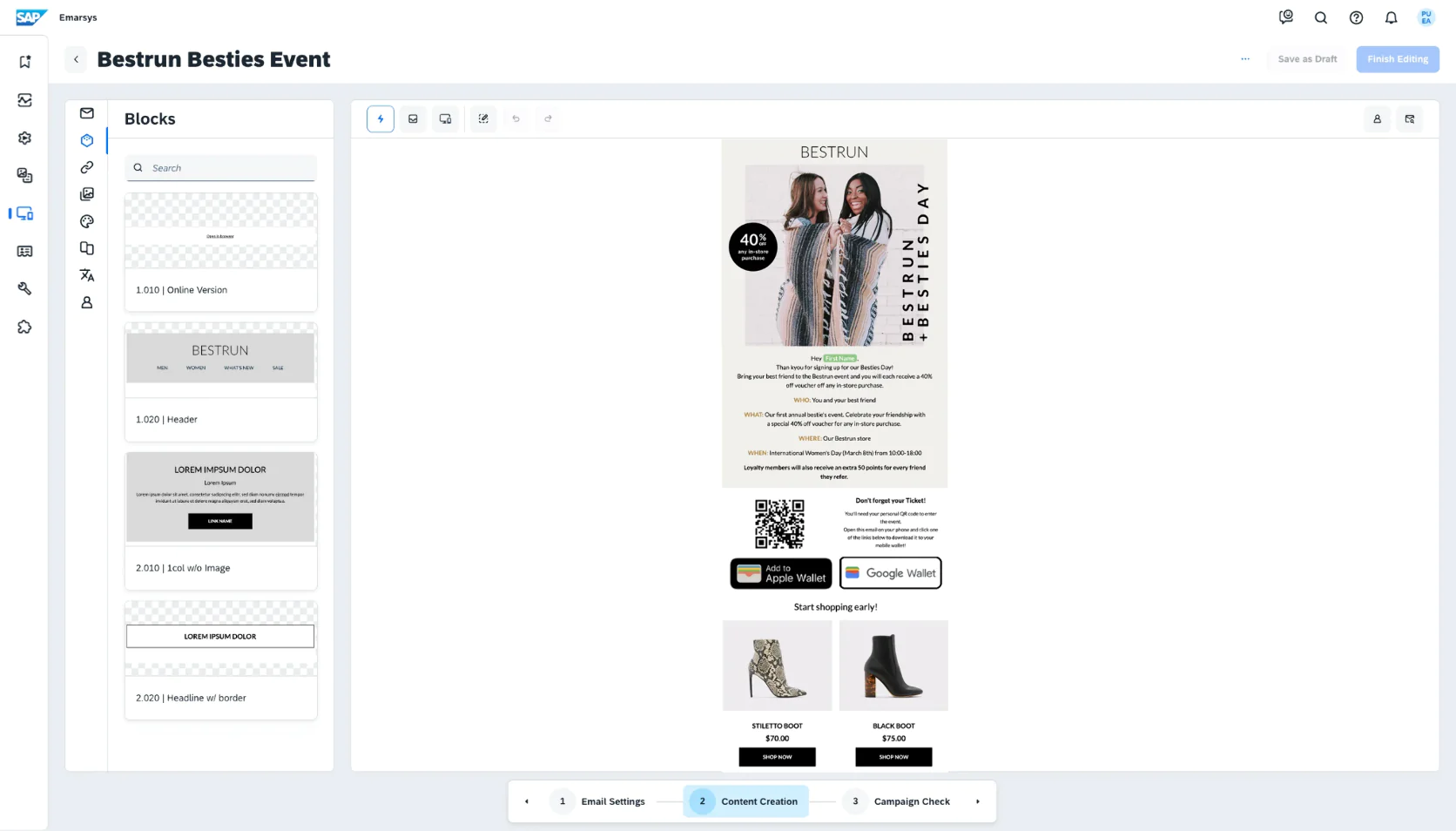

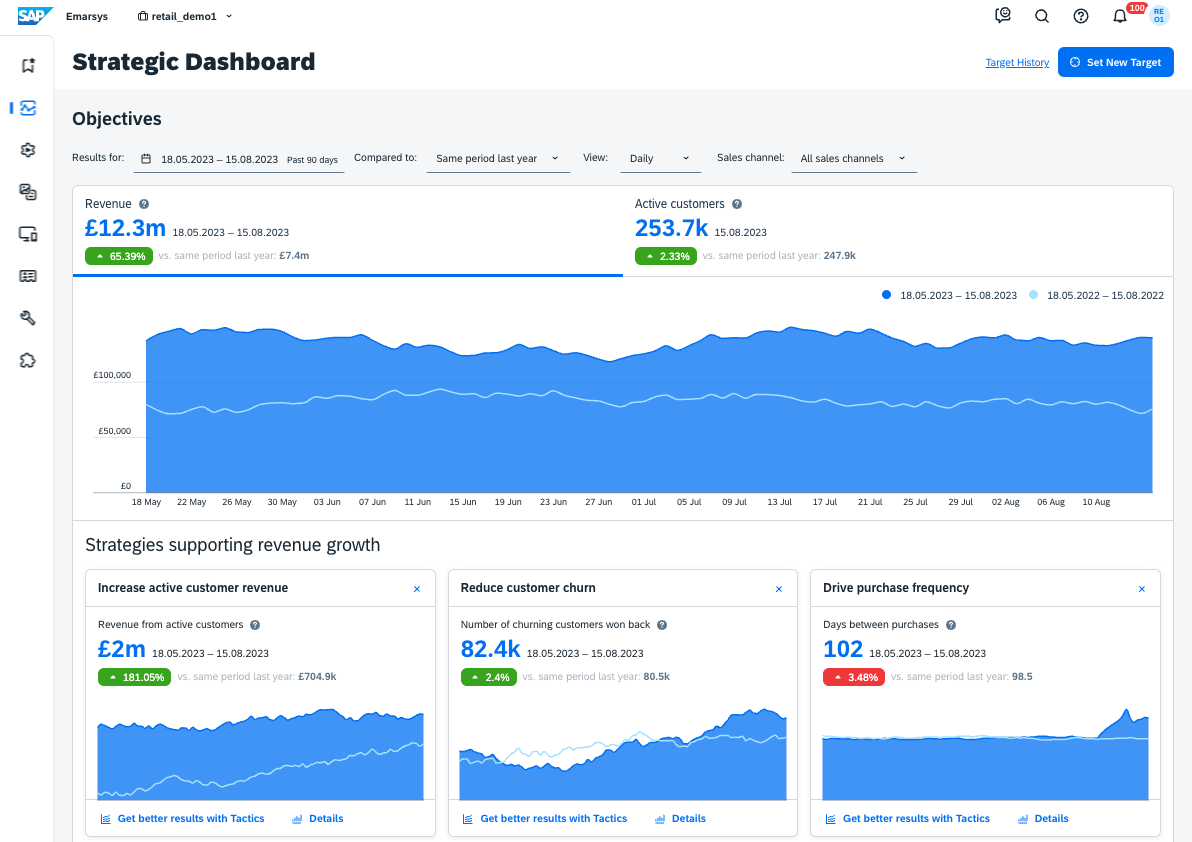

SAP Emarsys is a heavy hitter in the marketing automation space, purpose-built for large retail and e-commerce brands. Now part of SAP, Emarsys positions itself as an omnichannel customer engagement platform that can execute and analyze campaigns across every channel from one place.

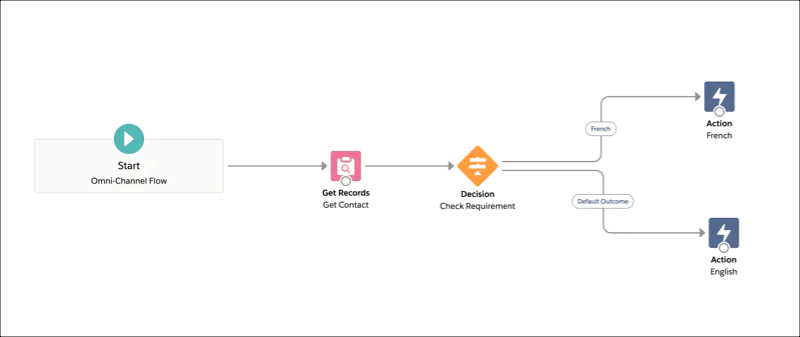

Marketers using Emarsys can design multi-step journeys combining email, SMS, push notifications, ads, and more in a single workflow.

Omnichannel Campaigns: Manage email, SMS, push notifications, ads, web push, in-app messaging, and direct mail from one platform.

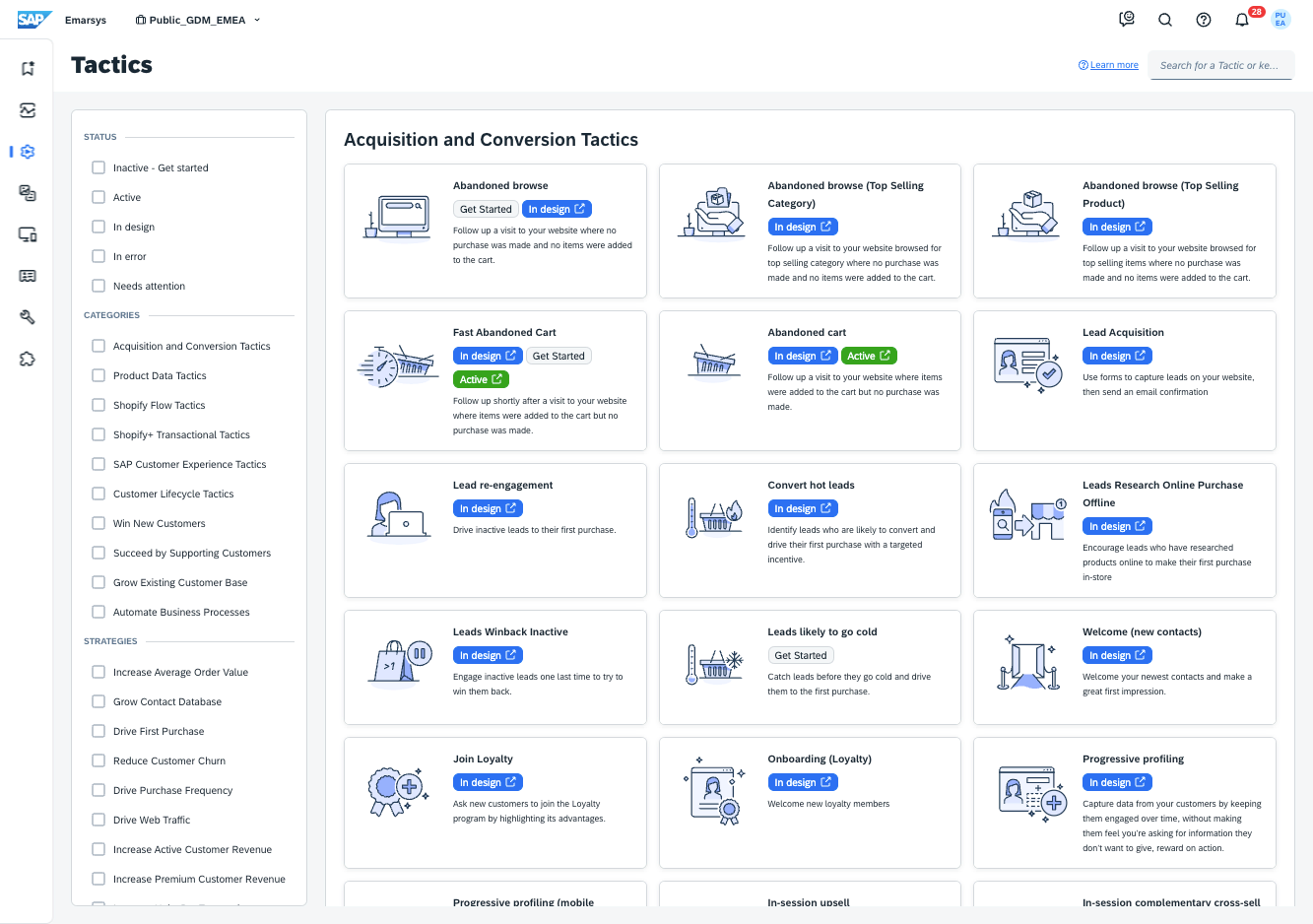

Pre-built Automation Tactics: Over 100 ready-to-use campaign templates for scenarios like win-back, post-purchase follow-up, and cart abandonment.

AI-driven Personalization: AI engine for product recommendations, churn prediction, conversion likelihood, and optimized send times.

Robust Integration: Native integrations with SAP’s commerce and CRM systems, as well as pre-built connectors for Magento, Shopify, and other e-commerce platforms.

Native Loyalty Module: Built-in loyalty points and rewards management directly within Emarsys.

Marketer-Friendly Interface: User-friendly segmentation UI and automation editors designed specifically for marketers.

Emarsys offers true omnichannel breadth. It natively supports a wider channel mix than many competitors, ensuring consistent messaging across email, SMS, web push, in-app messaging, ads, direct mail, and more.

Integration is a strong suit, too. Being part of SAP, Emarsys has direct integrations with SAP’s commerce and CRM systems but also plays well with other platforms like Magento and Shopify. Retail marketers appreciate Emarsys’s ability to integrate point-of-sale data, inventory updates, and loyalty program data, enabling more precise targeting and customer journeys.

The platform’s interface is marketer-friendly, reducing dependence on IT, and the inclusion of a native loyalty module further simplifies operations by removing the need for additional systems.

With enterprise power, however, comes enterprise complexity and cost. Emarsys carries a significant investment, often tens of thousands of dollars per year, and typically requires annual commitments. For smaller teams or mid-market brands, this might be overkill, providing features (like direct mail capability) they may never use.

Despite its marketer-friendly design, Emarsys still presents a learning curve. New users typically need substantial training to fully leverage its sophisticated features. The abundance of options, particularly the extensive library of pre-built tactics, can sometimes complicate decision-making, overwhelming teams without dedicated marketing operations specialists.

Finally, being integrated with SAP can be a double-edged sword. While SAP ecosystem users enjoy seamless integration, non-SAP shops may encounter less plug-and-play experiences over time. Support quality can vary as well—some clients enjoy excellent dedicated account management, while others feel overlooked by such a large vendor.

Emarsys and Sailthru target a similar profile (retailers who want personalization and cross-channel marketing), but they have different philosophies.

Sailthru shines in predictive analytics and editorial personalization, having roots in media/email, whereas Emarsys offers a more complete marketing suite with tactical modules and broader channel coverage. For example, if a brand wants to run integrated Google and Facebook ad audiences off their email list, Emarsys has that built-in; Sailthru would require exporting data to another tool.

Emarsys also has more out-of-the-box marketing blueprints—Sailthru is powerful, but more open-ended, meaning your team has to build campaigns from scratch.

In short, Sailthru might edge out Emarsys in pure algorithmic personalization (its prediction models are top-notch), but Emarsys wins in operational efficiency and channel scope.

Many growing brands that started on Sailthru consider Emarsys when they need to add channels like SMS and push or when they want an easier path to launching advanced campaigns without so much custom setup.

Emarsys does come at a higher cost, though—it’s often a “you get what you pay for” scenario.

If Sailthru’s limitations are causing you to seek an alternative, and budget isn’t an issue, Emarsys is likely to cover your wish list and then some.

Both Maestra and Emarsys position themselves as all-in-one hubs for marketing, but they approach it differently. Emarsys, being older and enterprise-focused, is like a sophisticated toolkit that gives you many pieces to assemble your marketing machine. Maestra is more of a fully assembled engine that emphasizes real-time adaptation.

One key difference: real-time responsiveness. Maestra’s CDP updates instantly and triggers flows in the moment (e.g., price-drop alerts), whereas Emarsys, though it has real-time components, often relies on scheduled syncs or batch updates for some data.

Maestra also bakes in loyalty and on-site personalization with an ease that might require more integration in Emarsys.

On the flip side, Emarsys offers some channels Maestra doesn’t natively (like direct mail). In terms of usability, Maestra aims to deliver enterprise power in a more user-friendly package—in other words, to give you Emarsys-like capabilities without the steep learning curve or need for large teams.

Also, Maestra’s flat pricing model (with all features included) contrasts with Emarsys’s module-based pricing (certain advanced modules might cost extra in Emarsys, whereas Maestra includes everything by default). Brands that want a unified platform with minimal add-ons often lean toward Maestra for that reason.

Finally, support: Maestra provides a dedicated CSM even for smaller clients, basically a high-touch experience that enterprise vendors usually reserve for only their biggest clients. Emarsys will certainly support you, but the level of hand-holding Maestra gives could be a differentiator, especially if you don’t have a huge in-house team.

Tool #3: Salesforce Marketing Cloud

Best Sailthru alternative for large enterprises in the Salesforce ecosystem

Salesforce Marketing Cloud (SFMC) is the 800‑pound gorilla of enterprise marketing suites. Part of the broader Salesforce family, it’s built for companies that want end‑to‑end marketing capabilities tightly integrated with their CRM and sales data.

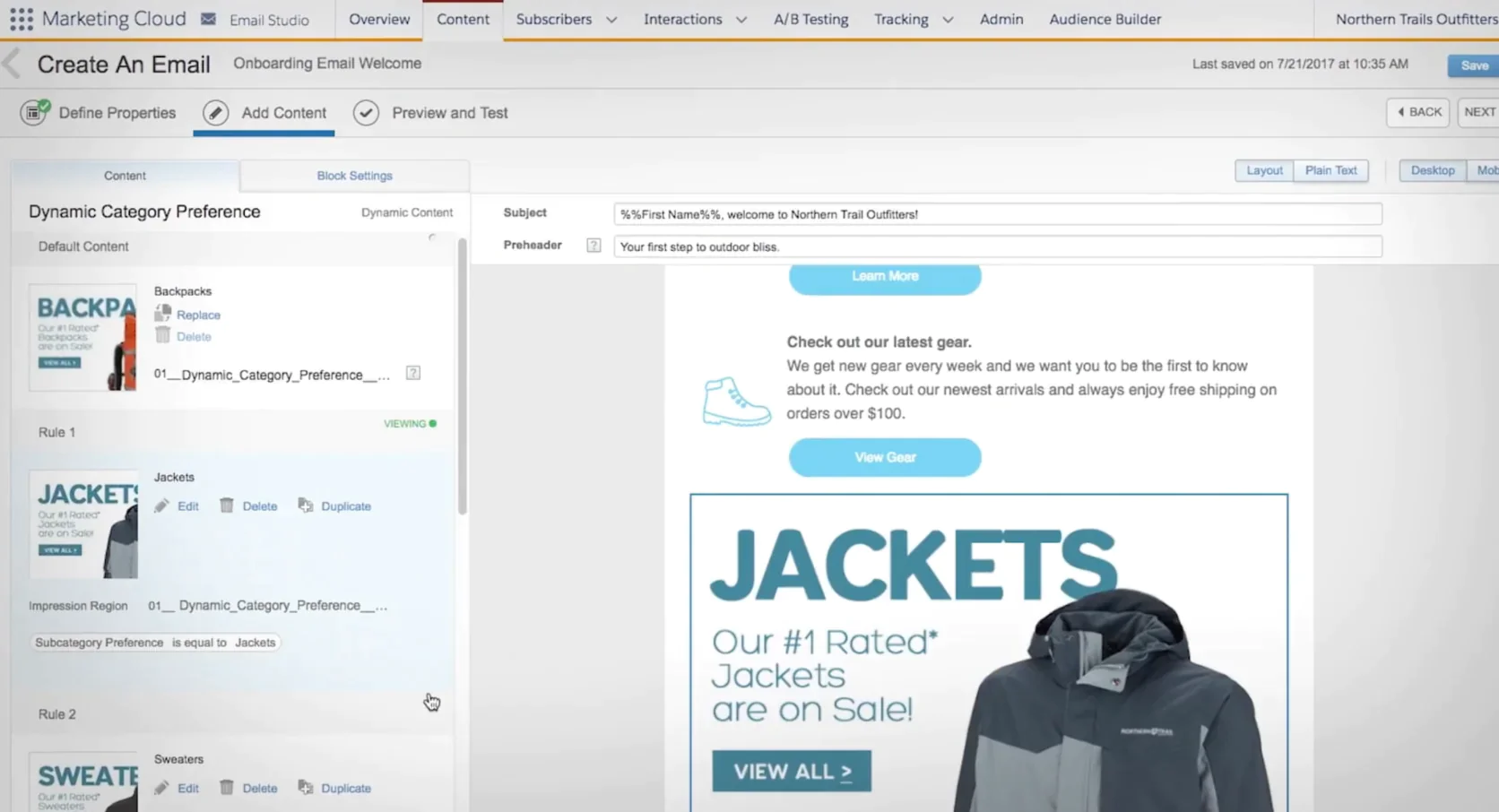

SFMC is actually a collection of specialized “Studios” and “Builders”: Email Studio, Mobile Studio, Social Studio, Journey Builder, Advertising Studio, Personalization (formerly Interaction Studio), and more.

Salesforce Marketing Cloud’s Journey Builder

Together, these cover virtually any marketing scenario—from blasting millions of emails, to managing SMS campaigns, to social media engagement, to web personalization—if you can dream it, SFMC likely has a tool for it.

Journey Builder: A powerful visual canvas where you can orchestrate complex customer journeys with branching logic, waits, triggers, and decision splits. Journey Builder can incorporate events from any connected data source. It’s extremely flexible—even allowing calls to external APIs for advanced cases.

Multi‑channel muscle: SFMC isn’t just email; Mobile Studio handles SMS and push, Advertising Studio lets you create custom ad audiences using your Salesforce data, Social Studio manages social posts and listening, and Personalization (Interaction Studio) delivers on‑site and in‑app personalization using machine learning. Having all these under one roof means your campaigns can be truly integrated.

Salesforce Marketing Cloud’s email builder

Einstein AI: Salesforce has woven its Einstein AI into Marketing Cloud for optimization. Einstein features can predict the best send time for each contact, suggest optimal subject lines, and even compute scores like likelihood to open or convert. There’s also Einstein for product recommendations and web personalization, similar to Sailthru’s predictive content but within the Salesforce universe.

Salesforce integration: As expected, SFMC ties in natively with Salesforce CRM data. You can use CRM fields (like loyalty status, total purchase value, or support ticket history) directly in your segmentation and personalization. And vice versa—marketing outcomes (email engagement, etc.) can be visible to sales reps in CRM.

Ecosystem and scale: Salesforce’s AppExchange and partner network means there are countless extensions and services available. Need a custom SMS integration or a specific analytics plugin? Likely there’s one built for SFMC. And when it comes to deliverability or compliance, Salesforce has teams and features to support enterprise requirements (IP warming, distributed marketing for franchises, heavy compliance tools for regulated industries, etc.). It’s truly enterprise‑grade.

For a retail marketing leader, SFMC’s appeal is having every tool in one mega‑platform and the ability to tap into the rich customer data from Salesforce’s CRM.

Imagine being able to use a customer’s purchase history from your e‑commerce (Salesforce Commerce Cloud) and their service interactions (Salesforce Service Cloud) directly in crafting marketing segments—SFMC offers that unified view of the customer across marketing, sales, and service touchpoints.

Many large retailers and consumer brands use SFMC for its scalability—it can reliably send enormous volumes of messages (think millions of emails or texts per day)—and for the comfort of having one vendor (Salesforce) handling all their multi‑channel needs.

SFMC’s breadth and depth are unparalleled, but all that power comes with significant complexity. SFMC is known for being dauntingly complex, especially for new users or smaller teams. The learning curve is steep—many companies end up hiring certified SFMC specialists or relying on consulting partners to manage it. The UI can feel dated or fragmented because each “Studio” is somewhat its own module with its own interface quirks.

It’s not the kind of platform where a single marketer can easily jump in and DIY everything after a week of training. If you thought Sailthru required some technical know‑how, SFMC is on another level in terms of moving parts.

Cost is another barrier. Salesforce Marketing Cloud is expensive and modular—you pay for various components (e.g., want both Email Studio and Interaction Studio? That’s more $$$). It often involves multi‑year contracts, and pricing can scale up dramatically as your contact list or message volume grows. It’s not unusual for large implementations to run into the high six or seven figures annually when all is said and done.

For context, a Sailthru customer spending, say, $200k a year might find SFMC coming in at two to three times that cost for similar volumes, once you factor in all modules and required support. Essentially, SFMC is usually justified only for very large marketing operations where that investment pays off.

Another challenge is agility. Because SFMC is so vast, making changes—like tweaking a complex journey or integrating a new data source—can be slower. Some users find that what would be a quick update in a leaner platform might involve a lot of steps or even Salesforce support involvement in SFMC.

Also, being such a huge system, there might be features you simply never touch but are still paying for. It’s the classic case of “using 20% of the platform” if your needs are actually simpler.

Support for SFMC can be hit or miss unless you have a premium support package. Salesforce does have a robust community and documentation, but direct support might refer you to their service reps or partners for complex work.

In short, SFMC is not very DIY‑friendly for small teams—it really shines when you have an entire marketing ops department or agency utilizing its full power.

Choosing between Sailthru and SFMC often comes down to scale and ecosystem. Sailthru is like a precision tool—great at what it does (especially predictive personalization in email/web) and more nimble to operate. SFMC is a massive toolset—it can do more, but it’s heavier to wield.

If a brand is already deep into Salesforce (using their CRM, commerce, etc.), SFMC can unlock synergy that Sailthru cannot. For example, a retailer on Salesforce Commerce Cloud might leverage SFMC’s direct tie‑in to web catalog data for personalization, whereas with Sailthru they’d need to pipe that data in via API.

On the other hand, Sailthru might deploy quicker and be easier for a lean team to manage, whereas SFMC could overwhelm them.

Cost‑wise, Sailthru might actually be cheaper than SFMC for equivalent volumes.

If Sailthru’s limitations are pushing you to consider SFMC, you likely have very complex needs or a mandate to integrate marketing with the rest of the company’s Salesforce data. Just be prepared for a more complex journey in exchange for those capabilities.

Maestra and SFMC are studies in contrast regarding philosophy. Maestra is about unifying essential tools in one cohesive, real‑time platform that a marketing team of any size can leverage. SFMC is about offering every possible tool, but it can feel like a bundle of separate pieces.

For instance, Maestra’s real‑time CDP vs SFMC’s multiple data extensions and periodic synchronizations—Maestra aims for immediate, seamless data use, whereas SFMC often involves scheduled data pushes between Salesforce CRM and Marketing Cloud.

In terms of use, Maestra strives to be user‑friendly despite its breadth—it hides the complexity under the hood—while SFMC unapologetically exposes a lot of complexity to the user (which can be powerful if you know what you’re doing).

A brand that might need two or three Salesforce Studios to replicate what Maestra does could find Maestra a breath of fresh air—fewer modules, more integration.

Also, Maestra includes features (like loyalty programs and advanced web personalization) by default, which in SFMC either require add‑ons or integrating another Salesforce product.

On cost, Maestra’s flat monthly fee (albeit high for SMBs) can be simpler compared to SFMC’s intricate usage‑based and module‑based pricing that can surprise you as you scale.

In summary, if SFMC is the mega‑department store of marketing tools, Maestra is like a curated boutique—it focuses on giving you exactly what a modern e‑commerce marketer needs, nothing less but also nothing overly extra, all in one cohesive interface.

Companies that lack a large ops team or just want to execute quickly often prefer Maestra’s approach over SFMC’s “big enterprise” approach.

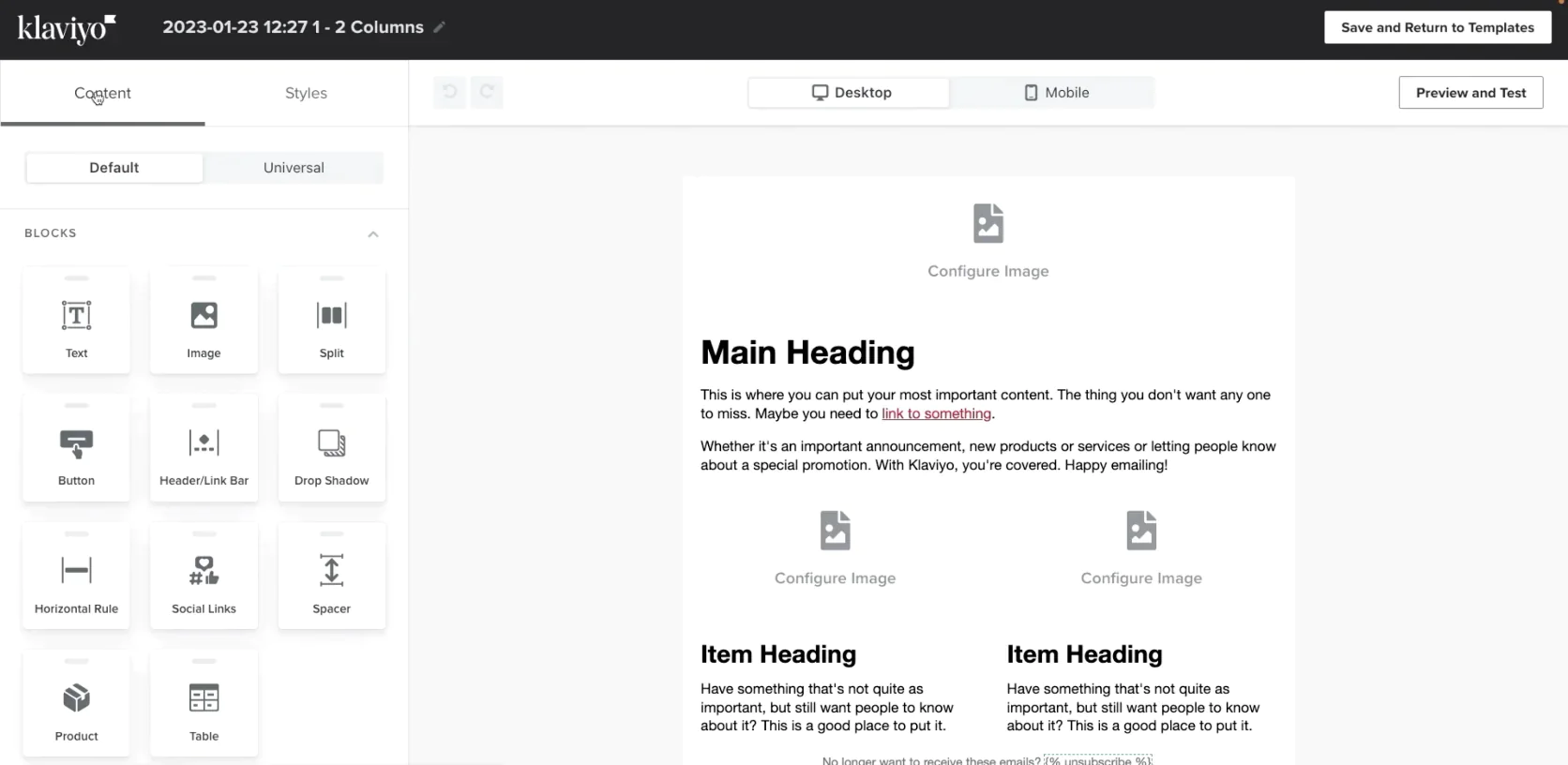

Best Sailthru alternative for SMB and DTC email & SMS marketing

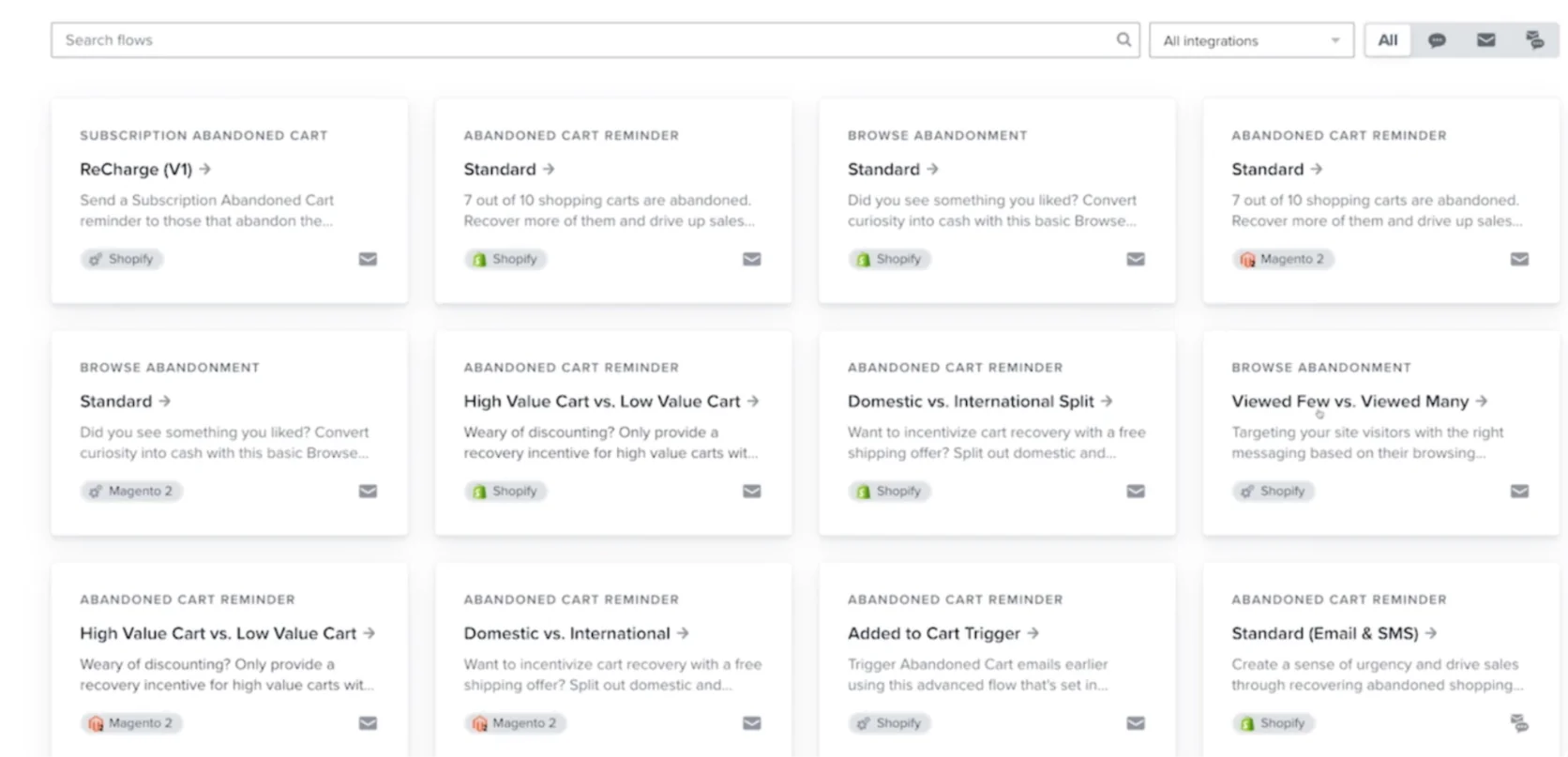

Klaviyo has established itself as the premier marketing automation platform for small and mid-sized e-commerce businesses, especially direct-to-consumer brands.

Its value proposition revolves around data-driven email and SMS marketing with strong, straightforward integrations into platforms like Shopify, WooCommerce, BigCommerce, and Magento.

Unified Customer View: Comprehensive profiles capturing website behavior, email engagement, purchase history, and custom properties.

Seamless E-commerce Integration: One-click integrations with major e-commerce platforms, automating data ingestion.

Combined Email & SMS Marketing: Integrated management of email and SMS channels, enabling combined campaigns and analytics.

Automation and Templates: Pre-built automation flows (Welcome Series, Abandoned Cart, Winback) with customizable templates.

Flexible Pricing Model: Free tier for small businesses, with scalable pricing based on contact lists and no long-term commitment.

Community and Educational Resources: Active community forums, webinars, benchmarks, and extensive marketing guides.

Klaviyo excels at delivering user-friendly yet powerful marketing tools tailored specifically for SMBs and DTC brands. Its seamless integrations with major e-commerce platforms make setup quick and effortless. Users particularly value its unified handling of email and SMS marketing, enabling consistent messaging and simplified analytics.

The platform offers a strong set of pre-built automation templates that significantly reduce setup time and complexity.

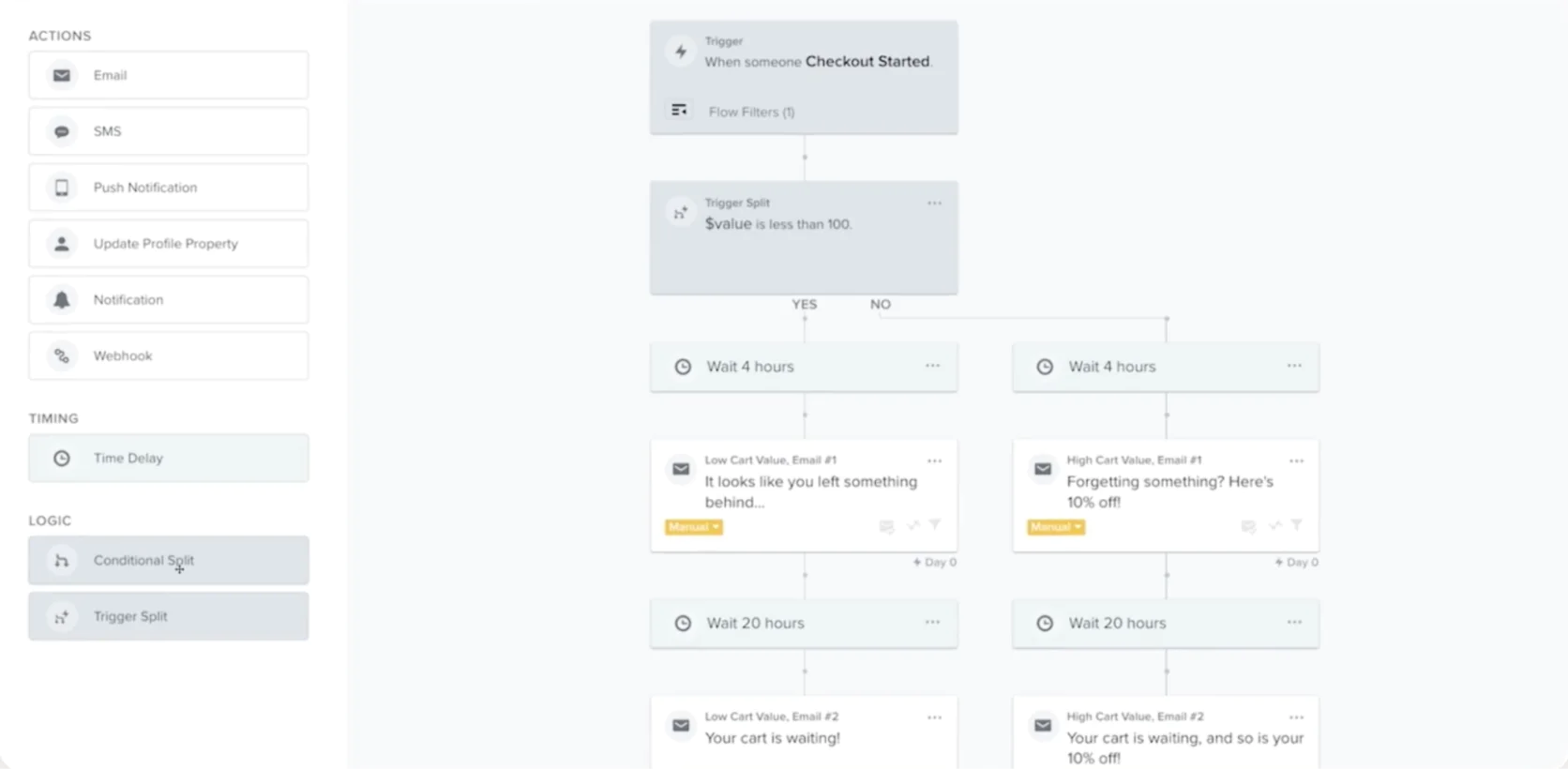

Flow templates in Klaviyo

Additionally, Klaviyo's transparent, scalable pricing structure is highly attractive to growing businesses, allowing them to adjust their plan as their customer base expands.

However, Klaviyo has limitations, especially as businesses scale. It primarily focuses on email and SMS, lacking comprehensive capabilities for broader channels like advanced site personalization, loyalty programs, direct mail, or deep AI-driven predictive personalization.

As contact volumes grow significantly, the cost of Klaviyo can increase substantially, potentially matching or exceeding enterprise-level platforms without offering equivalent advanced features.

Additionally, Klaviyo operates mostly on a self-service model. While large accounts might receive dedicated support, smaller clients might find personalized support limited and might need to rely on external agencies or community resources for strategic guidance.

Klaviyo and Sailthru often come up in conversations when a brand is at a crossroads of scaling. The fundamental difference is complexity and focus.

Sailthru is more powerful in personalization and data science—its predictive models and cross-channel personalization were pioneering. Klaviyo is more straightforward and focused specifically on e-commerce email/SMS. If Sailthru is a tailored suit, Klaviyo is a comfy t-shirt—easier to wear, but maybe not as impressive in a boardroom.

Brands will leave Sailthru for Klaviyo usually because they want something simpler or cheaper, perhaps after downsizing or refocusing on core email, or if they felt they weren’t using Sailthru’s advanced features enough to justify the cost. Conversely, a brand might leave Klaviyo for Sailthru when they outgrow what Klaviyo can do (like needing more advanced personalization or more channels).

Data integration is another factor: Sailthru can act as more of a centralized data hub with its APIs and breadth, whereas Klaviyo mostly relies on ecom platform data plus its own tracking—if you have many data sources, Sailthru might handle that better.

At the end of the day, for an SMB or even mid-market DTC brand with lean resources, Klaviyo tends to be a fan favorite because it delivers a lot of value quickly. Sailthru might be overkill for that profile. On the other hand, larger retailers with big data ambitions might hit a ceiling with Klaviyo.

Maestra offers an all-in-one solution including loyalty, on-site personalization, etc., with a high-touch support model. Klaviyo is more narrow in scope—essentially, it’s the king of email/SMS for SMBs. If we compare features, Maestra offers many things Klaviyo doesn’t (loyalty programs, on-site personalization, push notifications beyond just SMS, etc.) in a unified way.

Maestra also provides a real-time CDP which can handle more complex data unification than Klaviyo’s more basic customer profiles. For a brand that’s evolving from a simple email strategy to a full-funnel marketing strategy, Maestra could be the next step after Klaviyo, as it brings those multi-channel capabilities and advanced segmentation without needing a whole Martech stack.

Another difference is service: Klaviyo is self-serve; Maestra gives you a dedicated CSM guiding you. That can be invaluable if you’re, say, a $50M/year online brand trying to go to $100M—you may want that partnership to strategize sophisticated retention campaigns, rather than just software access.

However, for very small brands, Maestra’s cost is prohibitive, so Klaviyo remains the better choice until you reach a certain scale or complexity.

In summary, Klaviyo is excellent at what it does (email/SMS for ecom), but Maestra is there for when you need to go beyond that—incorporating loyalty, richer personalization, and a more hands-on partnership to drive growth.

Best Sailthru alternative for mobile-centric real-time engagement

Braze is designed for event-driven, personalized messaging at scale, excelling particularly in mobile engagement. It ingests event data from apps or websites (e.g., “opened app,” “added to wishlist”) and triggers real-time messaging and user segmentation based on these events.

Creating a segment in Braze

Real-time Event Processing: Immediate segmentation updates and message triggering based on user actions.

Mobile-first Channels: Robust capabilities for push notifications, in-app messaging, SMS, and emerging channels like mobile wallets and connected devices.

Developer-friendly Flexibility: Strong APIs, webhooks, and custom event tracking for sophisticated integration and messaging scenarios.

Advanced Personalization and Testing: Supports complex personalization logic, conditional content, and extensive multivariate testing.

Intuitive Interface for Power Users: Modern interface and Canvas flow builder designed to meet the needs of technically skilled marketing teams.

Braze’s standout strength lies in its speed and real-time capabilities, making it ideal for time-sensitive scenarios such as flash sales, instant re-engagement, or live events.

Its mobile channel management is deeply integrated, providing granular control over app interactions, push notification opt-ins, and real-time personalized content delivery.

Its developer-friendly design allows brands to use Braze for both marketing automation and transactional messaging, supporting robust integrations through APIs and webhooks. This flexibility extends to dynamic content integration through its Connected Content feature.

However, Braze comes with significant technical overhead, requiring considerable initial setup and ongoing developer resources. Marketers without strong technical support might struggle to fully leverage the platform's capabilities.

The cost can also become prohibitive as your active user base grows, making it an expensive option for those not fully utilizing its mobile-centric features.

Additionally, Braze lacks native e-commerce-specific modules such as built-in loyalty programs or commerce recommendation engines, requiring external integrations for these features.

While the platform provides decent support, complex implementations often necessitate professional services or third-party consultants, adding to operational complexity.

Braze and Sailthru might target similar outcomes (personalized cross-channel messaging), but they come from opposite ends. Sailthru started with email/web and added some mobile; Braze started with mobile and added email.

If you’re primarily concerned with email newsletters and on-site personalization (like many media or retail brands originally using Sailthru), Braze might feel like using a rocket ship to drive down the street. However, if you feel Sailthru is too slow in reacting to user behaviors or lacks modern mobile engagement features, Braze is a clear step up.

Also, Braze’s strength is orchestrating messaging tightly around user actions (like triggering on precise app events), whereas Sailthru often triggers on broader events (like daily syncs or batch events).

In terms of data, Sailthru has its strong predictive models and a unified profile, but Braze might be better at handling high-volume event streams (because that’s what it was built for). So a brand with a very active user base (millions of daily active users doing things) might trust Braze to handle that firehose more than Sailthru.

On the other hand, Sailthru’s out-of-the-box predictive algorithms for things like “predict the optimal send time” or “predict likelihood to purchase” were a selling point—Braze doesn’t provide that natively (you’d integrate your own or a third party).

Braze vs. Maestra can be seen as developer’s canvas vs. marketer’s canvas. Braze offers immense flexibility if you have the team and budget to utilize it fully. Maestra offers a more packaged solution—including many pieces Braze doesn’t provide natively (loyalty system, on-site personalization, predictive product recs, etc.)—with a guiding hand.

A company that has a very product-centric approach and engineering resources might prefer Braze because they can integrate it deeply and customize heavily. Companies that want a lot of capabilities out-of-the-box and less engineering dependency might lean Maestra. For instance, to achieve loyalty messaging with Braze, you’d need to integrate loyalty data yourself; with Maestra, it’s built-in and simply part of the drag-and-drop flow.

Another angle: real-time adaptation. Both handle real-time triggers well (Maestra’s real-time CDP vs. Braze’s event streaming)—in fact, that’s a core strength of both over something like Sailthru. But Maestra wraps that real-time engine into a more guided, marketer-friendly UI with strategy support, whereas Braze gives you raw power to build what you need.

If Braze is a powerful sports car engine, Maestra is the fully-loaded car with the engine plus all other components needed to drive growth, with a GPS included (the customer success guidance).

Cost-wise, they might be similar at enterprise scale, but mid-market brands might find Maestra’s pricing easier to swallow than Braze’s (Braze often pursues big enterprises or high-growth tech companies).

In summary, Braze is ideal for brands where mobile engagement is front and center and who have the means to exploit a very flexible, technical platform. If Sailthru’s primary weakness for you is lack of sophisticated mobile and real-time capabilities, Braze is a top choice.

If you also value things like built-in loyalty or a more consolidated approach, you might consider alternatives like Maestra that cover more bases with less custom work.

Best Sailthru alternative for flexible cross-channel marketing with a modern twist

Iterable is a growth marketing platform tailored for B2C companies in sectors such as retail, e-commerce, subscription services, and fintech. It manages communications across multiple channels including email, push notifications, SMS, in-app messaging, web push, and direct mail (via integrations).

Iterable’s visual email composer

Iterable distinguishes itself by combining extensive multi-channel capabilities with a modern, marketer-friendly interface and robust flexibility.

Comprehensive Multi-channel Management: Native support for email, SMS, push notifications, in-app messaging, web push, and direct mail through integrations.

Iterable: сreating push notification template

Intuitive Workflow Builder: User-friendly, visual Workflow Studio allowing complex, logic-based messaging flows without coding.

Flexible Data Model: Highly customizable data structure with support for custom events, user attributes, and product or content catalogs.

Advanced Experimentation: Built-in A/B and multivariate testing capabilities for messages and workflows, along with Send Time Optimization.

Robust Integrations: Strong ecosystem with integrations for data warehouses (e.g., Snowflake), CDPs like Segment, and audience syncing with platforms like Facebook and Google.

Mid-market Community and Support: Active community, strategy webinars, and comprehensive customer success support aimed at mid-market brands.

Strengths and Weaknesses:

Iterable excels at providing extensive multi-channel marketing capabilities with an intuitive, modern interface that appeals particularly to marketers who value flexibility and ease-of-use. Its flow builder allows non-technical users to craft sophisticated customer journeys efficiently, supported by a flexible data model ideal for unique business needs and complex segmentation.

Iterable: user segmentation

The platform’s focus on experimentation and iterative improvement through robust A/B testing and quick segmentation queries fosters a dynamic marketing approach. Iterable’s ecosystem also integrates well with other critical tools in a company’s technology stack, making it attractive to data-driven teams.

However, Iterable may not be suitable for businesses seeking an entry-level price point. Positioned primarily for mid-sized to larger companies, its pricing can escalate quickly with scale, potentially becoming cost-prohibitive for smaller businesses.

Additionally, while offering strong basic analytics, Iterable lacks built-in advanced predictive analytics and AI-driven personalization. Users requiring complex predictive insights or deep AI recommendations must rely on external integrations.

Iterable’s largely self-service nature can be challenging for teams that require extensive strategic support or hands-on assistance. Its email editing and design features, while solid, do not notably stand out compared to competitors, and creating complex dynamic content may require technical expertise.

Iterable and Sailthru share a lot of overlap in purpose—both target personalized cross-channel communication for consumer brands. However, the experience of using them differs. Sailthru excels in certain advanced personalization like complex algorithms and has a legacy of strong email performance, whereas Iterable shines in modern UI and cross-channel ease.

If a Sailthru user is frustrated with the UI or speed of executing campaigns, Iterable would feel like a refreshing upgrade—things that might have required custom work in Sailthru (like building a complicated workflow, or ingesting a new event type) can often be done faster in Iterable’s interface. Iterable is also generally perceived as “lighter weight” in a good way—not as heavy to maintain as Sailthru can be.

On the other hand, Sailthru has unique strengths like their personalized send time optimization and prediction manager which were somewhat ahead of their time; Iterable has some of that but not as deep.

Also, if a company heavily used Sailthru’s on-site personalization scripts or open-time email content tech, they’d need to replace those with other solutions when moving to Iterable (Iterable doesn’t offer a web personalization product—you’d use another tool or custom code).

Data-wise, Sailthru’s schema (lists, blast, etc.) is different from Iterable’s more free-form list and event system—some find Iterable more flexible, others might miss Sailthru’s built-in structures for certain newsletter use-cases (though Iterable can do them too).

Often, brands on Sailthru consider Iterable when they want a more modern, marketer-friendly tool that still handles sophisticated campaigns. If Sailthru’s support or UI has been lacking for them, Iterable’s high customer satisfaction and fresh interface is appealing.

It’s telling that many growing DTC brands and tech companies choose Iterable over Sailthru in recent years, citing ease of use and better support as reasons (G2 reviews frequently mention Iterable’s quality of support being high).

Iterable and Maestra could serve a similar mid-market customer, but with different philosophies.

Iterable is certainly user-friendly, but you are in charge of driving—you’ll configure segments, build your workflows, figure out how to incorporate loyalty if you have it, etc. Maestra, conversely, comes with some of those pieces integrated (loyalty, predictive recs, etc.) and offers more of a partnership model (with dedicated success managers) to help guide strategy.

Think of it this way: Iterable gives you the keys to a very capable car—you can drive anywhere, but you’re driving. Maestra offers a chauffeured experience—it gives you the car plus a bit of navigation and driving assistance to ensure you get where you need to go efficiently.

Feature-wise, Maestra includes a real-time CDP and loyalty module that Iterable doesn’t natively have. If those matter, Maestra might reduce the number of tools you need.

On channels, both cover email, SMS, push; Maestra also covers web personalization out-of-the-box, which Iterable doesn’t.

Finally, pricing: Iterable is custom-priced and usage-based, and tends to get expensive as you scale. Maestra has a flat rate that is high but includes everything. Depending on how negotiations go, one or the other could be more cost-effective.

In short, Iterable is excellent for teams that want a lot of flexibility and have the resources to operate it, but don’t want the pain of old-school enterprise systems. Maestra tries to deliver a broad solution with more guidance.

If a brand values having a full-service partner and features like built-in loyalty, they might lean Maestra. If they value having a platform to mold to their unique processes and maybe already have some loyalty or recommendation system in place, Iterable is a great choice.

Best Sailthru alternative for simplified mid-market e-commerce automation

Dotdigital (formerly Dotmailer) is a UK-based marketing automation platform popular among mid-market retail and B2B brands. It focuses on email and SMS marketing with straightforward automation capabilities and robust integrations with major e-commerce platforms such as Magento/Adobe Commerce and Shopify.

Dotdigital’s flow builder

Dotdigital offers dependable functionality without excessive complexity, catering to marketers who prefer practicality and ease of use.

User-friendly Interface: Intuitive EasyEditor drag-and-drop email builder and straightforward automation setup.

Dotdigital’s email editor

Strong E-commerce Integration: Deep, native integrations with Magento, Shopify, BigCommerce, automatically syncing customer and order data.

Basic Personalization and Automation: Customizable email content, dynamic segmentation, and automated flows for common scenarios like abandoned carts or welcome series.

Support and Account Management: Responsive customer support, especially strong in UK/EU regions, providing hands-on assistance during onboarding.

Dotdigital excels in usability and accessibility for marketers without technical backgrounds. Its clean interface and gentle learning curve allow mid-market brands to deploy effective campaigns rapidly. The robust e-commerce integrations significantly reduce setup complexity, enabling marketers to swiftly segment customers and leverage straightforward product recommendations.

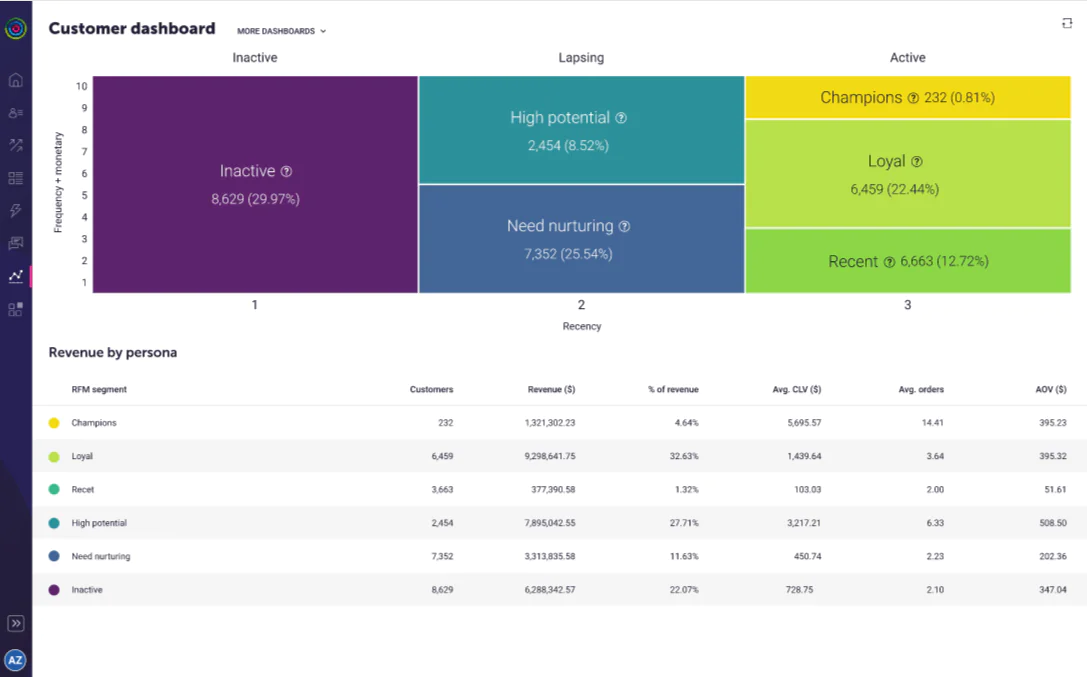

Customer dashboard in Dotdigital

Cost-effectiveness is another significant advantage, with scalable pricing suitable for mid-sized businesses. Dotdigital delivers essential marketing functionality at competitive prices without charging for unnecessary features. Customer support is often praised, especially within the UK and EU, where the company offers responsive, hands-on account management.

However, Dotdigital's simplicity means limited channel options and advanced features. It primarily supports email and SMS, with basic push and web personalization capabilities. Complex scenarios requiring extensive multi-channel strategies or advanced predictive capabilities might find the platform lacking.

Furthermore, Dotdigital is less suited for highly complex operations, especially those involving large databases or extensive integration with custom data sources. Its straightforward interface might frustrate advanced users seeking granular control or complex segmentation logic. Finally, Dotdigital's steady innovation pace and modest profile might not appeal to brands looking for cutting-edge technology or rapid feature evolution.

Dotdigital vs Sailthru is often a case of enterprise-grade vs mid-market focus. Sailthru offers more advanced personalization and a broader toolkit (e.g., predictive analytics, onsite personalization via Concierge, maybe more robust API usage)—but with that comes complexity and cost. Dotdigital offers the essentials with a simpler experience and a lower price.

One tangible difference is channels: Sailthru can handle some push notifications and maybe some more advanced channel use (and at least historically did things like onsite recommendations via scripts), whereas Dotdigital’s multichannel reach is mostly email & SMS. So a Sailthru client using those extra channels might miss them on Dotdigital.

On data, Sailthru’s strength was as a single platform for email + onsite + data, whereas Dotdigital might need help from other systems to fully replicate that.

However, many users moving from Sailthru to Dotdigital cite reasons like easier to use, better support, more budget-friendly. For example, if a company used Sailthru mainly for batch emails and some basic automation, they could accomplish that with Dotdigital with less cost and arguably less training.

In terms of capability, Sailthru still outshines Dotdigital on advanced personalization—Dotdigital can’t, for instance, automatically personalize send times based on algorithms or predict user behavior like Sailthru’s Prediction Manager could. But not every mid-market brand needs that level of sophistication, or they might not have seen ROI from it and prefer to stick to simpler segmentation.

Maestra and Dotdigital both position as “all-in-one” in a sense. Maestra bundles more advanced capabilities (CDP, loyalty, on-site personalization, AI) into its platform—making it a contender to replace multiple point solutions. Dotdigital is more narrowly focused on being a solid email/SMS automation platform that integrates with other tools you might have.

A brand might choose Dotdigital over Maestra if:

budget is a constraint (Dotdigital will generally come at a lower price point than Maestra’s ~$2k+/mo),

they don’t need things like loyalty built-in or have those handled elsewhere,

they prioritize ease and are okay with sticking to email/SMS focus.

Dotdigital can be a stepping stone for companies that may later jump to a platform like Maestra when they outgrow it.

Conversely, a brand might skip Dotdigital and go to Maestra if they want a more comprehensive solution that can grow with them without needing to bolt on other services. For example, Dotdigital doesn’t handle loyalty—if you need it, that’s another vendor to integrate, whereas Maestra would cover it.

Similarly, if real-time behavior-based personalization is a goal, Maestra’s real-time CDP is a differentiator, whereas Dotdigital might not update segments in true real-time (often more periodic or triggered by certain events but not as instant).

In essence, Dotdigital is a great Sailthru alternative for those who felt Sailthru was overly complex or costly for their needs. It’s a “reliable sedan” that improves customer engagement without the overhead. But if your ambitions are to have an all-singing, all-dancing cross-channel strategy with deep personalization, you might eventually leapfrog Dotdigital for something like Maestra or Emarsys down the line.

Best Sailthru alternative for retailers seeking specialized retention marketing

Listrak is a U.S.-based marketing automation platform with a strong specialization in the retail and e-commerce sector. It emphasizes customer retention and loyalty through personalized, cross-channel campaigns including email, SMS, behavioral web messaging, and clienteling tools for in-store experiences.

Listrak’s SMS and MMS builder

Listrak utilizes predictive analytics and machine learning specifically tailored for retail scenarios, enabling highly personalized and automated campaigns.

Retail-specific Automation: Pre-built solutions for back-in-stock alerts, price drop notifications, and replenishment reminders.

Unified Cross-channel Campaigns: Integrated management of email, SMS, web messaging, push notifications, and social retargeting.

Advanced Customer Data Management: 360-degree customer profiles with identity resolution linking email, mobile, and in-store interactions.

Predictive Analytics: Retail-focused predictive models identifying potential churn, purchase likelihood, and product recommendations.

Detailed Analytics and Benchmarks: Comprehensive retail analytics, lifetime value, cohort analysis, and industry benchmarks.

Strategic Support and Services: Dedicated strategic account management, deliverability expertise, and optional managed services.

Listrak excels through its retail specialization, providing tailored solutions out-of-the-box such as browse and cart abandonment campaigns and targeted product recommendations. Its unified cross-channel approach simplifies marketing orchestration, reducing dependency on multiple platforms. Advanced data management features ensure detailed customer insights and effective targeting.

Retail marketers particularly value Listrak’s robust analytics and benchmarks, as these directly influence strategic decision-making. The dedicated support and strategy services are another strength, offering extensive guidance and proactive assistance to marketers aiming for effective customer retention.

Listrak’s performance summary dashboard

However, Listrak faces challenges regarding interface intuitiveness and ease-of-use, with some marketers finding the platform less modern and user-friendly than competitors.

Its modular pricing structure can lead to increased costs, especially when adding new features or channels, potentially causing frustration among budget-conscious brands.

The legacy nature of the platform means certain interfaces may feel outdated or less streamlined, impacting user experience for teams accustomed to modern, highly responsive platforms. Additionally, deliverability management can be complex, especially for smaller clients reliant on shared IPs, potentially affecting email campaign performance.

Listrak and Sailthru are more similar than different in many respects—both target personalization, both have strong retail use cases, both integrate web behavior and have predictive models.

The difference often comes down to execution and partnership. Sailthru prided itself on tech (predictive intelligence, open-time personalization) and had a strong presence in media/email heavy industries. Listrak prided itself more on retail strategy and having a full suite for a retailer (covering SMS, a bit of loyalty, etc.).

So a brand might leave Sailthru for Listrak if they felt Sailthru’s roadmap for things like SMS or new channels wasn’t moving fast enough, or if they wanted closer strategic support on retention marketing. Alternatively, a Sailthru user might have been lured by Listrak’s specialization: for example, Listrak’s on-site solutions (they have pop-ups and product recommendations that Sailthru might not have offered natively in the same way after Concierge ended).

Listrak also tends to emphasize identity resolution and cross-device tracking, which if Sailthru struggled with connecting email to SMS behaviors, Listrak aims to solve that.

From a cost perspective, they’re likely comparable—both enterprise-level.

Feedback often comes that Listrak’s UI is a bit less slick but their support is better, whereas Sailthru’s tech might be a tad more advanced in specific areas but perhaps harder to use. That aligns with the idea: Sailthru, flexible but needs more work; Listrak, a bit more turnkey for retail use but maybe less flexible outside that.

Maestra and Listrak both highlight a unified platform approach with loyalty, omnichannel, etc., so there’s overlap.

A key difference might be real-time capabilities—Maestra offers real-time CDP and in-session personalization, whereas Listrak, while it has real-time triggers, might not update segments absolutely instantaneously for use mid-session (not sure if it does that level).

A brand might consider Maestra over Listrak if they want a fresh platform that combines what Listrak does with potentially easier use and one flat price. Or if they are very growth-oriented and want that “full-service partner” vibe Maestra gives (though Listrak also gives a partnership, it’s larger and maybe slightly less nimble since they have many clients).

Listrak though has proven retail chops—some might stick with it because of that track record and the depth of retail-specific know-how.

Best Sailthru alternative for small e-commerce teams on a budget

Omnisend specifically caters to smaller e-commerce businesses, offering an accessible and easy-to-use multi-channel marketing automation platform. It integrates seamlessly with platforms such as Shopify, WooCommerce, and BigCommerce, providing email, SMS, and push notification capabilities.

Omnisend’s prebuild abandoned cart automation

Omnisend simplifies omnichannel marketing by delivering essential e-commerce automation workflows with minimal setup.

Pre-built E-commerce Workflows: Ready-to-use automated campaigns for abandoned carts, welcome series, order confirmations, and more.

All-in-one Channel Integration: Unified management of email, SMS, web push notifications, WhatsApp, and Google Ads audiences.

Easy Drag-and-drop Builders: User-friendly email and form builders optimized for e-commerce-specific content and product recommendations.

Affordable Pricing and Generous Free Tier: Comprehensive free plan for small-scale usage, with affordable upgrades starting from approximately $16/month.

High Deliverability and Guidance: Robust deliverability management and extensive best practice resources tailored specifically to e-commerce marketers.

Strengths and Weaknesses:

Omnisend excels by focusing clearly on the needs of smaller e-commerce teams, providing immediate value through pre-built workflows and straightforward setup. Its ability to handle email, SMS, and push notifications from one central platform allows small businesses to manage multi-channel marketing effectively without significant investment.

Omnisend’s segment builder

Affordability is another major advantage. Omnisend's generous free plan and low-cost paid tiers make sophisticated marketing automation accessible even to micro-businesses, accompanied by reliable, responsive support.

The platform also prioritizes high deliverability rates, providing practical resources and guidance that help translate marketing campaigns into actual sales.

On the downside, Omnisend is less suitable for businesses with complex segmentation requirements or those needing advanced personalization. Its product recommendations and analytics capabilities, while effective, remain relatively basic compared to larger enterprise-focused platforms.

Primarily designed for digital commerce, Omnisend might not meet the needs of companies outside of retail e-commerce, such as B2B firms or mobile app-centric services.

Furthermore, while Omnisend can technically scale, very large enterprises with extensive requirements may find its feature set and analytics too limited for sophisticated marketing operations.

Finally, while convenient, Omnisend’s SMS capabilities are limited in scope and may become costly at higher volumes or for extensive conversational interactions, potentially requiring supplementary platforms for advanced SMS management.

Omnisend is not a one-to-one replacement for Sailthru feature-for-feature. Instead, it’s an alternative for a specific segment of Sailthru’s audience—namely, smaller e-commerce focused teams that find Sailthru too complex or pricey. These users might realize, “We’re only really using Sailthru for email blasts and a cart workflow; we can do that in Omnisend much more cheaply and easily.”

The trade-off is losing the higher-end capabilities (Sailthru’s predictive analytics, for instance, or its more robust APIs if you were using those). But not all businesses fully leverage those.

In summary, Omnisend vs Sailthru is simplicity/cost vs sophistication. If Sailthru’s big guns are more than you need, Omnisend lets you right-size your marketing automation. It’s especially compelling if you’re on Shopify or similar, since Omnisend is tailored for that ecosystem.

Maestra is aiming at rapidly scaling and midmarket brands with a full suite including loyalty, advanced CDP, etc., and a higher-touch model. Omnisend aims at small business with a do-it-yourself model.

If we think of growth trajectory: a company might start on Mailchimp, upgrade to Omnisend as they need multi-channel automation, then if they really scale and need more power, they might graduate to a Maestra or Emarsys. They address different life stages.

Maestra and Omnisend both say “omnichannel for e-commerce”, but Maestra includes things like built-in loyalty and uses AI more. Omnisend provides the basics extremely well.

One can also mention that Omnisend’s highest tier still doesn’t reach Maestra’s entry price. For companies where $2k/month is nothing, they might skip Omnisend. But for those where that’s a lot, Omnisend is a godsend (pun intended).

Here’s how the competition stacks up in key areas:

Ease of Use and Onboarding: Tools like Omnisend and Dotdigital stand out for their intuitive interfaces and quick setup, making them great for small teams to start fast. However, they may lack depth as needs grow. Maestra manages to be user-friendly and feature-rich—delivering simplicity without ceiling.

Advanced Personalization & AI: Emarsys and Salesforce Marketing Cloud offer robust AI-driven personalization and analytics for enterprises. Bloomreach (Exponea) similarly focuses on AI personalization at scale. These are powerful but often complex solutions. Maestra brings comparable AI personalization—from product recommendations to churn likelihood—in a turnkey package that mid-market teams can actually use without a data science PhD.

Mobile-Centric Engagement: Braze (and to an extent, Iterable) excel at real-time mobile and in-app messaging for app-driven brands. They’re developer-friendly and great for granular control—but can be overwhelming. Maestra incorporates mobile push and SMS alongside email and web, ensuring mobile customers get a seamless experience. You get Braze-like outcomes (e.g., instant push after a key action) with a fraction of the effort.

Retail and E-commerce Focus: Listrak and Klaviyo are tailored to retail—Listrak for larger omnichannel retailers with predictive retail models, and Klaviyo for SMB D2C brands with its Shopify integrations. Maestra combines the best of both: sophisticated retail marketing features (loyalty, product catalogs, segmentation by purchase behavior) delivered in a scalable way like Klaviyo (plug-and-play integrations, ease of use). Whether you’re a fast-growing D2C or an established retailer, Maestra adapts.

Pricing and Accessibility: Omnisend and Klaviyo offer free or low-cost entry points, making advanced marketing accessible to smaller businesses. They’re fantastic until a certain growth point when costs climb and capabilities plateau. Maestra’s flat pricing model might seem higher at entry, but it unlocks all capabilities from the start—and often ends up cheaper than patching together several “cheaper” tools as you scale. Plus, the value of having everything integrated (and supported by a team) yields growth that far outweighs the subscription fee.

Developer Flexibility vs Full-Service: Iterable and Cordial commend how quickly non-technical marketers can adopt their platforms, and they offer flexibility to those with technical chops. They give teams the keys to drive themselves. Maestra, however, provides a full-service partnership—it’s the difference between renting a car and having a chauffeur. If you have the resources and want total control, Iterable is great; if you prefer to have an expert co-pilot and a smoother ride, Maestra delivers that white-glove experience.

With Maestra, you’re not just getting a tool—you’re gaining a full-service partner. Its real-time Customer Data Platform powers hyper-personalized marketing flows and loyalty programs that are nearly impossible to replicate with a patchwork of single-purpose platforms. Whether you’re scaling up or aiming to refine your current strategies, Maestra is built to grow with your brand.

Choosing the right platform can truly transform your customer experience and drive long-term growth. Don’t settle for “good enough” when you can have the best. Sailthru showed what’s possible with data-driven marketing; Maestra takes it to the next level—minus the headaches.

Start with Maestra—book a demo today and see how it can revolutionize your business. Smarter customer engagement, higher retention, and unified marketing excellence are all within reach, with Maestra as your partner in success.