Tom Tailor: How to Encourage Offline Customers to Buy Online

Tom Tailor: How to Encourage Offline Customers to Buy Online

Challenges

Convert offline customers into online shoppers

Boost revenue shares through direct marketing

Boost revenue shares through direct marketing

Solutions

Launching an omnichannel loyalty programAdding item returns, reservations, and try-on options in-store and launching other steps to encourage customers who buy offline to buy online insteadLaunching targeted and behavior-based trigger campaigns for both online and offline customers

Results

Revenue generated by identified customers from campaigns reached 8.93% of the total revenue from online and offline sourcesRevenue from triggered campaigns increased threefold (based on last-click attribution)54 new triggers

Integrated with:

CRM and Cash Desk, website

While supporting its long-running and well-established retail chain, Tom Tailor continues to develop its e-commerce marketplace. The brand’s goals are to increase its share of online sales in total revenue and improve the omnichannel customer experience. Encouraging offline customers to buy online instead of offline is an effective way to achieve these goals. Elena Lozhkina from Tom Tailor, and Yulia Somova-Goltsvirt from Kokoc Group’s Profitator Agency have shared their experience regarding:

- Why offline and online customer bases should be combined and how the omnichannel loyalty program plays a part.

- Why the 54 or even 100 triggers introduced don’t feel like spam.

- What would be more attractive to customers than discounts with insights from our hypothesis testing.

- When offline customers will be ready to switch over to online, if at all possible.

- What issues retail customers have that may stop them from buying online.

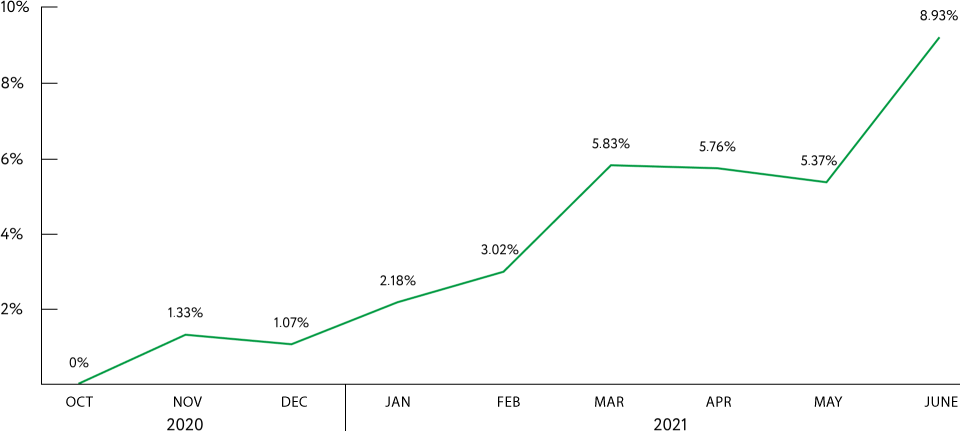

Results of Marketing Automation and the Omnichannel Loyalty Program

Revenue from campaigns attributed to identified sales vs. the total revenue of the online store and the retail chain.

Data from the summary report generated on the campagins launched with Maestra.

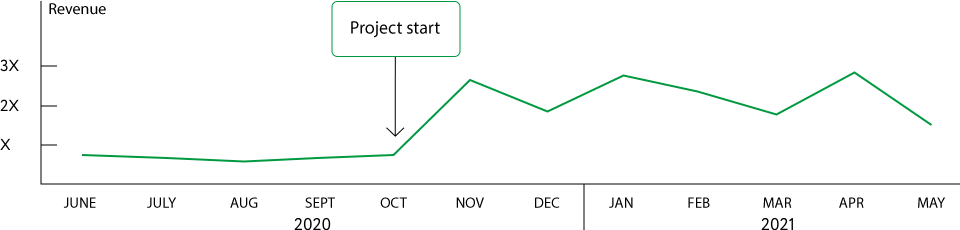

Revenue from tailor-made trigger workflows:

Data from Google Analytics (last click attribution)

-

54triggers were activated

-

8.93%was the maximum share of revenue from direct communications (attributed to identified sales) compared to the total 9-month revenue

-

3times more revenue from last-click trigger campaigns

Why Maestra? Our online store and brick-and-mortar stores have always operated separately. We have always had a problem when trying to combine the online and offline sides of the business. Combining the two sides was impossible with our last CRM contractor, resulting in each side operating separately. The main focus behind choosing Maestra was the chance to combine customer bases and build a shared communications network through both channels. This year, our main task was to encourage offline customers to buy online. Maestra enabled us to follow online and offline customers’ actions and their journeys

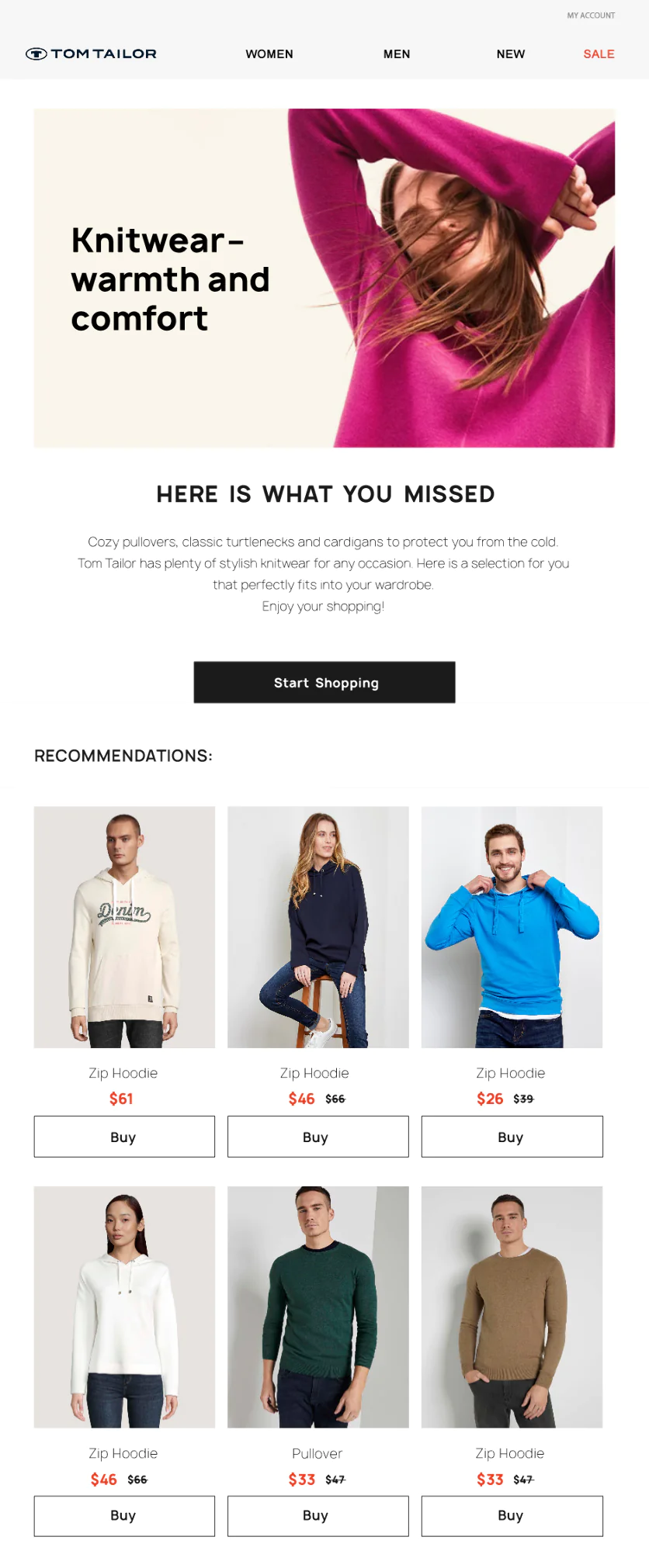

Email Channel Modernization. We have changed the visual template of our campaigns a lot and are more than happy with everything currently related to our communications. With the last mailing system, we had template issues as well as limited capabilities. Generally, it was a stand-alone tool with limited features that were incapable of giving an overall view of data from both channels. However with Maestra, we can now view online and offline purchases as well as break down and evaluate the details to see who our customers are and what they prefer. For this reason, we are now getting clearer and deeper insights that we can be happy with

Challenges. It has taken a lot of hard work to merge the two customer bases. It is difficult for me to name the exact reasons for the challenges we faced. For example, the database cleansing process took us quite a while before we could proceed with joining the two bases. From time to time we still come across some details that were somehow missed by the platform. I cannot be sure where exactly the problem lies, whether it be with the platform or with our system. However, such problems have happened far less over the past 6 months.

Although the Maestra manager we work with isn’t as accessible as our own full-time employee, we are happy with the level of communication, leadership and personal approach we receive. However, we have been short-handed and would have appreciated 40% more of his time during the initial 3 to 4 months since the project’s inception. It would have considerably boosted the launch’s success.

We agree that the first 3 to 4 months are always the most important. During this period, a select manager studies our customer’s technology stack. Usually we need 3 to 5 days to prepare the terms of reference (ToR) along with all the planned campaigns. After that, the client’s development team will get involved. However, the teams have limited resources so they are not always able to add a large number of unique details and planned workflows quickly in the beginning. To facilitate a launch we recommend:

— Highlighting project priorities and breaking up the integration into various steps. After at least one milestone or a part of ToR has been completed, the project can bring value. At the same time, the team should prepare to activate new campaigns and train for future integrations.

— Before the project is launched, the company’s IT department and/or service vendor (s) should study sample ToRs and prepare for integration. This way, the team can resolve or be ready for most of the potential issues at introductory meetings.

— Syncing timeframes with the integration team to understand and plan when the project can be started. It is very important to carefully monitor internal task queues as well as the development sprints, especially since desynchronization in the first stage can shift or change the timing of the entire launch.

Supporting the Decision to Automate Marketing

Problem

Solution

Brick-and-mortar stores and the online store operated separately. Because the marketing activities and metrics were different, it was too complicated to combine the two channels. Therefore, no single approach to customers could be applied.

To align online and offline databases with the marketing automation platform, offer a single management tool for both and create reports for all the commands in only one window.

Online and offline promotions had their own unique rules, making promotion combinations and terms difficult to understand.

To launch a loyalty program that tracks online and offline behavior of customers and syncs promotions for both.

Revenue growth had slowed because there was no process to test new ideas and launch marketing campaigns.

To use the platform to launch and test new ideas and boost revenues from new marketing campaigns.

In general, we are happier with Maestra. We are able to collect much more data on customers and their actions and launch more automated campaigns rather than worry in that something may go wrong. We are now able to run A/B tests to test our campaigns.

We are happy the platform has now introduced workflows based on triggered events. However, we would like to have a simple analytical tool in order to investigate campaigns in each communication sequence. We need to understand how our campaigns work as a whole at every stage, as in where and at what point we lead a customer, why they have bought certain items, etc.

Maestra’s drawback is that they have a pretty weak Business Intelligence (BI) module. We decided not to wait for Maestra to improve it and took on the analytics ourselves instead. We decided to get the raw data from the Maestra data warehouse and then load the results into Microsoft PowerBI.

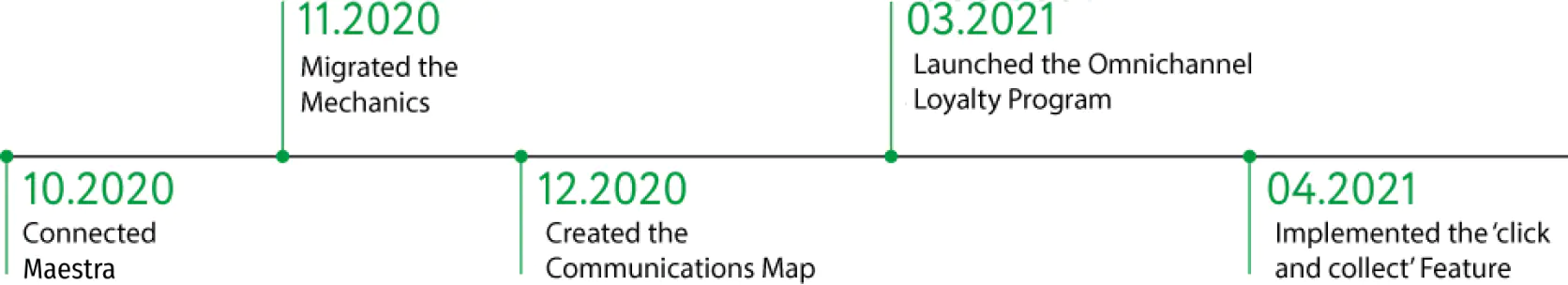

Implementing the Platform

It took 8 months to implement the platform, and launch the online and offline loyalty programs, triggers and new campaigns. All the integrations were performed in parallel so that Tom Tailor could use the platform features as soon as possible without slowing down business.

Specifics Considered During Integration:

Customers’ bonus points and statuses had to be transferred from the current loyalty program. Tom Tailor’s current loyalty program used to run on a legacy system. To retain the bonus points and statuses, the team integrated the customers’ personal accounts along with POS and website data. It took a few weeks to prepare for this data transfer, and the team worked on it at night to make sure operations still ran smoothly during the day.

Independent promotions for the online and retail channels. Items and discounts can be different in the online and offline channels. The loyalty program had to account for these differences as well as about 50 promotions that had already been running against the recently made rules. The new loyalty program was aligned to cover those promotions so they were ready at launch.

Click-and-collect orders with segmented items within a single payment. With the click-and-collect model, a customer can order online and pay at a brick-and-mortar store. By default, the platform recorded orders like this as online ones attributed to the point of order placement. If a customer bought extra items at the “collect” store, their online promotion would not be applied to these extra items. This was seen as a problem. So a special feature was developed to separate items in the receipt. It would apply online promotions to an original order and then apply offline promotions to the cross-sale items. The platform now marks items like this specifically to ensure that BI gets the correct information by points of sale and promotions.

Omnichannel features for customers. Maestra is the master database for contacts and bonus points. However, it stores only bonus points for retail customers, whereas contact details are stored by the website. For this reason the online and offline bases could have different details for the same customer. To fix this issue, a feature was added. If a customer changes their data at a brick-and-mortar store, once online, they get a pop-up message asking them if they’d like to update their data on the website as well.

Testing. There were extra subcontractors to combine the online and offline databases together. The results needed control and testing, which again was an additional workload for the team.

The Maestra team is very enthusiastic about platform development. They are always ready to consider client requests, even irregular ones coming from client specifics. Many clients are unwilling to change their business processes to fit a CRM module. Instead, they expect the vendor to adjust their CRM module requirements or add features, just as it was in our experience.

For example, the retail chain and the online store keep their own books for warehouse inventory. Accordingly, the two channels might have different items in stock and different discounts. To fix this, Maestra implemented an additional feature to track what the store sold or cross-sold to the customer as well as any items they may have decided not to buy.

The team was able to integrate everything we planned. Whenever new demands come up, new integrations are put in place. For example, the POS had to be adjusted to support filling in of missing emails for long-standing retail customers. Tom Tailor and Maestra’s teams worked hard together to debug and test the necessary features.

We never stop working with the customer — we keep engaging our customers and implementing additional capabilities. Specifically, we are now adjusting the feature that encourages customers to type in feedback for their current brick-and-mortar store on a global map application, such as Google Maps.

Activating the Triggers

-

1campaign per customer every 2 days is the highest possible limit for automated campaigns to ensure communication doesn't feel like spam

Custom trigger workflows were used to automate communications with customers and plan as many engagement scenarios as needed. The first task was to automate communication with clients and create workflows that foster the highest level of interaction possible — automated campaigns helped with this. In total, 54 trigger-based campaigns were activated, with a plan of activating 100 by the end of 2021.

A marketer works on fitting the workflow logic into the communication map and then sets it up in the platform. Priorities help avoid spamming customers, while at the same time supporting a large pool of different triggers. So, if an abandoned cart sequence is enabled, the other triggers will then be disabled. As another example, customers that are in the process of ordering or with a recent history of purchasing will not receive promotions. This rule, however, does not apply to transactional and service messages.

Our main rule is this: if a campaign requires a lot of work and requires the efforts of a designer, copywriter, etc. or needs more idea elaboration, we send it manually first. If it turns out to be effective and we see its results, we then automate it. This helps us ensure campaigns are profitable while helping save resources on creating manual campaigns.

Let’s take a closer look at our most noteworthy campaigns:

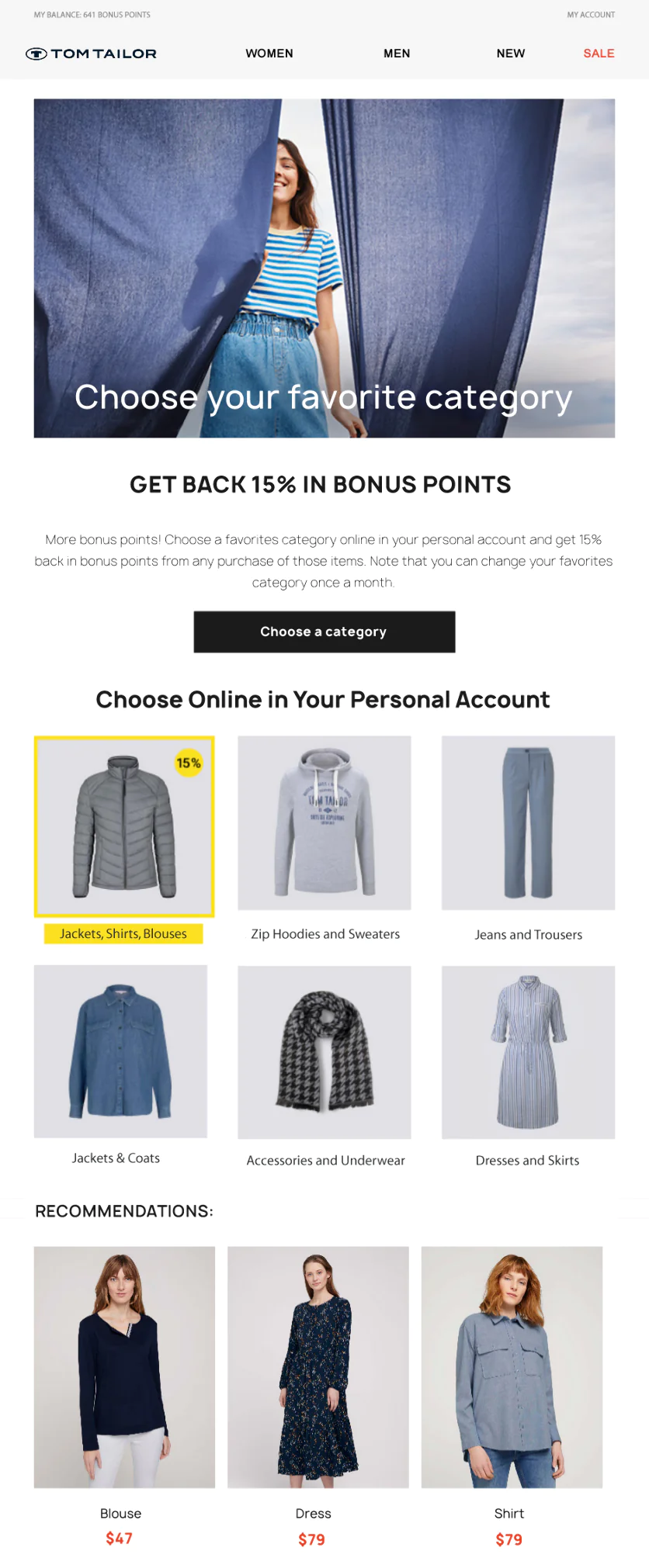

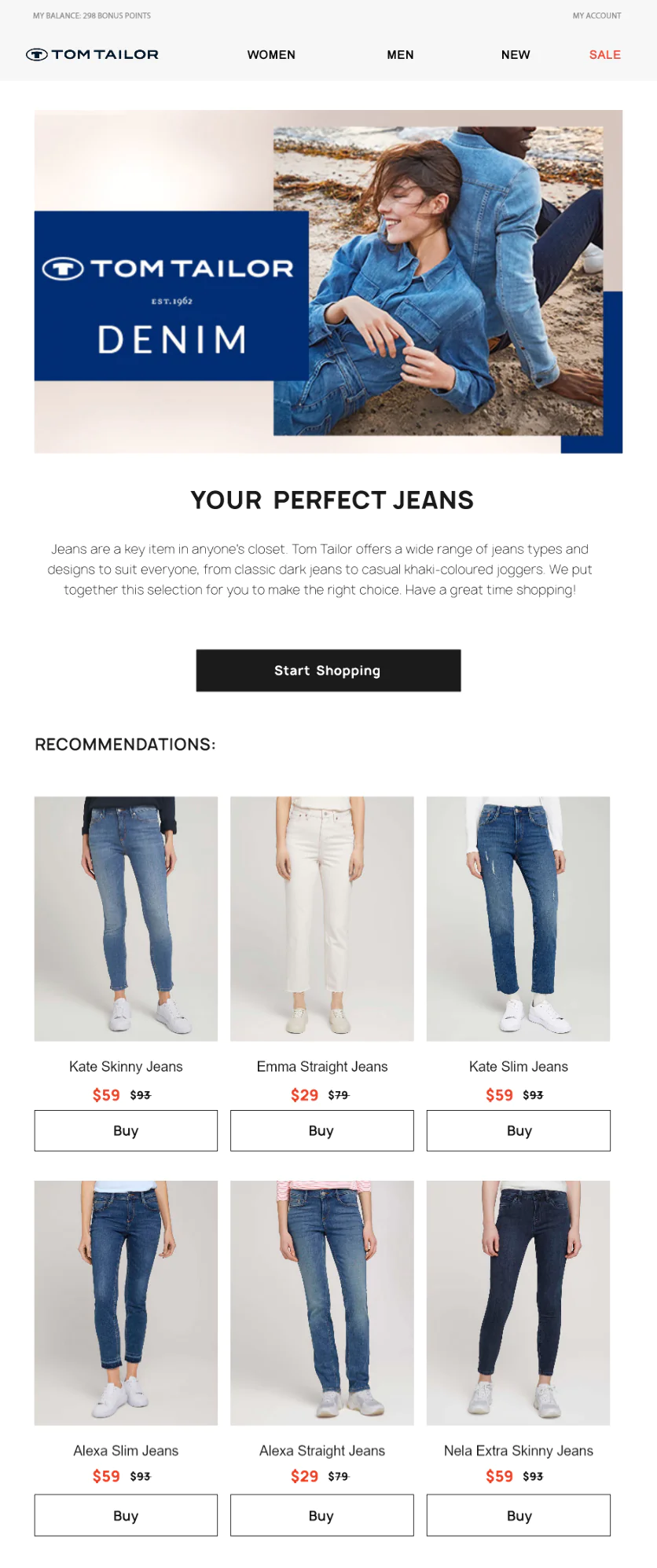

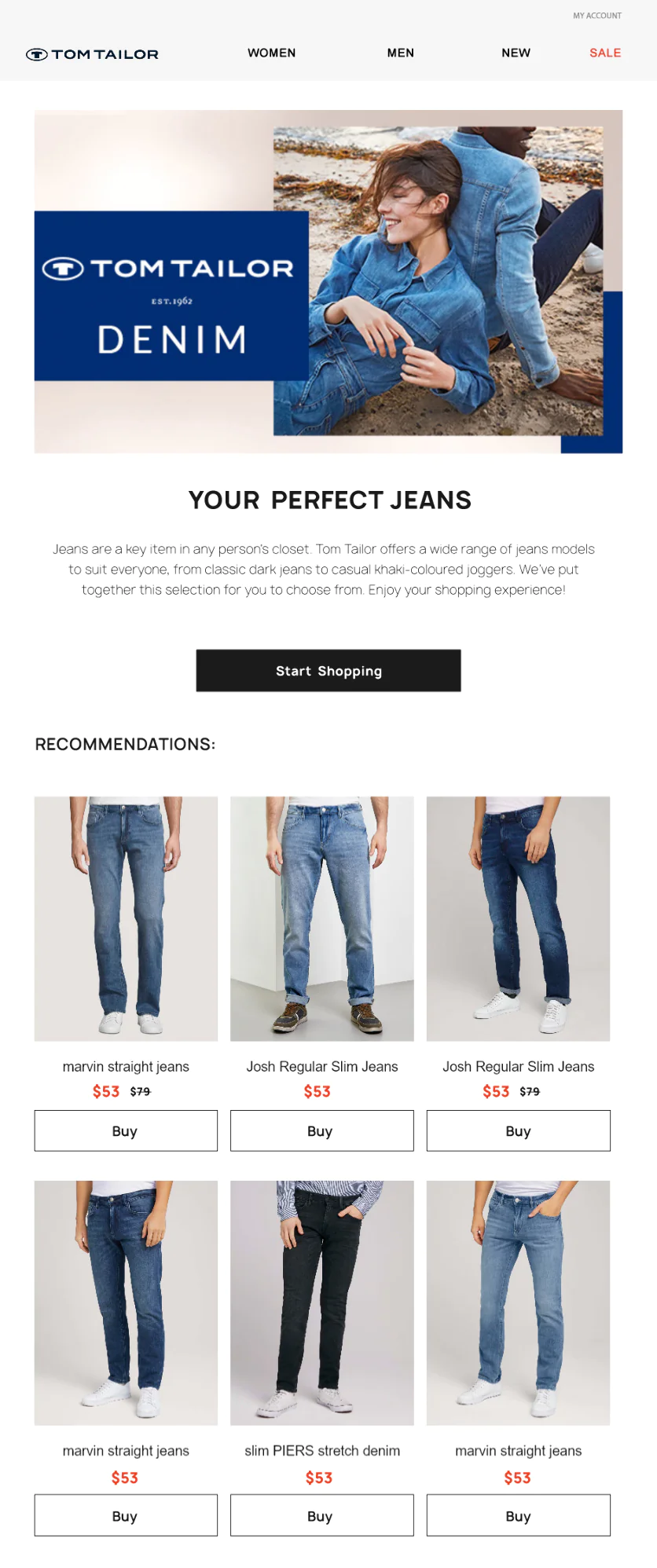

Seasonal campaigns make selections based on the weather, winter or summer categories, or a favorite category. Today, campaigns like this address narrower product categories such as textiles, denim, outerwear or accessories. Next, we plan to cover all categories to boost revenue across the board from these types of campaigns.

An automated workflow will generate any seasonal campaigns with catalog items and send emails when scheduled or when an event occurs

Seasonal campaigns are segmented by gender. The loyalty program collects data and awards bonus points for filling in data sheets. Customers can spend points both online and offline

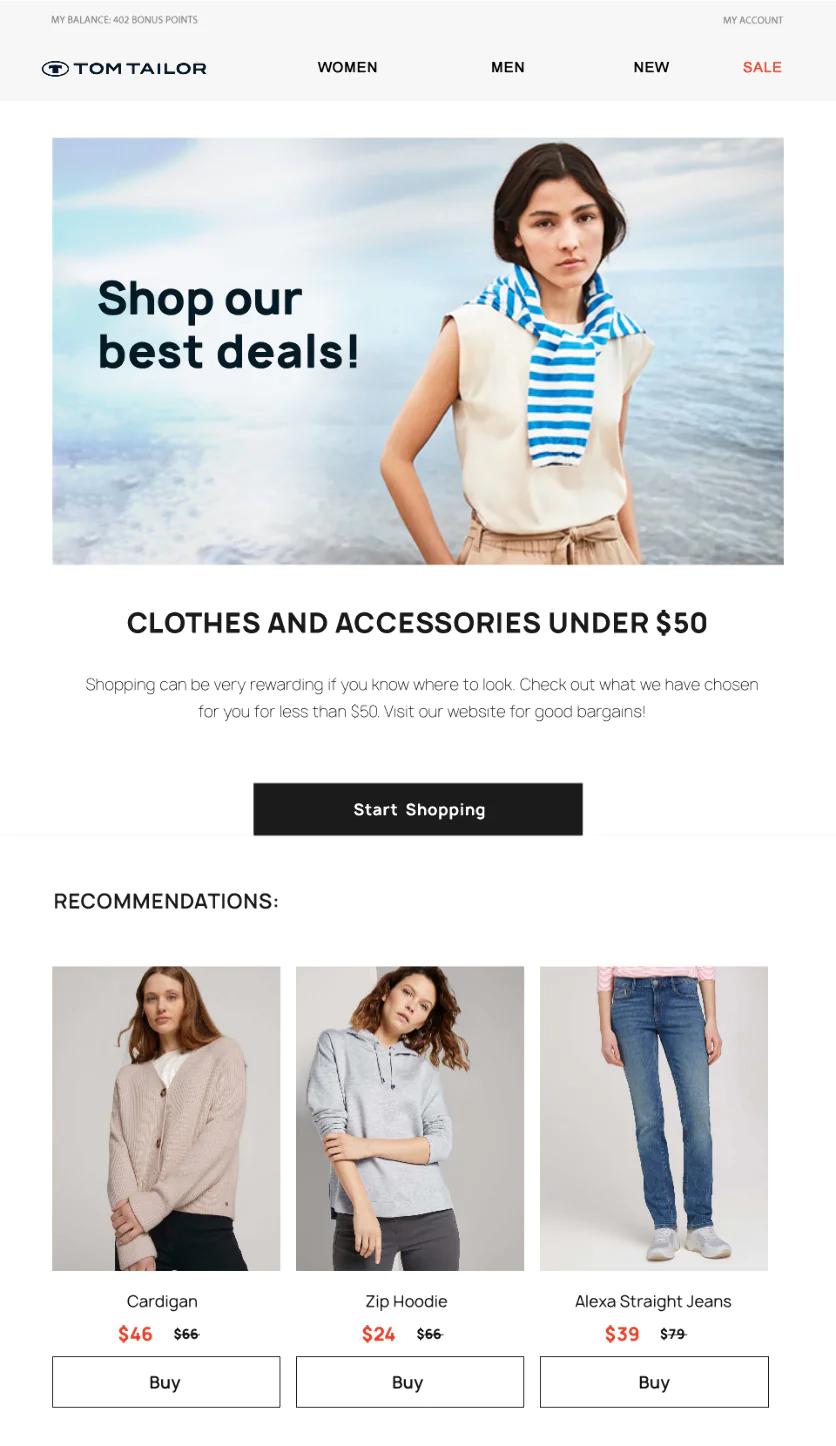

Cost-Based Selections. At Tom Tailor, the average order value is $50. To develop the most suitable offer for customers, cost-based selections were created and then split into two categories: items that cost up to $30 and items that cost up to $50. Interestingly, the order conversion rate for both campaigns proved to be twice as high as that of promotional campaigns. This method of categorization saves resources that may have been spent on discounts and, in turn, keeps profits high.

The marketer can initiate an automatic selection that takes into account gender specifications and price of goods. For example, a selection can be made for items close to the average order value, without cheaper accessories or items below the average order value. These types of campaigns will reactivate inactive customers, while active ones or those with much higher or lower order values will not get these types of messages.

Cost-based selections help reactivate inactive customers and avoid issuing unnecessary discounts. Cost-based campaigns have double the conversion rate of promotional campaigns with discounts

-

×6six times higher conversion rate for orders from loyalty level upgrade campaigns compared to abandoned cart campaigns

Leveling Up in the Loyalty Program. A customer receives a message letting them know how much they need to spend on their next order to upgrade their level in the loyalty program and invites them to make a purchase. These emails proved to bring the highest revenue per email (RPE). It’s also worth mentioning here that the conversion rate outscored that of the abandoned cart, which had previously shown the best conversion rate.

The loyalty program upgrades a customer’s status based on the total value of their purchases. A message that informs the customer of the amount left until the next level is a good tactic to increase the customer’s desire to place an order

If you test lots of different strategies, you might get surprising results. Our loyalty level upgrade campaigns are a good example of this. In order to send fewer communications but still get more revenue, we estimated the RPE (revenue per email) and the ratio between the number of campaigns and the customer base.

Triggers have become a sensitive topic for us. Before migrating to Maestra, there were eight triggers for the online stores and five for the retail stores. Now there are 54 of them that generate significant revenue. Recently, we had a technical issue where our triggers failed and stopped working. Within days the number of orders fell by almost a third.

Testing Hypotheses

To determine the most effective types of communications and maximize customer engagement, we test our hypotheses with A/B testing.

-

Bonus points are better than discounts:×4conversion rate for orders

Recovering an abandoned cart: bonus points vs. discounts

We launched a trigger-based email sequence for abandoned carts. The first message would remind the customer of the items they added to their cart and the second one would offer bonus points or a discount, encouraging customers to complete the orders they had previously abandoned. We split the discounts vs bonus points tests between two groups to better understand exactly which feature works best. Group A was offered 500 bonus points and group B was offered a 5 percent discount. The reliability rate of the test was 95 percent, according to last click attribution.

-

×1.3higher click rate

The test results showed higher conversion and click rates for the bonus points compared to the discount. This was a surprising outcome, since the bonus points can only cover up to 50 percent of an order. Applying the discount to a regular priced purchase/cart is actually more cost-efficient for the customer.

Relevant Item Selections vs Selections Covered by Bonus Points

Next we tested what encourages customers to spend their bonus points on their next purchase. For this, we compared 2 types of emails:

- Email A: A message with the amount of earned bonus points and a CTA to buy items selected using the customer’s preferences.

- Email B: Only items which did not cost more than the amount of bonus points that that the customer had collected.

The reliability of the test was 95 percent, based on last click attribution.

The test revealed that personalization with a thoughtful approach towards our customers works the best. Group B showed higher click rates and a 7 times higher revenue boost.

To understand what kinds of messages are more engaging, we compared personalized selections of relevant items with those covered by bonus points. Surprisingly, the selections covered by bonus points were more effective

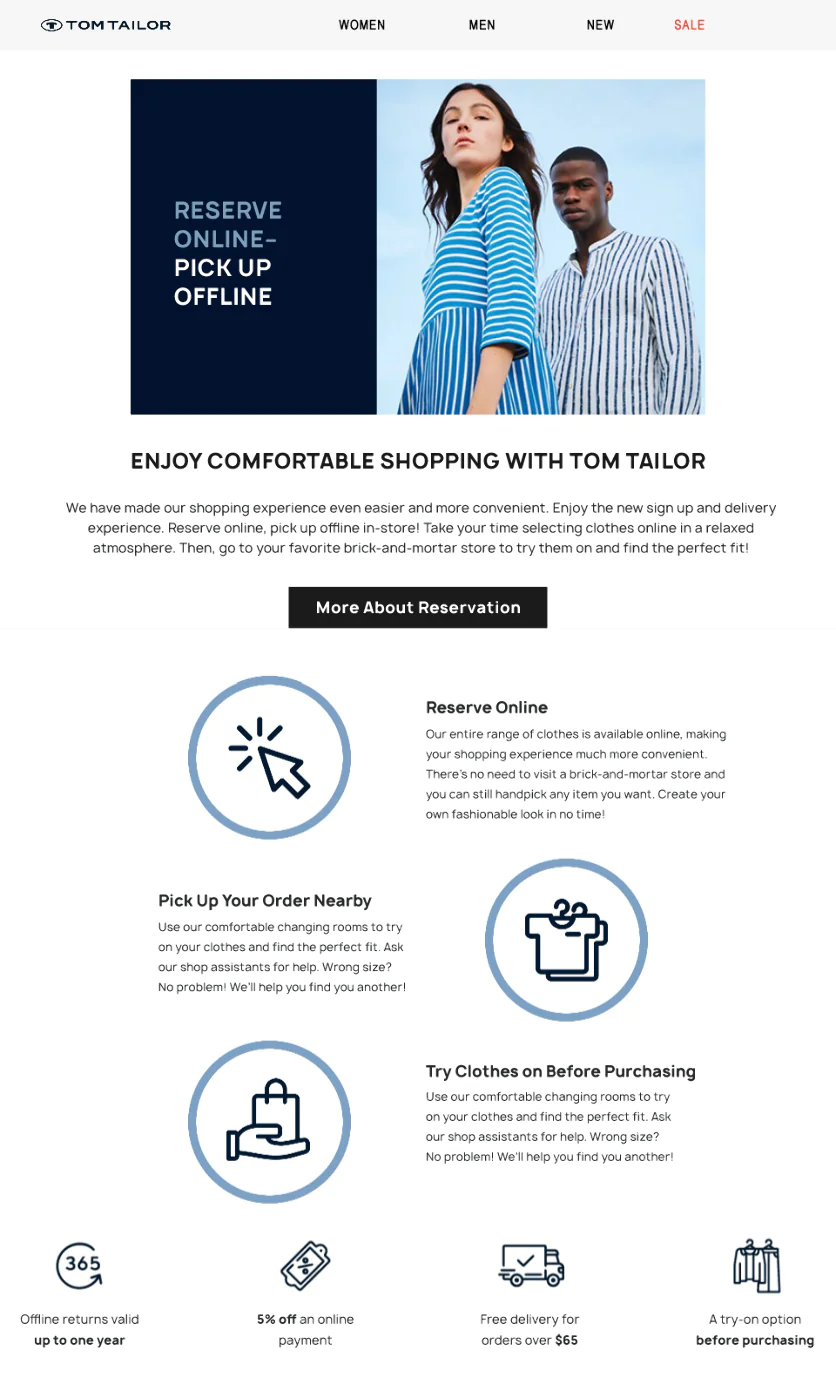

Addressing Customer Concerns for Offline to Online Migration

Once we had the capability to conjoin the online and offline customer bases and track customers’ actions in both channels, we were able to learn more about the behaviors of retail customers. It helped us to understand the reasons why customers chose not to buy online, namely:

- 80 percent were afraid of choosing the wrong size and having to deal with returns

- 50 percent were not aware of the try-on option for online stores

- 30 percent had never shopped online because they could not return items offline

We addressed each concern respectively. We have added order returns to brick-and-mortar stores and a free shipping option for some loyal customers. We then extended the return period to 365 days. Finally, we informed customers of the try-on option for our online stores. We also launched targeted advertising for offline customers to tell them about the aforementioned advantages.

Developing the Omnichannel Customer Experience

Maestra Product

Loyalty Program

Originally only a small marketplace, Tom Tailor’s online store has set a goal for major growth. A small online store usually has a tight budget, which limits their resources in attracting customers with higher order amounts. Therefore, we decided to boost our revenues by developing omnichannel features such as taking a base of customers who have made purchases in retail stores, have bonuses and are loyal to the brand, and encouraging them to buy in the online store. Our target for this year and next is to turn as many offline customers as possible into online ones. This means that we could offer two sales channels for customers to choose from, depending upon which was more convenient.

We set a goal of doubling the share of omnichannel customers. To achieve that, we first analyzed the database. We took customer segments with an active email subscription, estimated how many of them are customers with omnichannel orders, and analyzed the actions of those who buy only offline. We learned that customers do read our messages but still prefer brick-and-mortar stores. To try changing their minds, we developed and tested a few promotions:

A 50% discount on the first order as a motivator.

We chose a sample of retail customers who had visited our website and sent them messages offering a 50% discount on their first online order. We then compared those results with a control group.

The total amount of orders placed was 73, with 62 of them being online and 11 of them offline purchases. The conversion rate of this campaign amounted to 0.4%. We realized that converting customers from offline to online buyers was possible, but some customers would always prefer to buy offline, no matter the discount offered to them.

A 50% discount promotion to attract retail customers to buy online

For over a year, we have been trying to engage offline retail customers to encourage them to buy online. What’s noteworthy is that there is a 0.4–0.5% conversion rate with retail customers in various communication channels, including SMS, whereas the SMS conversion with online customers is always over 1%. This shows us that most offline customers are not eager to buy, which makes it more difficult to influence and engage them.

As another example, since early May, we have been handing out flyers with the 50% online order discount at our offline stores and estimating its potential value. In the end, we found that there were two challenges that needed to be fixed. The first was to ensure that our offline store teams handed out our flyers to customers, particularly with customers who weren’t interested in online sales that didn’t appear especially beneficial. The second challenge was to motivate customers to buy online. This promotion did not bring in that many orders, with the conversion rate being only 0.4–0.5%. We came to the conclusion that this figure is the average offline to online conversion for our brand. In autumn, we plan to extend this promotion over the whole retail chain in every brick-and-mortar store we have.

Click and Collect

The next major step was to implement the click-and-collect system, allowing customers to place orders online and try them on and pay in-store.

As soon as we started sending out campaigns, half of the orders were from retail customers who had never bought online in the past. Therefore, Maestra helped us to see how the traditional email channel can influence both online and offline sales.

The click-and-collect system helps retail customers to buy online while still sticking to their usual purchases

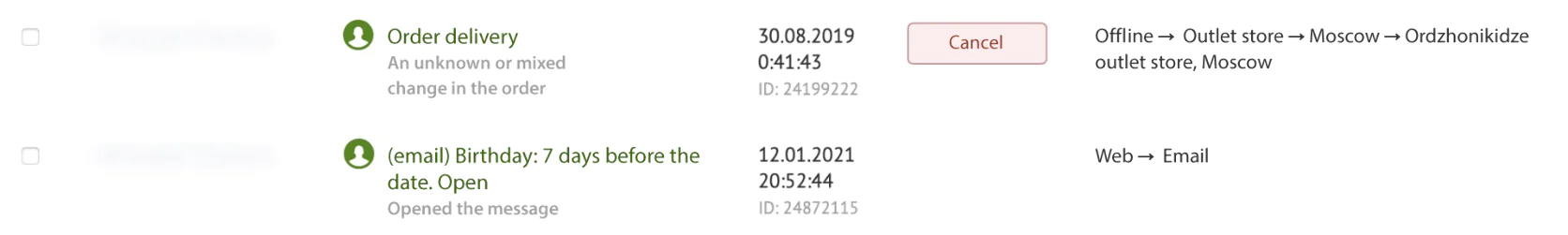

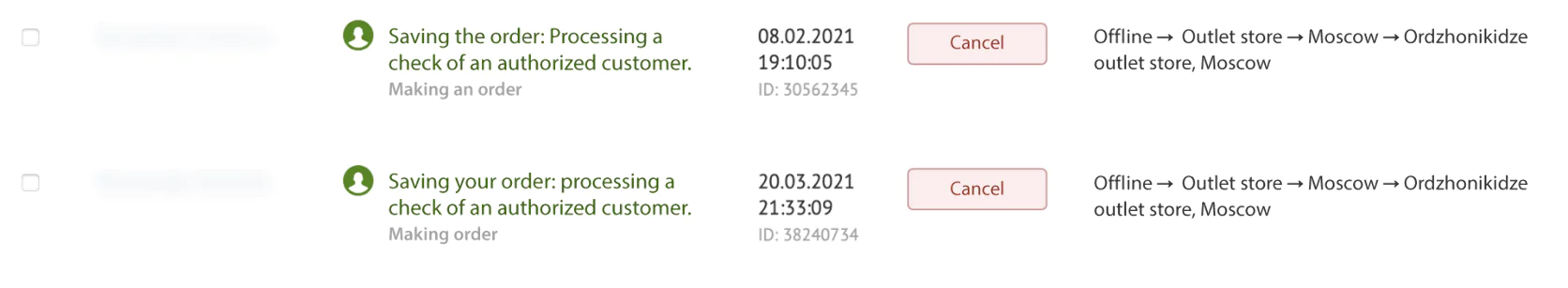

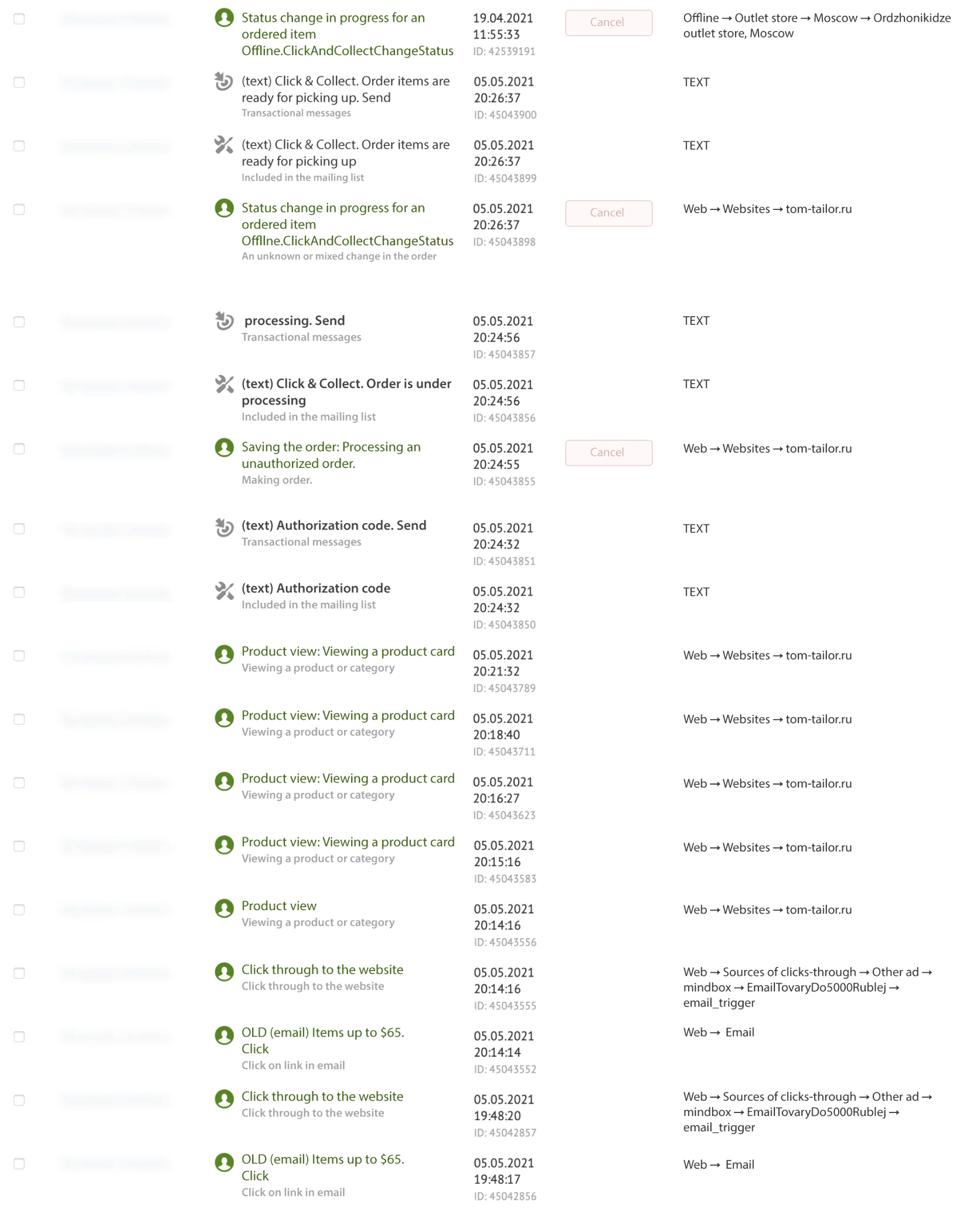

Retail Customers Migrating Online. Example:

Migrating customers from offline to online is a long and continuous journey. The click-and-collect system may prove to be a crucial factor in helping to facilitate that journey. Below is an example of a real customer’s offline to online migration timeline:

2018. The customer buys items at retail stores. They are a regular retail customer with a rich purchase history.

January 2021. The customer joins the loyalty program at an offline POS and begins to receive personalized trigger messages:

February 2021. The customer opens their messages but continues buying offline:

The customer begins to visit our website from email notifications:

April 2021. Authorized on the website for the first time:

The first “click-and-collect” order. Thereafter, the customer placed two additional orders. This implies that the customer clearly enjoys the service and buying online:

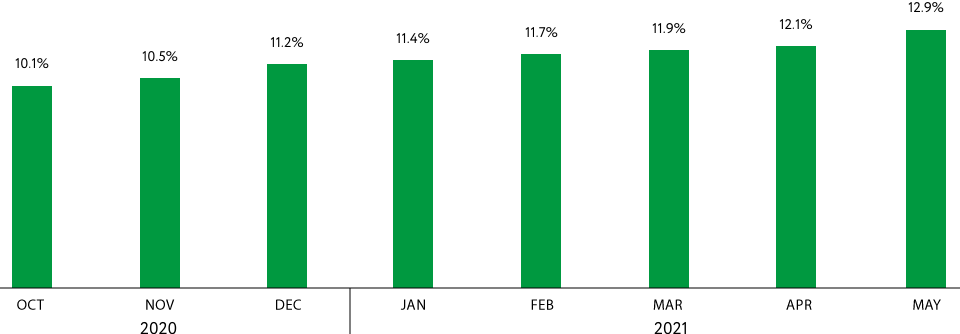

The Omnichannel Customer Base Growth: Results

The share of omnichannel customers with specified emails in the customer database. As new communication means and campaigns are introduced, the omnichannel share grows slowly, but steadily

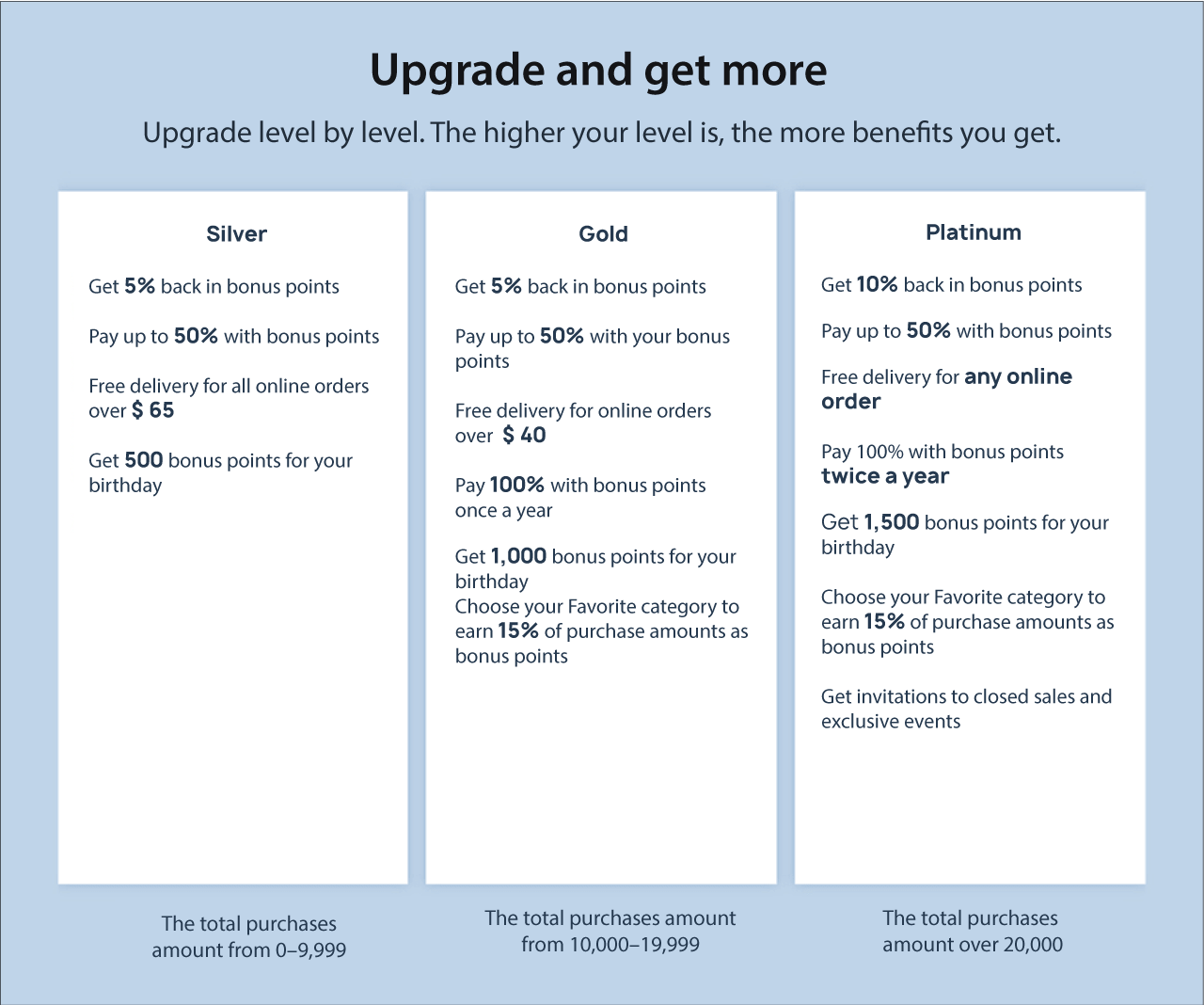

Why We Decided to Update the Loyalty Program Rules

At first, the loyalty program rules divided customers into two segments: Standard and VIP. 95% of customers belonged to the standard segment and 5% belonged to the VIP segment. VIP customers were the minority and were actively buying without any assistance or influence from us. However, the standard customers were rather inactive, wherein we experienced customer churn. So, the VIP baseline proved to be too high. To lower this line and create a new means of communication, we extended the program to include a third active tier.

To estimate loyalty program productivity, we calculated the retention rate after some considerable time from the program’s debut and compare it with a control group.

The rules of the loyalty program

Three loyalty program levels. The customer’s level depends on the total value of their purchases. Earned bonus points do not expire. However, a customer still has to spend a certain amount annually to retain their status.

Our customers played an active role in determining the loyalty program’s rules and the level names by participating in our surveys. For customers, the transition was easy and simple. Customer levels/statuses were gradually upgraded and transferred from their initial setting to a new segment. After transferring all levels, we quickly substituted the segments, turned off the old segments and turned on the new ones.

In reality, nothing has changed for the customer. We do not inform customers directly about changes in the loyalty program to avoid a large volume of questions. Instead, we inform only active customers in pop-up windows whenever they visit our website or at a POS at one of our retail stores.